Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

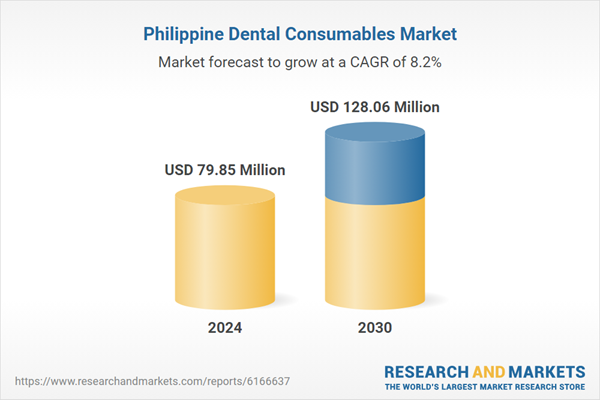

This shift is being further reinforced by a rising middle-income population, increased discretionary spending on elective treatments, and the professionalization of service delivery through corporate dental chains and digitally integrated clinics. The market shows strong potential for sustained growth across both general and specialty segments, driven by structural changes in care delivery and shifting consumer expectations.

Key Market Drivers

Expanding Middle-Class Population and Disposable Income

The steady expansion of the middle-class population in the Philippines, coupled with increasing household disposable income, is a key driver behind the rising demand for dental services and, consequently, dental consumables. Between 1991 and 2021, the middle-class population in the Philippines expanded substantially from 28.5% to 39.8% of the total population. In absolute terms, this reflects a jump from approximately 16.2 million to 44 million individuals within the middle-income segment. This demographic shift signifies a broader consumer base with higher purchasing power, directly influencing demand for discretionary services such as private dental care and driving increased consumption of premium dental consumables.As income levels rise, Filipino consumers particularly within the growing middle-income bracket are demonstrating a greater willingness to invest in proactive and aesthetic oral healthcare, moving beyond basic pain or emergency-driven treatments. Between 2021 and 2023, the average family income in the Philippines rose by 15.0%, increasing from PHP 307,190 to PHP 353,230. This upward shift reflects improved household purchasing capacity, with the average annual income reaching approximately USD 6,358. This income growth is contributing to greater consumer spending on elective healthcare services, including dental care, and is reinforcing the upward momentum in demand for high-quality dental consumables across the country.

Middle-class consumers are increasingly turning to private dental clinics and corporate dental chains for higher-quality, personalized services. These clinics, in turn, are investing in advanced dental technologies and modern materials to meet rising expectations. This dynamic generates sustained demand for consumables such as: Disposable infection control items (gloves, suction tips, masks, barriers) due to increased focus on hygiene. Advanced adhesives, cements, and impression materials to support same-day or minimally invasive procedures. Digital-compatible consumables (e.g., for CAD/CAM workflows) as clinics adopt modern systems to serve more discerning patients. As private dental services become more profitable due to higher average revenue per patient, procurement of quality dental consumables increases in both volume and variety.

With greater disposable income, middle-class consumers are also influenced by social media, beauty standards, and wellness trends, placing greater emphasis on dental aesthetics and hygiene. The “selfie culture,” professional presentation, and personal grooming trends are encouraging more people to prioritize their dental appearance. This results in: A surge in demand for smile makeovers, teeth whitening, and orthodontics, Increased consumption of high-quality restorative and cosmetic consumables. Patients being more open to out-of-pocket spending on non-covered services and branded dental materials.

These consumer behaviors are rapidly expanding the consumer-facing segment of the dental consumables market, especially in urban and semi-urban areas. The impact of middle-class income growth is no longer limited to Metro Manila or Cebu; it extends to second-tier cities such as Iloilo, Bacolod, Cagayan de Oro, and General Santos. As these urban centers modernize and healthcare infrastructure improves, dental clinics are emerging in new locations to tap into this growing demand.

Consequently, suppliers and distributors are seeing new business opportunities in regional penetration of dental consumables, The Philippines is undergoing a significant urbanization shift, with 50% of the population currently residing in urban areas. This trend is projected to accelerate, with estimates indicating that 84% of Filipinos will live in cities by 2050. This rapid urban migration is reshaping healthcare consumption patterns, concentrating demand for dental services and by extension, dental consumables in metropolitan regions where access to modern clinics and elective treatments is more prevalent.

Key Market Challenges

Limited Access to Dental Care in Rural and Underserved Areas

A significant portion of the Philippine population, especially in rural provinces and remote islands, continues to have limited access to basic and advanced dental care services. This geographic and infrastructural disparity stems from: A shortage of licensed dentists in non-urban areas, as most dental professionals prefer to establish practices in major cities such as Metro Manila, Cebu, and Davao. Underdeveloped clinic infrastructure and lack of investment in dental equipment and hygiene supplies in public health centers, which impedes the use of modern dental consumables. Logistical challenges in distribution, particularly in archipelagic regions like MIMAROPA and parts of Mindanao, where transport costs and delivery delays reduce product availability and inflate prices.This results in a low volume of dental procedures in these regions, directly restricting the consumption of dental consumables and creating a regional imbalance in market demand.

Key Market Trends

Digital Transformation in Dental Practice and Supply Chain

The adoption of digital dentistry is gaining traction across private clinics and advanced dental centers in the Philippines, streamlining both patient care and operational workflows. This includes Use of intraoral scanners, CAD/CAM systems, and digital radiography, which enhance treatment accuracy and reduce chairside time. Growth of 3D printing and digital impressions, leading to increased demand for compatible consumables such as digital impression materials, biocompatible printing resins, and milling blocks. Expansion of e-commerce platforms and digital procurement portals, which simplify ordering, inventory tracking, and product comparison for clinics, especially in second-tier cities and provincial regions.This trend is not only modernizing dental care but also driving the adoption of tech-integrated consumables that meet the specifications of digital systems, pushing the market toward higher-value products.

Key Market Players

- DENTSPLY SIRONA (PHILS.), INC.

- Straumann Philippines

- 3M

- Henry Schein International

- Ivoclar Vivadent AG

Report Scope:

In this report, the Philippines Dental Consumables Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Philippines Dental Consumables Market, By Product:

- Dental Implants

- Crowns & Bridges

- Dental Biomaterials

- Orthodontic Materials

- Endodontic Materials

- Periodontic Materials

- Dentures

- CAD/CAM Devices

- Retail Dental Hygiene Essentials

- Others

Philippines Dental Consumables Market, By Specialty:

- General

- Pediatric

- Endodontics

- Oral Surgery

Philippines Dental Consumables Market, By End User:

- Hospitals

- Dental Clinics

Philippines Dental Consumables Market, By Region:

- National Capital Region

- Cordillera Administrative Region

- Ilocos Region

- Cagayan Valley

- Central Luzon

- Southern Tagalog

- Mimaropa

- Rest of Philippines

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Philippines Dental Consumables Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DENTSPLY SIRONA (PHILS.), INC.

- Straumann Philippines

- 3M

- Henry Schein International

- Ivoclar Vivadent AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 79.85 Million |

| Forecasted Market Value ( USD | $ 128.06 Million |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Philippines |

| No. of Companies Mentioned | 5 |