Market Introduction

The overhead line inspection market in Europe is essential to preserving the dependability, efficiency, and safety of the electrical transmission and distribution systems in the area. The need for efficient monitoring and inspection systems has grown dramatically as Europe moves toward a more sustainable energy system, incorporating renewable energy sources and extending cross-border links. Advanced technologies like drones, infrared thermography, LiDAR, satellite imagery, and AI-powered analytics are progressively replacing more conventional techniques like manual patrols and helicopter surveys. These technologies not only enhance accuracy but also cut inspection costs and improve safety by eliminating human exposure to high-risk areas.The European Union Aviation Safety Agency's (EASA) legislative reforms, which offer standardized frameworks for drone operations and encourage a wider use of unmanned aerial systems for overhead line monitoring, also influence the European market. The use of digital twin models, unmanned drones, robotic crawlers, and vegetation management systems are some of the major trends that allow utilities to proactively handle grid maintenance requirements. Innovation and competitiveness are being driven by prominent industry participants like Siemens Energy and Cyberhawk as well as specialized service providers. The market for overhead line inspection in Europe is expected to rise steadily due to the increased focus on sustainability, grid resilience, and smart grid integration.

Market Segmentation

Segmentation 1: by Asset

- Lines/Conductors

- Towers/Poles

- Insulators/Hardware

- Vegetation Corridor

Segmentation 2: by End User

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Integrated Utilities

- Government/Public Agencies

Segmentation 3: by Solution

- Visual Observation

- Infrared Thermography

- Corona/Partial Discharge Detection

- LiDAR and Photogrammetry

- High-resolution Visual (Photo/Video) with AI-based analytics

- Vegetation Management (Satellite Imagery and Aerial LiDAR)

- Others

Segmentation 4: by Method of Delivery

- Helicopters

- Drones

- Robots

- Ground

Segmentation 5: by Voltage

- Transmission (≥66 kV)

- Distribution (< 66 kV)

Segmentation 6: by Region

- Europe

Europe Overhead Line Inspection Market Trends, Drivers and Challenges

Trends

- Shift from helicopters to drones/UAVs for routine and post-storm inspections, with growing use of autonomous flights.

- Multi-sensor integration (LiDAR, high-res RGB, thermal/IR, UV) becoming standard; satellite imagery used as a complementary layer.

- AI/ML analytics moving to production for automated defect detection, corrosion grading, vegetation mapping, and digital-twin creation.

- Expansion of transmission projects increasing inspection demand and pushing data-driven O&M workflows.

- Rising adoption of inspection robots (line crawlers) and “drone-in-a-box” systems for high-frequency monitoring.

- Procurement models shifting toward managed services and data platforms with per-asset or per-kilometer pricing.

Drivers

- Aging grid assets and the need for higher reliability amid renewable energy integration.

- Regulatory support through harmonized EU drone rules enabling beyond-visual-line-of-sight (BVLOS) operations.

- Cost and safety benefits of replacing manual climbs and helicopter surveys with unmanned inspections.

- Advanced sensors enabling earlier detection of faults, minimizing outages and operational losses.

- AI-powered analytics platforms reducing time from inspection to actionable maintenance.

Challenges

- BVLOS approvals and regulatory processes remain fragmented across member states.

- Data governance and interoperability issues when integrating sensor data into existing utility systems.

- Weather constraints (wind, rain, visibility) affecting drone flights and sensor accuracy.

- Scaling AI analytics requires better model accuracy, training datasets, and field adoption.

- Shortage of skilled professionals in drone operations, data engineering, and powerline domain expertise.

- Cybersecurity risks in connected UAVs, robotics, and cloud-based inspection platforms.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available in European Region. Moreover, the study provides the reader with a detailed understanding of the overhead line inspection market by products based on method of delivery, solution, and voltage.Growth/Marketing Strategy: The Europe overhead line inspection market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the Europe overhead line inspection market.

Competitive Strategy: Key players in the overhead line inspection market have been analyzed and profiled in the study of overhead line inspection products. Moreover, a detailed competitive benchmarking of the players operating in the overhead line inspection market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- eSmart Systems AS

- Siemens Energy

- Sharper Shape Inc.

Table Information

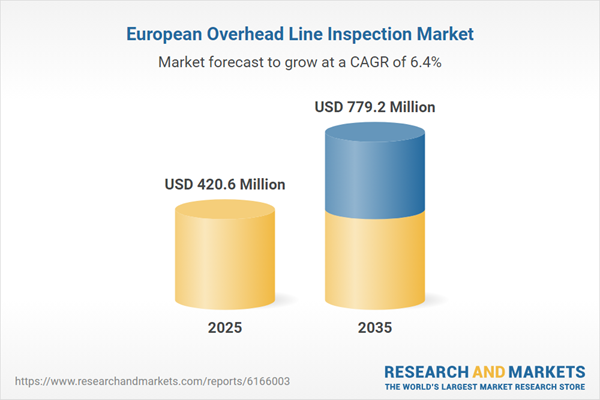

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | August 2025 |

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 420.6 Million |

| Forecasted Market Value ( USD | $ 779.2 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 3 |