Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With the increasing proliferation of electronic products in both consumer and industrial sectors, waste generation from these devices has become one of the fastest-growing waste streams worldwide. The market encompasses a wide range of activities, including dismantling, sorting, shredding, and processing of end-of-life electronics to extract reusable metals, plastics, and other critical materials while safely managing hazardous components.

WEEE recycling plays a pivotal role in reducing environmental pollution, conserving natural resources, and ensuring compliance with global sustainability goals. The market is defined by the systematic recovery of precious and base metals such as gold, silver, copper, aluminum, and rare earth elements, which are integral to the manufacturing of new electronic devices. In addition, plastics and glass recovered from electronic waste are also reintroduced into manufacturing cycles, reducing the dependency on virgin raw materials. The industry also addresses the safe handling of toxic substances like lead, mercury, cadmium, and brominated flame retardants, ensuring that these hazardous elements do not contaminate the environment or harm human health.

The scope of the WEEE Recycling Market extends across multiple product categories, including household appliances, IT and telecommunication equipment, consumer electronics, lighting devices, medical equipment, and industrial machinery. Each category presents unique recycling challenges due to differences in size, material composition, and the presence of hazardous components. For instance, small consumer devices like mobile phones and laptops require specialized processes for the recovery of rare metals, while large household appliances demand heavy dismantling and shredding equipment for effective material separation.

Market participants typically include specialized recyclers, electronic product manufacturers, waste management companies, and government agencies. Recyclers focus on efficient collection systems, advanced processing technologies, and material recovery methods to maximize yields. Manufacturers are increasingly adopting extended producer responsibility frameworks, integrating recycling initiatives into product lifecycle strategies. Governments play a key role by introducing regulatory frameworks, setting recycling targets, and establishing formal collection and recycling systems to reduce the prevalence of informal and unsafe disposal practices.

Key Market Drivers

Rising E-Waste Generation and Environmental Concerns

The rapid growth in global consumption of electrical and electronic devices has directly contributed to a surge in electronic waste generation, creating a critical driver for the Waste Electrical and Electronic Equipment (WEEE) Recycling Market. With technological advancements and continuous innovation in consumer electronics, IT equipment, household appliances, and communication devices, the lifecycle of these products has become increasingly shorter. Consumers often replace gadgets and appliances more frequently, leading to mounting volumes of discarded electronics. This rising e-waste stream has positioned recycling as a necessary and valuable industry to manage environmental sustainability and resource recovery.One of the primary environmental concerns associated with e-waste is the presence of hazardous materials such as lead, mercury, cadmium, and brominated flame retardants, which can have significant health and ecological impacts if not handled properly. When e-waste ends up in landfills or is improperly disposed of, these toxic substances can leach into soil and water, contaminating ecosystems and posing risks to human health. Recycling provides an effective way to mitigate these risks by ensuring safe extraction and treatment of harmful components. Moreover, recycling ensures the recovery of valuable metals such as gold, silver, copper, and palladium, reducing the need for resource-intensive mining activities that often degrade the environment.

As public awareness of climate change, pollution, and sustainable practices grows, governments, organizations, and consumers are increasingly recognizing the importance of responsible e-waste management. Recycling is seen not only as a solution for waste reduction but also as an enabler of circular economy principles, where discarded products re-enter the value chain as raw materials. This transition reduces dependency on finite natural resources and supports sustainability goals.

Furthermore, companies across multiple industries are adopting greener practices as part of corporate social responsibility (CSR) initiatives. Major manufacturers are integrating e-waste recycling into their business models by partnering with certified recyclers, offering take-back schemes, and ensuring environmentally sound disposal of obsolete equipment. These initiatives not only address compliance requirements but also enhance brand reputation among environmentally conscious consumers.

In addition, urbanization and digitalization trends in emerging economies have accelerated the penetration of electronic devices, intensifying the need for robust recycling infrastructure. Developing countries, while being major contributors to global e-waste, also face significant challenges in handling disposal and recycling efficiently. This gap presents opportunities for global recyclers to expand services and technologies in these regions.

Key Market Challenges

Complex Collection and Logistics Frameworks

The Waste Electrical and Electronic Equipment (WEEE) Recycling Market faces a significant challenge in establishing and managing effective collection and logistics frameworks. E-waste is generated from a wide variety of sources - ranging from households and offices to large industrial and commercial facilities - creating a highly dispersed and fragmented waste stream. Unlike conventional waste, electronic waste is not homogeneous; it consists of multiple device categories such as consumer electronics, industrial equipment, and household appliances, each requiring specific methods of collection, transportation, and processing. This complexity adds a logistical burden for recycling operators, who must design tailored strategies to gather and consolidate such diverse waste types efficiently.One of the primary hurdles is the lack of standardized collection infrastructure in many regions. Urban areas may have more accessible drop-off points, collection bins, or partnerships with retailers for take-back programs, while rural and remote areas often lack these facilities. This disparity creates inefficiencies and gaps in the recycling chain, ultimately reducing the amount of waste that actually makes it to certified recycling centers. Even when collection networks exist, ensuring consumer participation is another obstacle. Many end-users still store old or unused electronic devices at home, unaware of proper disposal methods or unwilling to make the effort to transport items to collection points. This consumer behavior results in a large portion of electronic waste either sitting idle or ending up in landfills and informal recycling channels, bypassing regulated systems.

The logistics of transporting collected waste also pose a challenge. Electronic waste is often bulky, heavy, and irregular in shape, making it costly to handle and move. Devices may contain hazardous substances such as lead, mercury, or cadmium, requiring special handling and safety compliance during transportation. These requirements add complexity to logistics operations, driving up costs and limiting the scalability of recycling efforts. Moreover, the lack of coordinated frameworks among municipalities, governments, and private sector participants often leads to fragmented logistics chains. Without centralized systems or unified policies, recyclers must manage inconsistent collection patterns, which undermine efficiency and raise operational costs.

To address these challenges, companies in the WEEE Recycling Market are pressured to invest in advanced logistics planning, consumer awareness campaigns, and public-private partnerships. However, such initiatives require substantial financial outlays, technical expertise, and policy support, which are not always available. Until streamlined and efficient collection and logistics systems are developed at scale, this challenge will continue to limit the industry’s ability to recover valuable materials and reduce the environmental footprint of electronic waste. The ongoing difficulty in aligning collection infrastructure, consumer participation, and efficient logistics remains one of the most pressing obstacles impeding the long-term growth and sustainability of the WEEE Recycling Market.

Key Market Trends

Rising Adoption of Circular Economy Practices in E-Waste Recycling

The Waste Electrical and Electronic Equipment (WEEE) Recycling Market is witnessing a significant shift toward the adoption of circular economy practices, reshaping how businesses, governments, and consumers approach electronic waste management. Traditionally, e-waste recycling was primarily focused on waste collection and basic material recovery, often relying on landfills or rudimentary recycling processes. However, the growing recognition of resource scarcity, environmental concerns, and economic opportunities is pushing the industry toward circular economy models that emphasize reuse, refurbishment, and closed-loop recycling.Circular economy principles are redefining the value chain by encouraging manufacturers to take responsibility for the entire lifecycle of electronic products, from design to disposal. This has resulted in the development of extended producer responsibility (EPR) frameworks, where producers are incentivized or mandated to recover and recycle their products at the end of life. Companies are increasingly designing electronic devices with modularity, easier disassembly, and recyclability in mind. This proactive approach not only reduces the environmental footprint but also ensures a consistent supply of valuable secondary raw materials such as rare earth elements, copper, and gold.

The emphasis on circular economy practices also creates new business opportunities for service models like device leasing, repair services, and take-back programs. Many technology companies are now offering customers the option to return used devices in exchange for credits or discounts, which are then refurbished or recycled. This approach not only reduces waste but also enhances customer loyalty while creating additional revenue streams. At the same time, small and medium enterprises in the recycling industry are entering partnerships with manufacturers to streamline reverse logistics and improve material recovery efficiency.

From a regulatory perspective, the circular economy trend is aligned with global sustainability goals, such as reducing greenhouse gas emissions, conserving natural resources, and minimizing landfill usage. Governments are increasingly supporting this shift by introducing stringent e-waste recycling targets, incentivizing green design, and funding technological advancements in recycling processes. These initiatives further encourage stakeholders to invest in closed-loop systems and innovative recycling technologies that can extract maximum value from discarded electronics.

Key Market Players

- Sims Limited

- Umicore NV

- Electronic Recyclers International, Inc. (ERI)

- Veolia Environmental Services

- TES-AMM Pte Ltd

- Attero Recycling Pvt. Ltd.

- Stena Recycling AB

- EcoATM, LLC

- Boliden Group

- Retech Recycling Technologies GmbH

Report Scope:

In this report, the Global Waste Electrical and Electronic Equipment Recycling Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Waste Electrical and Electronic Equipment Recycling Market, By Source of Waste:

- Household Appliances

- IT & Telecommunications Equipment

- Consumer Electronics

- Lamps

- Batteries

Waste Electrical and Electronic Equipment Recycling Market, By Recycling Method:

- Physical Recycling

- Chemical Recycling

- Thermal Recycling

- Biological Recycling

Waste Electrical and Electronic Equipment Recycling Market, By End-User:

- Raw Material Recovery

- Refurbishment

- Component Recovery

Waste Electrical and Electronic Equipment Recycling Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Waste Electrical and Electronic Equipment Recycling Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Sims Limited

- Umicore NV

- Electronic Recyclers International, Inc. (ERI)

- Veolia Environmental Services

- TES-AMM Pte Ltd

- Attero Recycling Pvt. Ltd.

- Stena Recycling AB

- EcoATM, LLC

- Boliden Group

- Retech Recycling Technologies GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

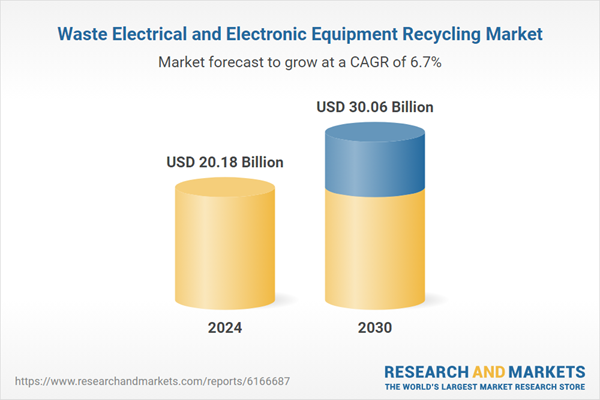

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.18 Billion |

| Forecasted Market Value ( USD | $ 30.06 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |