At the same time, the emergence of bio-based fertilizers and the growing implementation of precision agriculture are reshaping traditional farming methods by prioritizing both yield and environmental impact. Globally, nations are increasing their focus on food production capacity, leading to a stronger push to stabilize fertilizer supplies. Government-backed initiatives are promoting the balanced application of nutrients and encouraging the adoption of cleaner, eco-conscious fertilizers to maintain soil health and food security. Production scaling and efficient supply chain management are becoming more central as agricultural demand continues to climb across regions.

In 2024, the dry fertilizer segment accounted for USD 173.9 billion in market value, underscoring its significant presence. Dry formulations continue to dominate due to their extended shelf life, logistical convenience, and greater resistance to spoilage from moisture or microbial activity. Their stability makes them an ideal option for bulk distribution and storage in areas with limited cold chain support. Additionally, their lightweight composition contributes to lower transportation costs, and they are easier to apply or mix when needed, giving them a clear operational advantage in many regions.

The horticulture application segment led the market with a valuation of USD 99.1 billion in 2024. This sector uses a wide range of advanced fertilizers, including micronutrient-rich blends, slow-release formulations, and foliar sprays, to support high-value crops such as fruits, vegetables, and greenhouse plants. Due to the sensitivity of horticultural crops to nutrient balance, precision in application is essential. Controlled-environment agriculture, including hydroponic systems, has further increased the use of specialized fertilizers to maintain optimal plant growth and maximize output in minimal space.

China Fertilizer Market generated USD 44.8 billion holding 43% share in 2024 driven by high-intensity farming practices and a growing demand for staple crops like corn, rice, and wheat. Continuous cultivation practices have resulted in soil nutrient depletion, necessitating regular replenishment through fertilizer use. The region's large agricultural base and the urgency for food security make it a primary consumer of fertilizers, with China and India leading demand due to their scale and population dynamics.

Leading companies in the Global Fertilizer Market include Coromandel International Limited, EuroChem Group, Bunge Limited, K+S Group, Nutrien, Sinofert Holdings Limited, Uralkali, IFFCO, Israel Chemicals, Syngenta, Haifa Group, Yara International, The Mosaic Company, OCP Group, Westfarmers, and CF Industries Holdings. Companies operating in the fertilizer market are enhancing their market position by diversifying product portfolios with sustainable and customized nutrient blends, including controlled-release and bio-based fertilizers. Strategic partnerships with agri-tech firms are enabling digital integration, allowing manufacturers to offer value-added services like real-time soil analysis and precision application tools. Many players are expanding manufacturing capacity in emerging markets to meet rising local demand and reduce supply chain risks. Firms are also investing in R&D to develop nutrient-efficient products aligned with eco-regulations. Additionally, long-term contracts with governments and agricultural cooperatives are being pursued to ensure steady offtake.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Fertilizer market report include:- Bunge Limited

- CF Industries Holdings

- Coromandel International Limited

- EuroChem Group

- Haifa Group

- IFFCO

- Israel Chemicals

- K+S Group

- Nutrien

- OCP Group

- Sinofert Holdings Limited

- Syngenta

- The Mosaic Company

- Uralkali

- Wesfarmers

- Yara International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | August 2025 |

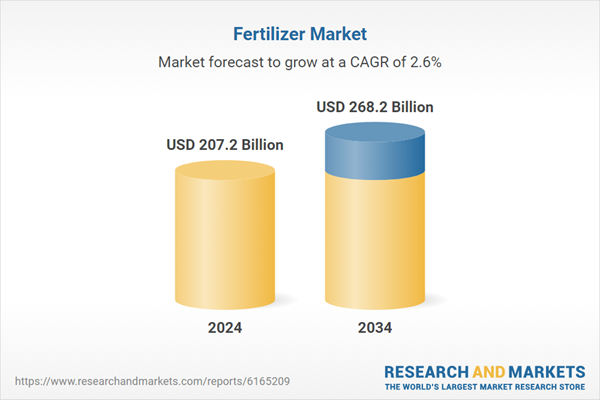

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 207.2 Billion |

| Forecasted Market Value ( USD | $ 268.2 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |