The emergence of compact, energy-efficient AFE ICs is accelerating adoption in wearable and implantable medical devices, enabling continuous biosignal monitoring while conserving power and enhancing patient comfort. In automotive and transportation, the evolution of ADAS and electronic vehicle systems is intensifying demand for high-reliability, precision-focused AFE ICs that perform under extreme environmental conditions. Additionally, the aerospace sector’s electrification and automation trends are boosting requirements for sensor fusion and radar interface solutions.

The multi-channel AFE segment is experiencing the fastest growth in the AFE IC market, projected to grow at a CAGR of 9.4% between 2025 and 2034. This acceleration is largely driven by rising integration of complex sensor networks in sectors such as automotive safety systems, industrial monitoring, and advanced medical diagnostics. To meet these needs, developers must focus on configurable, low-noise AFE ICs with built-in digital interfaces. Manufacturers that design compact, power-efficient multi-channel solutions tailored to mission-critical sectors will remain competitive and gain broader adoption.

The automotive and transportation segment is expected to grow at a CAGR of 10% throughout 2034. Rapid advancements in electric vehicles and ADAS technologies are fueling the demand for low-noise, multi-channel AFE ICs that enable precise data acquisition from radar, camera, and lidar systems. Additionally, accurate battery monitoring systems are essential in EVs, driving the need for automotive-grade analog front-end solutions built to meet stringent safety and reliability standards.

U.S. Analog Front-End (AFE) IC Market generated USD 776.2 million in 2024. Growth across the country is fueled by its leadership in semiconductor innovation, and strong demand from healthcare diagnostics, automation, and automotive electronics sectors. With the growing market for wearable health tech and automotive sensors, manufacturers in the U.S. must prioritize developing low-power, highly integrated AFEs that are both compact and compliant with regulatory standards. Strategic collaboration with domestic OEMs and healthcare technology providers is essential to accelerate product development, localization, and faster time-to-market.

Key players operating in the Global Analog Front-End (AFE) IC Market include NXP Semiconductors, Monolithic Power Systems, Inc., Texas Instruments Incorporated, Analog Devices Inc., Infineon Technologies AG, STMicroelectronics, Microchip Technology Inc., and Nisshinbo Micro Devices Inc. Leading companies in the analog front-end IC market are focusing on enhancing product performance while reducing size and power consumption. Priorities include expanding portfolios with multi-channel, low-noise AFEs that support digital integration and deliver superior signal fidelity.

Firms are also investing in advanced packaging technologies to enable high-density integration for space-constrained applications like wearables and automotive modules. To address diverse end-user requirements, players are tailoring products for specific verticals such as industrial IoT, healthcare diagnostics, and electric vehicles. Additionally, companies are forming strategic alliances with OEMs, semiconductor foundries, and regional distributors to optimize supply chain efficiency and improve market reach. These strategies help accelerate innovation cycles, reduce design complexity for clients, and strengthen brand positioning across key growth regions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Analog Front-End (AFE) IC market report include:- Analog Devices Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- ROHM Co., Ltd.

- Microchip Technology Inc.

- Cirrus Logic, Inc.

- Monolithic Power Systems, Inc.

- Onsemi

- MaxLinear

- ams-OSRAM AG

- Ricoh

- Nisshinbo Micro Devices Inc.

- Renesas Electronics Corporation

- Hycon Technology Corp

- SINOWEALTH Electronic Ltd.

- Qorvo

- Asahi Kasei Microdevices Corporation

- Trusignal Microelectronics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

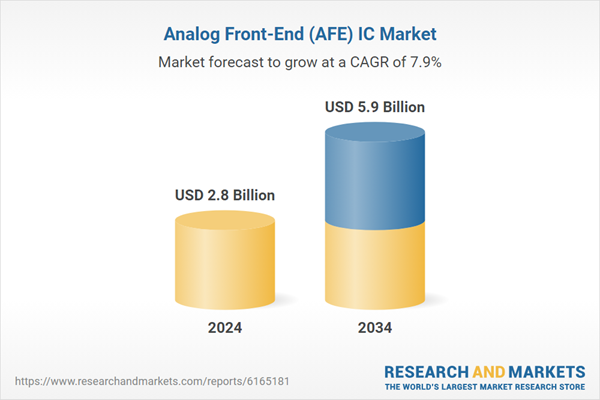

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |