Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These tanks are engineered with a robust external structure, typically constructed from carbon steel or stainless steel, and feature an internal lining of high-performance fluoropolymers such as PTFE, FEP, or PFA. The fluoropolymer lining provides exceptional chemical resistance, thermal stability, and non-reactive properties, ensuring the safe containment of aggressive chemicals, pharmaceuticals, food-grade liquids, and specialty chemicals during long-distance transportation.

ISO tanks, also referred to as intermodal tanks, are standardized containers that comply with international shipping regulations, enabling efficient transfer between ships, trucks, and rail without the need for repackaging. The integration of fluoropolymer linings enhances the versatility of these tanks, allowing them to handle highly corrosive acids, alkalis, solvents, and other reactive substances that would otherwise compromise traditional metal or polymer-based containers. This makes them a preferred choice for chemical, pharmaceutical, and specialty food industries where product purity and safety are paramount.

The market is driven by increasing global trade of chemicals, pharmaceuticals, and specialty liquids, which necessitates safe, durable, and regulatory-compliant transport solutions. Fluoropolymer lined ISO tanks offer advantages such as high mechanical strength, resistance to temperature fluctuations, low maintenance requirements, and long service life, which collectively reduce operational costs and enhance efficiency for manufacturers, distributors, and logistics providers. Additionally, the lining prevents contamination and ensures product integrity, which is critical in sectors with stringent quality standards.

Technological advancements in material science are continuously enhancing the performance of fluoropolymer linings. Modern linings provide improved adhesion to steel shells, higher resistance to thermal cycling, and greater flexibility to accommodate expansion and contraction of liquids during transport. Furthermore, innovations in tank design, including advanced insulation, pressure management systems, and monitoring sensors, are expanding the functional capabilities of these tanks, making them suitable for both ambient and extreme temperature applications.

Key Market Drivers

Increasing Demand for Safe and Corrosion-Resistant Chemical Transport

The growing global chemical industry has created a strong need for safe, durable, and corrosion-resistant transportation solutions, directly driving the demand for fluoropolymer lined ISO tanks. Chemical manufacturers increasingly require containers that can withstand highly corrosive substances, including acids, alkalis, and reactive solvents, without compromising the quality and safety of the transported products. Fluoropolymer lining offers excellent chemical resistance and ensures product purity, preventing contamination and degradation during transit. This is particularly important in industries such as pharmaceuticals, specialty chemicals, and agrochemicals, where even minor contamination can have serious consequences.The global expansion of chemical manufacturing hubs, especially in Asia Pacific, North America, and Europe, is further boosting demand for reliable bulk transportation solutions. Companies are increasingly opting for ISO tanks over traditional drums and intermediate bulk containers (IBCs) because they provide higher volume capacity, better efficiency, and enhanced safety during long-distance transport. Moreover, stricter regulations governing the transportation of hazardous and corrosive materials have made compliance a critical factor. Fluoropolymer lined ISO tanks help businesses meet these regulatory requirements while maintaining operational efficiency.

The increasing focus on sustainability and reducing chemical wastage is also encouraging adoption. Traditional tanks often require frequent maintenance or replacement due to corrosion, leading to higher operational costs and environmental waste. Fluoropolymer lined ISO tanks, with their extended lifespan and minimal maintenance requirements, address these challenges effectively. Additionally, manufacturers are investing in innovations such as multi-layer fluoropolymer linings, enhanced welding techniques, and tank designs that improve durability and reduce risks associated with chemical transport.

Overall, the need for safe, corrosion-resistant, and reliable chemical transportation solutions is a primary driver for the fluoropolymer lined ISO tank market, with applications spanning multiple industries. Companies seeking to enhance operational efficiency, ensure product safety, and comply with stringent regulations are increasingly adopting these advanced tank solutions, positioning the market for substantial growth over the coming years. Global adoption of corrosion-resistant chemical transport solutions has grown by over 30% in the past five years.

Demand for safe chemical handling and storage tanks has increased by approximately 25% worldwide. Investments in advanced lining technologies for chemical transport containers have risen by nearly 20% globally. Industrial sectors such as pharmaceuticals, petrochemicals, and specialty chemicals have expanded their use of corrosion-resistant transport solutions by around 15%. Regulatory compliance and safety standards have driven a 10-15% increase in the deployment of specialized chemical transport systems worldwide.

Key Market Challenges

High Initial Investment and Manufacturing Costs

One of the most significant challenges facing the Fluoropolymer Lined ISO Tanks market is the high initial investment and manufacturing costs associated with these specialized tanks. Fluoropolymer linings, such as PTFE, FEP, or PFA, are expensive due to the complex chemical synthesis processes and stringent quality control standards required during production. The tanks themselves also involve high-grade stainless steel shells to ensure durability and chemical resistance, further increasing the upfront cost. For companies looking to adopt these tanks, especially small and medium-sized enterprises (SMEs), the capital expenditure can be a major deterrent.The high production costs are not limited to raw materials. Manufacturing processes require specialized equipment and skilled labor to ensure that the fluoropolymer lining adheres perfectly to the tank’s interior surface. Any imperfections during the lining process can result in chemical leaks or contamination, leading to product loss, safety hazards, and reputational damage. Additionally, the tanks often require rigorous testing and certification according to international standards such as ISO 9001, ISO 14001, or ADR for hazardous chemical transportation, which adds another layer of cost and operational complexity.

These high costs can limit the market’s adoption in price-sensitive regions where industrial budgets are constrained or where alternative storage solutions, such as standard stainless steel tanks, are already available. Even though the long-term benefits of corrosion resistance, chemical compatibility, and durability often outweigh the initial expenditure, decision-makers may prioritize short-term cost savings, delaying investment in fluoropolymer-lined tanks.

Furthermore, the high cost also affects the scalability of production for manufacturers. Expanding capacity or entering new markets may require substantial financial investment, creating barriers for smaller or emerging players. This scenario not only limits market penetration but can also concentrate the market in the hands of established players with sufficient financial resources. To mitigate this challenge, companies are exploring strategies such as modular tank designs, longer product lifecycles, and innovative financing options to offset initial costs. However, the high upfront investment remains a critical challenge for broad market adoption, especially in emerging economies where capital-intensive solutions face slower acceptance.

Key Market Trends

Growing Demand for Safe and Corrosion-Resistant Chemical Transportation

The Fluoropolymer Lined ISO Tanks market is witnessing significant growth due to the increasing global demand for safe, efficient, and corrosion-resistant transportation of chemicals. Fluoropolymer linings, such as PTFE, PFA, and FEP, offer excellent chemical resistance, making them ideal for transporting aggressive and hazardous chemicals, including acids, solvents, and specialty chemicals. Industries such as pharmaceuticals, agrochemicals, petrochemicals, and food processing are increasingly relying on these tanks to ensure the integrity of transported materials while minimizing contamination risks.The rising focus on occupational safety and regulatory compliance is further driving market adoption. Stringent regulations regarding the transport of hazardous chemicals, particularly in regions such as North America, Europe, and Asia Pacific, have pushed companies to invest in high-quality ISO tanks with superior lining technologies. Fluoropolymer linings reduce corrosion-related failures, extend tank lifespan, and reduce maintenance costs, offering tangible operational advantages for logistics and chemical manufacturing companies.

Additionally, the growth of global chemical trade, driven by increasing industrial production and expansion of specialty chemical markets, is contributing to higher demand for these tanks. Companies are increasingly looking for standardized ISO tank solutions that can support multimodal transportation, including rail, road, and sea, while ensuring compliance with international shipping standards. The ability of fluoropolymer-lined ISO tanks to safely transport sensitive chemicals over long distances without degradation is making them the preferred choice for chemical logistics providers.

Innovation in tank design and materials is also playing a crucial role in this trend. Manufacturers are introducing tanks with improved thermal insulation, lighter weight, and enhanced resistance to mechanical stress, catering to the evolving needs of end-users. The combination of chemical resistance, durability, and operational efficiency is solidifying the position of fluoropolymer-lined ISO tanks as an essential component in the global chemical supply chain.

Key Market Players

- Jiangsu RANA Fluorine Material Technology Co., Ltd.

- EXSIF Worldwide

- Danteco Industries

- Allied Supreme Corp.

- Sigma Roto Lining Pvt. Ltd.

- ACE Container

- Dong Runze Special Vehicle Equipment Co., Ltd.

- Sun Fluoro System Co., Ltd.

- CG Thermal LLC

- Valqua NGC, Inc.

Report Scope:

In this report, the Global Fluoropolymer Lined ISO Tanks Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fluoropolymer Lined ISO Tanks Market, By Application:

- Chemical Storage

- Food & Beverage

- Pharmaceuticals

- Aerospace

- Oil & Gas

Fluoropolymer Lined ISO Tanks Market, By Tank Type:

- Standard ISO Tanks

- Specialty Tanks

- Insulated Tanks

- Non-Insulated Tanks

Fluoropolymer Lined ISO Tanks Market, By Material Type:

- Fluoropolymers

- Polyethylene

- Polypropylene

- Others

Fluoropolymer Lined ISO Tanks Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fluoropolymer Lined ISO Tanks Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Jiangsu RANA Fluorine Material Technology Co., Ltd.

- EXSIF Worldwide

- Danteco Industries

- Allied Supreme Corp.

- Sigma Roto Lining Pvt. Ltd.

- ACE Container

- Dong Runze Special Vehicle Equipment Co., Ltd.

- Sun Fluoro System Co., Ltd.

- CG Thermal LLC

- Valqua NGC, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

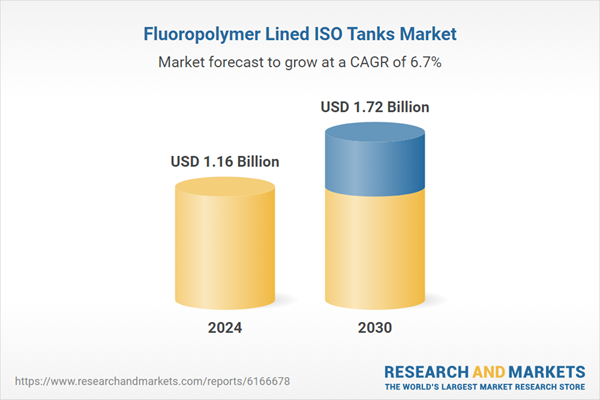

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.16 Billion |

| Forecasted Market Value ( USD | $ 1.72 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |