Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Ggrowth is moderated by several structural and clinical headwinds. The entrenched clinical preference for arteriovenous fistulas (AVFs) as the first-line access option limits the total addressable market for grafts. Additionally, concerns surrounding graft-related complications such as thrombosis and infection and the NHS’s cost-containment measures have restricted broader adoption of newer, higher-cost graft technologies.

The market outlook remains strategically favorable, supported by consistent procedural volume growth, a rising ESRD patient base, and increasing demand for access solutions in elderly and high-risk patients who are often ineligible for AVFs. Importantly, the landscape offers growth opportunities for manufacturers focused on advanced vascular graft technologies such as heparin-bonded, infection-resistant, or drug-eluting grafts particularly those that align with the NHS’s long-term goals of improving patient outcomes while maintaining cost efficiency.

Key Market Drivers

Rising Prevalence of Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD)

The rising prevalence of Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD) is one of the most significant demand drivers propelling the growth of the United Kingdom Hemodialysis Vascular Grafts Market. As more patients progress to advanced stages of kidney dysfunction, the need for reliable and long-term vascular access solutions such as hemodialysis vascular grafts continues to grow.In the United Kingdom, approximately 1 in 10 adults is currently living with Chronic Kidney Disease (CKD), and the affected population is steadily increasing. This rise is closely linked to the country’s aging demographic profile and the growing incidence of comorbid conditions such as type 2 diabetes and hypertension, which are primary contributors to renal impairment. Notably, it is estimated that around 3.7 million individuals are in the early stages of CKD (Stages 1 and 2), while an additional 3.5 million people have progressed to more advanced stages (Stages 3 to 5), underscoring the escalating burden on the UK’s renal healthcare system and highlighting the increasing demand for chronic disease management and renal replacement therapies, including hemodialysis.

A significant portion of ESRD patients in the UK are treated via hemodialysis, which requires consistent and high-flow blood access several times per week. For patients whose veins are unsuitable for AVFs such as the elderly, diabetic individuals, or those with prior failed access sites vascular grafts become the default solution. As more patients move into this high-dependency bracket, healthcare providers increasingly require durable and infection-resistant grafts to manage long-term dialysis regimens. The NHS and renal care units prioritize the early planning and establishment of vascular access for CKD patients approaching dialysis.

Grafts are often selected when time constraints, poor vessel quality, or prior failed AVF attempts necessitate a quicker, more predictable access method. This urgency in access planning, particularly with the growing ESRD burden, boosts procedural volume and accelerates graft utilization across NHS and private centers. As CKD and ESRD become more prevalent, the burden on UK renal services intensifies, increasing the focus on efficient, low-complication access solutions. Vascular grafts particularly PTFE-based options are well-established and clinically proven for their ease of implantation, predictable performance, and moderate cost-effectiveness in eligible patients. Their use helps healthcare providers maintain continuity of dialysis treatment, prevent hospital admissions from catheter-related infections, and manage growing patient loads.

Key Market Challenges

Clinical Preference for Arteriovenous Fistulas (AVFs) Over Grafts

A key barrier to vascular graft adoption is the clinical preference for arteriovenous fistulas (AVFs) as the first-line vascular access method. AVFs are considered the gold standard by nephrologists and surgeons due to their superior long-term patency, lower infection risk, and better patient outcomes. The National Institute for Health and Care Excellence (NICE) guidelines and NHS protocols emphasize AVFs wherever anatomically feasible, limiting graft use to patients for whom fistulas are not viable. As a result, grafts are often reserved for high-risk or elderly patients, which significantly narrows the addressable market.This preference reduces procedure volume for vascular grafts, thereby slowing market penetration and impacting revenue growth for device manufacturers focused solely on graft technologies.

Key Market Trends

Transition Toward Advanced and Next-Generation Graft Technologies

The UK market is witnessing a growing shift from conventional grafts to next-generation vascular grafts that offer superior performance, reduced complications, and extended durability.Drug-eluting and infection-resistant grafts are gaining clinical traction. These grafts release anti-proliferative or antimicrobial agents to prevent stenosis and infection, two leading causes of graft failure. Technological improvements such as self-sealing grafts, reinforced PTFE, and heparin-bonded grafts are enabling better patency rates and reducing the need for revision procedures. The growing interest in biomaterial-based hybrid grafts and tissue-engineered vascular grafts (TEVGs) signals a future where grafts can integrate better with host tissues and minimize immune response. This trend is creating growth opportunities for medical device manufacturers focused on innovation and R&D, and driving procurement interest among UK hospitals looking to reduce long-term dialysis complications and improve patient outcomes.

Key Market Players

- W. L. Gore & Associates

- BD

- LeMaitre Vascular Ltd.

- Getinge AB

- Vascular Laser Genesis

- CryoLife (Artivion, Inc)

- Merit Medical Systems

Report Scope:

In this report, the United Kingdom Hemodialysis Vascular Grafts Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Hemodialysis Vascular Grafts Market, By Raw Material:

- Polyester

- Polytetrafluoroethylene

- Polyurethane

- Biological Materials

United Kingdom Hemodialysis Vascular Grafts Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Hemodialysis Vascular Grafts Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- W. L. Gore & Associates

- BD

- LeMaitre Vascular Ltd.

- Getinge AB

- Vascular Laser Genesis

- CryoLife (Artivion, Inc)

- Merit Medical Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

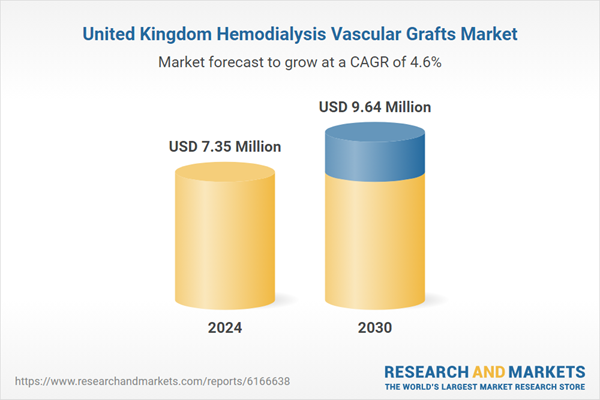

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.35 Million |

| Forecasted Market Value ( USD | $ 9.64 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 7 |