Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

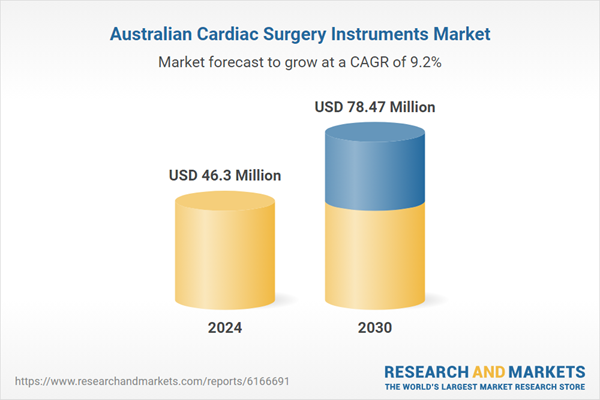

Growth in this space is structurally supported by Australia’s aging population, a rise in complex cardiac conditions, and the clinical community’s shift toward precision-driven surgical interventions. As more hospitals modernize their surgical departments and adopt advanced technologies, the need for high-performance, ergonomically designed, and procedure-specific instruments is accelerating. While capital expenditure constraints and a shortage of specialized surgical staff continue to present barriers particularly outside major metropolitan areas the trajectory remains upward. Healthcare institutions are prioritizing investments in tools that support not only surgical accuracy but also workflow efficiency and patient safety.

Manufacturers that deliver next-generation instruments aligned with evolving procedural standards particularly in minimally invasive, redo, and high-risk cardiac surgeries are well-positioned to capture long-term market share. The focus is shifting from generic instrument sets to customized, value-added solutions that support both surgeon performance and institutional outcomes, reinforcing Australia as a high-value, innovation-ready market within the global cardiac surgery ecosystem.

Key Market Drivers

Aging Population and Increased Surgical Eligibility

Australia is experiencing a pronounced demographic shift, with a steadily increasing proportion of its population entering advanced age brackets. In 2020, individuals aged 65 and older accounted for approximately 16% of the population up from 12% in 1995 and just 8.3% in 1970. The trend becomes even more significant at the upper end of the age spectrum. The population aged 85 and over is forecast to grow from 400,000 in 2010 to approximately 1.8 million by 2050.This sharp rise in the oldest age group signals a substantial increase in demand for age-related healthcare services, particularly complex interventions such as cardiac surgery, and will place increasing pressure on Australia's surgical infrastructure and associated medical device markets. Cardiovascular disease (CVD) affects approximately one in six Australians, equating to over 4.5 million individuals nationwide. This represents a substantial health burden with broad implications for clinical care and healthcare resources. CVD is highly age-dependent, with incidence rates rising sharply in older demographics. As Australia’s population continues to age, the prevalence of CVD is expected to climb, reinforcing its position as a major driver of demand for advanced cardiac interventions including surgical procedures that rely heavily on specialized instrumentation.

Previously, advanced age and comorbidities often excluded older adults from being considered for open-heart surgery due to high perioperative risk. However, innovations in surgical techniques and perioperative care have significantly expanded surgical eligibility among the elderly. Minimally invasive and robotic-assisted surgeries now offer safer alternatives with shorter recovery times and lower complication rates. Enhanced anesthetic techniques and post-operative care protocols allow hospitals to manage elderly patients more effectively during the surgical process. This shift has resulted in broader clinical adoption of high-precision and ergonomic surgical instruments specifically designed for delicate anatomical handling in older patients, boosting demand across public and private surgical centers.

Elderly patients often present with calcified arteries, fragile tissues, and comorbid conditions, which make surgeries more complex and require greater surgical precision. Surgeons are increasingly relying on specialized, micro-engineered instruments such as fine-tip forceps, low-profile clamps, and minimally traumatic scissors that reduce the risk of intraoperative injury. Hospitals are procuring customized surgical kits tailored for geriatric cardiac procedures, which enhances both surgical safety and outcomes. This growing complexity in geriatric cardiac surgeries is translating into higher-value instrument sales, particularly for advanced tools designed to navigate anatomical challenges specific to older patients.

Key Market Challenges

High Capital and Maintenance Costs of Advanced Surgical Instruments

One of the primary constraints on market growth is the significant upfront investment required to procure advanced cardiac surgery instruments, particularly those used in minimally invasive and robotic-assisted procedures.Many public hospitals and regional healthcare centers operate under tight capital budgets. The cost of acquiring high-performance surgical tools especially those made from premium materials or featuring advanced ergonomics can be prohibitive. Reusable instruments often require rigorous sterilization, inspection, and periodic servicing to meet clinical and regulatory standards. This increases the long-term total cost of ownership, making procurement decisions more conservative. The financial barrier restricts the widespread adoption of newer or more specialized instruments, especially in smaller hospitals or remote areas, thereby slowing market penetration.

Key Market Trends

Surge in Minimally Invasive and Robotic-Assisted Cardiac Surgeries

As Australia continues to shift toward less invasive surgical techniques, the demand for highly specialized, precision instruments is rapidly increasing. Minimally invasive cardiac surgeries (MICS) and robotic-assisted procedures are being adopted across major cardiac centers, especially in Victoria, New South Wales, and Queensland.These surgeries require compact, ergonomically designed instruments such as endoscopic forceps, micro scissors, and articulating clamps that allow for maneuverability in restricted anatomical spaces. Leading hospitals are upgrading surgical suites with robotics and hybrid operating rooms, prompting parallel investments in compatible, next-generation instruments.

This trend is expected to drive procurement of advanced, single-use, or hybrid surgical tools that support better outcomes, faster recovery, and reduced intraoperative trauma - fueling premium product demand.

Key Market Players

- B. Braun Australia Pty Ltd

- KLS Martin Group

- Sklar Surgical Instruments

- Teleflex Medical Australia

- Aspen Surgical Products, Inc

- Roland Corporation Australia Pty Ltd

- BTC Health

Report Scope:

In this report, the Australia Cardiac Surgery Instruments Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Cardiac Surgery Instruments Market, By Product:

- Forceps

- Clamps

- Scalpels

- Scissors

- Needle Holders

- Others

Australia Cardiac Surgery Instruments Market, By Application:

- Coronary Artery Bypass Grafting

- Heart Valve Surgery

- Pediatric Surgery

- Heart Transplant

- Others

Australia Cardiac Surgery Instruments Market, By End User:

- Hospitals

- Ambulatory Surgical Centers

Australia Cardiac Surgery Instruments Market, By Region:

- Australia Capital Territory & New South Wales

- Northern Territory & Southern Australia

- Western Australia

- Queensland

- Victoria & Tasmania

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Cardiac Surgery Instruments Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- B. Braun Australia Pty Ltd

- KLS Martin Group

- Sklar Surgical Instruments

- Teleflex Medical Australia

- Aspen Surgical Products, Inc

- Roland Corporation Australia Pty Ltd

- BTC Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.3 Million |

| Forecasted Market Value ( USD | $ 78.47 Million |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |