Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Growing prevalence of these conditions worldwide, coupled with increasing awareness among patients and healthcare professionals about the benefits of targeted immunology therapies, is contributing to the market’s expansion. Pharmaceutical companies are investing in advanced research and clinical trials to explore the broader therapeutic potential of Tremfya, including its application in other inflammatory disorders. Expanding treatment guidelines that recommend biologics for moderate-to-severe cases are further boosting adoption rates.

The market is experiencing a shift toward long-acting biologics that reduce dosing frequency while maintaining therapeutic effectiveness, aligning well with Tremfya’s monthly or quarterly administration schedule. Continuous advancements in biologic drug formulation and delivery systems are supporting better patient compliance and treatment satisfaction.

There is also a notable increase in collaborations between pharmaceutical manufacturers and healthcare providers to improve patient education, optimize treatment pathways, and expand access through insurance coverage and reimbursement programs. Competitive dynamics are being shaped by ongoing product innovation, pipeline expansions, and strategic partnerships aimed at enhancing market penetration and addressing unmet needs. Furthermore, the increasing focus on personalized medicine is encouraging the development of targeted therapies like Tremfya, as clinicians seek more precise and effective treatment options for patients with complex immune-mediated diseases.

Despite the promising growth prospects, the Global Tremfya Market faces several challenges. High treatment costs remain a major barrier, particularly in low- and middle-income regions, limiting broader patient access. Patent exclusivity and regulatory requirements for biosimilars may restrict competitive pricing in the near term, prolonging cost-related limitations.

Some patients may also experience varying treatment responses, necessitating alternative therapeutic strategies. The market is subject to intense competition from other biologics and small molecule drugs targeting similar pathways, such as IL-17 and TNF inhibitors, which may impact Tremfya’s adoption in certain patient segments. Additionally, the lengthy and complex drug approval process for new indications can delay market expansion opportunities. Addressing these challenges through pricing strategies, patient assistance programs, and continued clinical research will be crucial for sustaining growth in the forecast period.

Key Market Drivers

Rising Prevalence of Chronic Inflammatory Diseases

The rising prevalence of chronic inflammatory diseases such as plaque psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis is a compelling driver for the Global Tremfya Market. In the United States, psoriasis affects approximately 3.0% of adults, translating to over 7.5 million individuals, according to data from the National Health and Nutrition Examination Survey. Among these, a significant portion go on to develop psoriatic arthritis, which impacts roughly 0.41% of the U.S. adult population, equating to nearly 912,000 adults.Inflammatory bowel diseases (IBD), encompassing Crohn’s disease and ulcerative colitis, are diagnosed in approximately 721 per 100,000 Americans, or nearly 1 in 100, as reported by the Crohn’s & Colitis Foundation in a comprehensive U.S. population-based study. Strong diagnostic data reinforces the growing burden of these conditions. These diseases are often chronic and debilitating, underscoring the importance of effective long-term treatment strategies. Tremfya’s targeted mechanism of selectively inhibiting the p19 subunit of interleukin-23 addresses the underlying inflammatory pathways more precisely than older systemic therapies. This precision results in favorable safety and efficacy outcomes, making Tremfya an appealing treatment for both clinicians and patients seeking better disease control and improved quality of life.

Rising obesity rates, environmental stressors, and an aging population contribute to increasing incidence and prevalence of these immune-mediated conditions. Healthcare systems emphasize early intervention to prevent disease progression, reduce flare-ups, and minimize complications such as joint damage or gastrointestinal scarring. Demand remains strong for biologics like Tremfya that offer durable remission and reduced dosing frequency. Altogether, the confluence of growing patient populations supported by robust U.S. epidemiological data and Tremfya’s effective, targeted profile is fueling market momentum and positioning it as a preferred therapy in managing chronic inflammatory diseases.

Key Market Challenges

High Treatment Costs

High treatment costs remain one of the most significant challenges impacting the Global Tremfya Market. Tremfya, being a biologic therapy, involves complex manufacturing processes, stringent quality controls, and advanced biotechnology infrastructure, all of which contribute to its high price point. The expense is further amplified by research and development costs, clinical trial investments, and regulatory compliance requirements. For many patients, particularly in low- and middle-income countries, the price of Tremfya places it beyond financial reach without robust insurance coverage or government subsidy programs. Even in developed markets, patients may face high out-of-pocket expenses, co-payments, or limitations in reimbursement policies, which can result in reduced adoption rates.Healthcare systems often prioritize cost-effectiveness, and biologics like Tremfya must demonstrate clear value over existing therapies to justify coverage. This economic barrier can lead to delayed treatment initiation, therapy discontinuation, or a preference for cheaper alternatives, even if they are less effective. Pharmaceutical companies face the challenge of balancing innovation with affordability while navigating pricing negotiations with payers. The high treatment cost issue also influences competitive dynamics, as the emergence of biosimilars or alternative biologics with lower prices could erode market share. Addressing this challenge requires strategic pricing, value-based reimbursement models, and expansion of patient assistance programs to make Tremfya more accessible.

Key Market Trends

Increasing Adoption of IL-23 Inhibitors

The increasing adoption of IL-23 inhibitors is emerging as a defining trend in the Global Tremfya Market, driven by the growing recognition of their targeted therapeutic benefits in treating chronic immune-mediated inflammatory diseases. IL-23 inhibitors, such as Tremfya, block the p19 subunit of the interleukin-23 cytokine, a critical driver of inflammation in conditions like plaque psoriasis and psoriatic arthritis. This highly specific mechanism of action offers a favorable efficacy-to-safety ratio, making these drugs an attractive option for both physicians and patients, particularly those who have experienced suboptimal responses or adverse effects with older biologic classes such as TNF-alpha inhibitors or IL-17 blockers. The extended dosing intervals associated with IL-23 inhibitors, often every eight to twelve weeks after initial loading doses, enhance treatment adherence by reducing the frequency of injections, which is a significant advantage for patients managing lifelong conditions.Clinical trial data and real-world evidence continue to validate the long-term durability of response and low immunogenicity risk, further building confidence in this drug class. Pharmaceutical companies are also expanding the scope of IL-23 inhibitor applications into new indications such as Crohn’s disease and ulcerative colitis, which could substantially broaden their market potential.

As prescriber familiarity grows and healthcare systems begin to recognize their long-term cost-effectiveness due to reduced disease flare-ups and improved quality of life, the uptake of IL-23 inhibitors is expected to accelerate. Strategic marketing efforts, patient support programs, and increased payer acceptance are contributing to their growing presence in treatment guidelines, reinforcing the trajectory of sustained adoption for Tremfya and its counterparts in the coming years. This trend reflects a broader shift in autoimmune disease management toward precision-targeted biologics that prioritize sustained remission, minimal side effects, and improved patient convenience.

Key Market Players

- Johnson & Johnson Services, Inc.

- Coherus BioSciences

- Amgen Inc.

- AbbVie Inc.

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- AstraZeneca plc

- Sanofi S.A.

- Bristol-Myers Squibb

Report Scope:

In this report, the Global Tremfya Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Tremfya Market, By Application:

- Plaque Psoriasis

- Psoriatic Arthritis (PsA)

- Others

Tremfya Market, By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Tremfya Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Tremfya Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson Services, Inc.

- Coherus BioSciences

- Amgen Inc.

- AbbVie Inc.

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- AstraZeneca plc

- Sanofi S.A.

- Bristol-Myers Squibb

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | August 2025 |

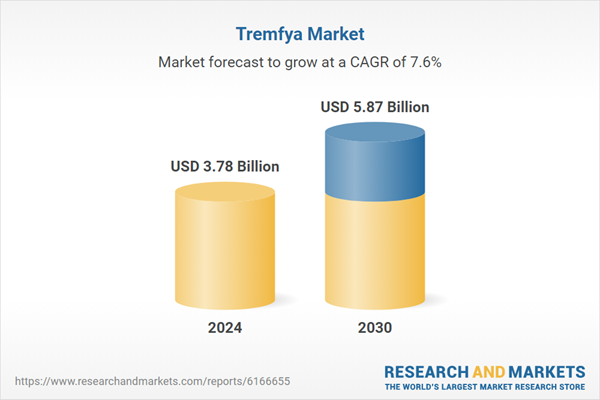

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.78 Billion |

| Forecasted Market Value ( USD | $ 5.87 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |