Additionally, financial support in the form of utility programs and government incentives for electric boiler installations is expected to positively influence product uptake. The push for smart building technologies and stricter energy efficiency codes is further accelerating the transition toward advanced boiler systems with enhanced diagnostics and automation. Innovation is being fueled by tightening emissions regulations, especially regarding low-NOx compliance, which is promoting widespread adoption of clean and energy-efficient heating systems across the region.

The natural gas boilers segment held 68.7% share in 2024 and is forecasted to grow at a CAGR of 5.5% through 2034. Their continued adoption is backed by an extensive gas supply infrastructure and the cost-effective, high-efficiency performance they offer. In both new builds and system upgrades, these units remain the system of choice, particularly in markets with deregulated gas services. High efficiency condensing gas boilers are being promoted through rebate and incentive programs, reinforcing their market demand and appeal to commercial operators.

The commercial office segment generated USD 581.2 million in 2024, driven by increasing installations of high-performance boiler systems in new and retrofitted office spaces. Enhanced HVAC system integration and growing demand to meet local building energy codes and sustainability targets are encouraging developers and property managers to opt for condensing boiler solutions. Modern office towers are leveraging automated boiler systems for improved energy management, occupant comfort, and building efficiency, supporting long-term market growth.

United States Commercial Boiler Market heled 83.9% share and generated USD 2.2 billion in 2024. Modernization projects across government facilities and schools are supporting widespread boiler replacements, enabled by public funding and infrastructure upgrade programs. Additionally, with a growing number of states implementing building electrification rules, there’s a noticeable shift toward electric boiler systems in cities focused on zero-emission mandates. Integration with intelligent building management solutions is becoming standard in U.S. installations, supporting efficiency goals and advancing the country’s commercial boiler market outlook.

Notable companies leading in the North America Commercial Boiler Market across North America include Parker Boiler, HTP, A.O. Smith, Thermal Solutions, P.M. Lattner Manufacturing, Burnham Commercial Boilers, Bosch Thermotechnology, Precision Boilers, Babcock & Wilcox Enterprises, U.S. Boiler Company, Fulton, Columbia Heating Products, Rinnai America, Cleaver-Brooks, Viessmann, NTI Boilers, Lochinvar, WM Technologies, Navien, Energy Kinetics, Rentech Boiler Systems, Miura America, PB Heat, AERCO, Daikin Industries, Bradford White Corporation, Lennox International, Ariston Holding, and Clayton Industries. Companies operating in the North America commercial boiler space are adopting multiple strategies to solidify their market positioning. Leading players are heavily investing in product innovation, especially focusing on low-emission, ultra-efficient systems like condensing and electric boilers to comply with regional environmental mandates. Many are expanding their smart boiler portfolios with built-in controls, remote monitoring, and predictive maintenance features, targeting integration with smart building infrastructures.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this North America Commercial Boiler market report include:- A.O. Smith

- AERCO

- Ariston Holding

- Babcock & Wilcox Enterprises

- Bosch Thermotechnology

- Bradford White Corporation

- Burnham Commercial Boilers

- Clayton Industries

- Cleaver-Brooks

- Columbia Heating Products

- Daikin Industries

- Energy Kinetics

- Fulton

- HTP

- Hurst Boiler & Welding

- Lennox International

- Lochinvar

- Miura America

- Navien

- NTI Boilers

- P.M. Lattner Manufacturing

- Parker Boiler

- PB Heat

- Precision Boilers

- Rentech Boiler Systems

- Rinnai America

- Thermal Solutions

- U.S. Boiler Company

- Viessmann

- WM Technologies

Table Information

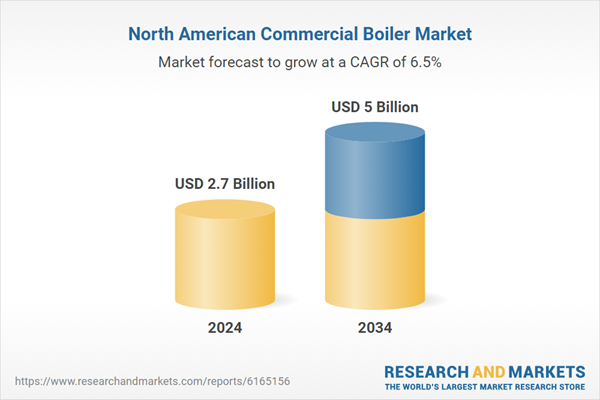

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 5 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | North America |

| No. of Companies Mentioned | 31 |