Market Introduction

Due to the region's nations' emphasis on developing and updating existing power transmission and distribution networks, the Asia-Pacific (APAC) overhead line inspection market is expanding significantly. The need for trustworthy and effective inspection solutions is being driven by factors such as the large-scale integration of renewable energy sources, increasing electricity demand, and rapid urbanization. The industry has historically been dominated by human inspections and helicopter surveys, but there is a noticeable trend toward more sophisticated techniques including infrared thermography, LiDAR mapping, satellite monitoring, drone-based aerial inspections, and AI-driven analytics. Utilities are using these technologies to increase worker safety in hazardous conditions, decrease inspection costs, and improve accuracy.The heterogeneous terrain of the APAC region, which includes both distant and challenging-to-reach rural areas and densely populated urban centers, creates distinct opportunities. To increase grid resilience and decrease downtime, governments and utilities are progressively implementing digital twin technologies, automated drones, and vegetation management systems. With the help of advantageous legislative frameworks and investments in the development of smart grids, nations like China, India, Japan, and Australia are spearheading the adoption of cutting-edge inspection technology. The APAC overhead line inspection market is expected to grow rapidly because to the increased focus on sustainability, energy efficiency, and renewable integration. This presents a number of opportunities for both regional and international service providers.

Market Segmentation:

Segmentation 1: by Asset

- Lines/Conductors

- Towers/Poles

- Insulators/Hardware

- Vegetation Corridor

Segmentation 2: by End User

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Integrated Utilities

- Government/Public Agencies

Segmentation 3: by Solution

- Visual Observation

- Infrared Thermography

- Corona/Partial Discharge Detection

- LiDAR and Photogrammetry

- High-resolution Visual (Photo/Video) with AI-based analytics

- Vegetation Management (Satellite Imagery and Aerial LiDAR)

- Others

Segmentation 4: by Method of Delivery

- Helicopters

- Drones

- Robots

- Ground

Segmentation 5: by Voltage

- Transmission (≥66 kV)

- Distribution (< 66 kV)

Segmentation 6: by Region

- Asia-Pacific

APAC Overhead Line Inspection Market Trends, Drivers and Challenges

Trends

- Strong shift from manual inspections and helicopter surveys to drone-based aerial inspections across China, India, Japan, and Australia.

- Adoption of AI/ML-powered analytics for fault detection, corrosion assessment, and vegetation monitoring.

- Increasing use of multi-sensor payloads (LiDAR, infrared thermography, UV cameras, and high-resolution RGB) for more accurate asset assessment.

- Growth of digital twin models and predictive maintenance solutions to improve grid reliability.

- Rising deployment of automated drone-in-a-box systems and robotic crawlers for continuous monitoring.

- Expansion of public-private partnerships and collaborations between utilities and technology providers.

Drivers

- Rapid urbanization and industrialization leading to surging electricity demand across APAC economies.

- Aging grid infrastructure and the urgent need for modernization and maintenance.

- Large-scale renewable energy integration (solar and wind) requiring stronger transmission and distribution networks.

- Rising government investments in smart grid development and energy transition initiatives.

- Cost and safety benefits of replacing high-risk manual inspections with drones and automated systems.

- Wide geographic diversity (mountainous regions, rural areas, coastal grids) driving demand for scalable inspection technologies.

Challenges

- Regulatory fragmentation across APAC countries slowing adoption of BVLOS (Beyond Visual Line of Sight) drone operations.

- Harsh weather conditions (monsoons, typhoons, extreme heat) affecting inspection reliability.

- Integration issues between inspection data and existing utility management systems.

- Limited skilled workforce for drone operations, data processing, and AI adoption.

- High upfront capital investment for advanced inspection systems and software platforms.

- Cybersecurity and data privacy concerns with cloud-based monitoring and analytics solutions.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available in APAC Region. Moreover, the study provides the reader with a detailed understanding of the overhead line inspection market by products based on method of delivery, solution, and voltage.Growth/Marketing Strategy: The APAC overhead line inspection market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the APAC overhead line inspection market.

Competitive Strategy: Key players in the overhead line inspection market have been analyzed and profiled in the study of overhead line inspection products. Moreover, a detailed competitive benchmarking of the players operating in the overhead line inspection market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Aerodyne Group

- AUAV

- DJI

- Garuda Aerospace

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | August 2025 |

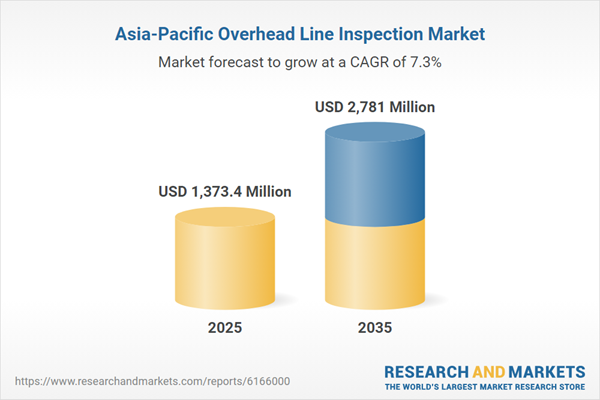

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 1373.4 Million |

| Forecasted Market Value ( USD | $ 2781 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 4 |