Industries such as aerospace, healthcare, and automotive are driving this growth. In aviation, particularly, the focus on fuel-efficient, lightweight parts has pushed manufacturers to invest heavily in hybrid AM to meet sustainability goals and emission regulations. The market is also gaining traction as governments continue to encourage green technology initiatives. As environmental standards tighten, hybrid manufacturing offers a reliable solution that aligns with global sustainability efforts, while enhancing manufacturing speed and material efficiency.

Carbon fiber-reinforced composites led the segment with USD 51.6 million in 2024 due to their excellent strength-to-weight ratio and resilience. Their dominance is especially visible in industries that demand lightweight yet durable components, helping manufacturers meet rising fuel economy and performance standards. These composites are becoming foundational in applications like high-end sporting gear, automotive performance parts, and structural aerospace components.

Technologies like fused deposition modeling and stereolithography collectively held 42.5% of the market in 2024. Fused deposition modeling (FDM) continues to gain popularity thanks to its cost-effectiveness, versatility, and ease of use across multiple sectors. FDM enables faster production of prototypes and end-use parts, making it ideal for industries that prioritize rapid design iterations, including automotive, healthcare, and industrial tooling.

United States Hybrid Composite for Additive Manufacturing Market generated USD 69 million in 2024. With a robust ecosystem of advanced manufacturing and a strong presence of end-use sectors, the U.S. has become a hotspot for innovation and adoption of hybrid composites. Government support for sustainable materials, increased focus on clean tech, and funding for next-gen manufacturing initiatives are key drivers pushing market development in the country.

Leading players in the Hybrid Composite for Additive Manufacturing Market include SGL Carbon, Arris Composites, Ultimaker, EOS, 3D Systems, Hewlett-Packard, Formlabs, Markforged, Phillips, and Stratasys. Major players are focusing on integrating hybrid capabilities into their existing 3D printing platforms to offer solutions that balance speed, accuracy, and material versatility. Strategic partnerships with OEMs and end-use industries are helping manufacturers co-develop application-specific components in aerospace and automotive. Companies are also increasing R&D investment to develop next-generation materials like reinforced polymers and carbon-based composites. Expansion into sustainable product lines and compliance with green regulations are other major strategies to appeal to eco-conscious sectors.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Hybrid Composite for Additive Manufacturing market report include:- 3D Systems

- Arris Composites

- EOS

- Formlabs

- Hewlett-Packard

- Markforged

- Philips

- SGL Carbon

- Stratasys

- Ultimaker

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | August 2025 |

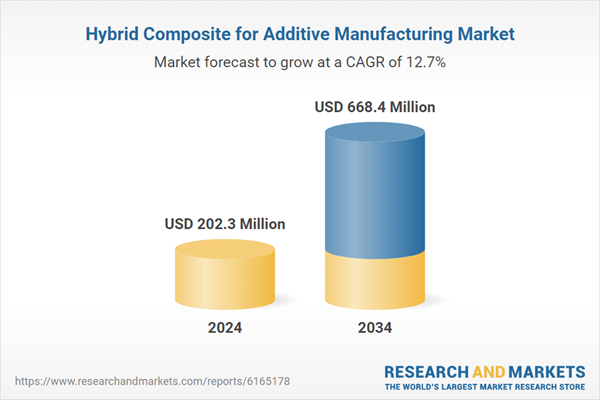

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 202.3 Million |

| Forecasted Market Value ( USD | $ 668.4 Million |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |