Azotobacter-based biofertilizers face challenges around consistency in performance due to environmental variability. Factors such as soil pH, temperature, and moisture content influence outcomes and may discourage farmers when results fluctuate across different regions. Limited shelf life is another hurdle, as any loss in product efficacy can lead to poor user experience and restrained adoption in some areas, potentially slowing down widespread use.

The liquid formulations segment generated USD 6 billion in 2024, holding a leading position due to their application efficiency, uniform coverage, and ease of handling. These attributes make them a preferred option, particularly for large-scale farming operations. Their compatibility with agricultural application systems further supports their widespread use across multiple farming environments.

The cereals and grains accounted for 41.6% share in 2024, maintaining the largest share by crop type. This dominance is supported by rising global demand for food security, government-backed organic farming initiatives, and the proven ability of azotobacter-based biofertilizers to improve grain and cereal crop yields. With growing awareness around soil health, many farmers are adopting these biofertilizers to meet sustainability goals while maintaining productivity.

U.S. Azotobacter-based Biofertilizer Market was valued at USD 2.3 billion in 2024, driven by modern agricultural techniques, a strong push toward organic farming, and a well-established farming sector. Supportive regulatory frameworks and heightened awareness around soil conservation continue to boost adoption rates across the country. In Canada, the market is growing rapidly with increasing adherence to environmentally responsible practices and an emphasis on sustainable agriculture. Collaboration between research organizations and key players is helping bring out new, efficient product variants and expanding the usage scope of azotobacter-based solutions.

Key participants in the Azotobacter-based Biofertilizer Market include Growtech Agri Science, Biotech International, K. N. BIO SCIENCES, Unisun Agro, IFFCO, Rizobacter, FARMADIL INDIA LLP, Green Vision Life Sciences, Gujarat State Fertilizers & Chemicals, and Jaipur Bio Fertilizers. Companies in the global azotobacter-based biofertilizer market are expanding their market presence by focusing on product innovation, targeted collaborations, and diversification of formulations. Leading players are investing in R&D to develop stable, long-lasting biofertilizers suitable for diverse soil and climate conditions. Strategic partnerships with research institutions and universities enhance product performance and regional adaptability. Several firms are emphasizing tailored solutions for different crops and expanding their distribution networks to reach under-served agricultural regions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Azotobacter-based Biofertilizer market report include:- Biotech International

- FARMADIL INDIA LLP

- Green Vision Life Sciences

- Growtech Agri Science

- Gujarat State Fertilizers & Chemicals

- IFFCO

- Jaipur Bio Fertilizers

- K. N. BIO SCIENCES

- Rizobacter

- Unisun Agro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | August 2025 |

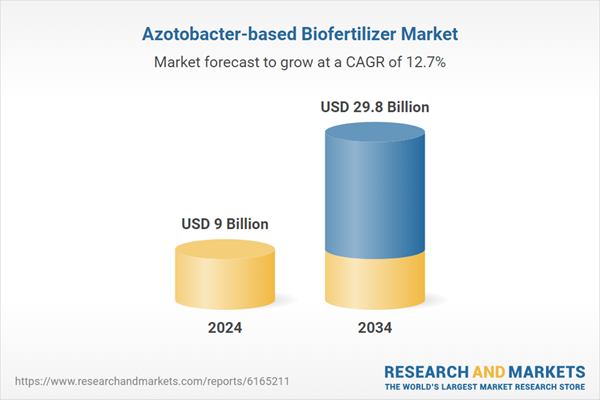

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 9 Billion |

| Forecasted Market Value ( USD | $ 29.8 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |