Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global automotive door sills market is evolving as part of the broader interior vehicle component industry. Demand is growing as consumers value vehicle interiors not just for comfort but as an extension of their lifestyle. Door sills, originally designed for protecting entry points, have transformed into features that contribute to style and branding. With illuminated options, they also interact with ambient lighting, enhancing nighttime appeal. Automakers are leveraging door sills as subtle branding opportunities and differentiation elements across trim levels.

Furthermore, According to the International Organization of Motor Vehicle Manufacturers (OICA), global light vehicle production reached approximately 87 million units in 2023, up from 85 million in 2022. This expansion increases demand for automotive components, including door sills, especially for new car production.

Trends in the market include the adoption of LED-based illuminated sills, use of lightweight and durable materials such as carbon fiber, and growing interest in modular sills that can be upgraded post-purchase. Customization remains a strong focus in the aftermarket, which caters to vehicle owners seeking premium upgrades without buying higher-end trims. Demand from e-commerce channels continues to increase, especially in urban centers with a younger customer base. According to the U.S. Bureau of Transportation Statistics, passenger car and light truck registrations in North America exceeded 290 million vehicles in 2023, driving aftermarket upgrades such as illuminated or customized door sills.

Challenges persist due to pricing sensitivity in cost-focused markets and the limited awareness of door sill features outside premium segments. Incompatibility of certain sills with older vehicle models and the threat of low-quality imitations in the aftermarket can affect consumer trust. Despite these hurdles, the market outlook remains optimistic due to innovation and changing consumer preferences in vehicle aesthetics.

Market Drivers

Growing Consumer Focus on Vehicle Aesthetics

Automotive door sills are gaining popularity as consumers seek vehicles with premium finishes and enhanced visual appeal. Door sills, especially those with illuminated or custom branding, contribute to a car’s aesthetic value, giving buyers a sense of exclusivity. According to the European Automobile Manufacturers’ Association (ACEA), over 30% of new cars in Europe in 2023 were mid- to high-end trims, which typically include premium door sills made of stainless steel, aluminum, or composite materials, boosting the market for high-quality finishes.Automakers are integrating these features across mid- and high-end models to align with evolving design preferences. Consumers also increasingly associate personalized interiors with luxury, prompting demand for decorative accessories like branded or color-matched door sills. This is particularly evident in markets where car buyers place high importance on vehicle customization. The rise of social media trends showcasing car interiors further propels consumer awareness and interest in such features. As the emphasis on design continues to grow, automakers are investing in door sill upgrades as a low-cost, high-impact enhancement to bolster showroom appeal and improve customer perception of overall vehicle quality.

Key Market Challenges

Volatile Raw Material Prices

The cost of materials such as aluminum, stainless steel, and carbon fiber has seen fluctuations due to global supply chain disruptions, trade regulations, and resource shortages. These price variations pose a major challenge to manufacturers who rely on consistent material sourcing to maintain profit margins. Rising input costs directly impact the pricing of door sills, making it difficult for producers to offer competitive products without sacrificing quality. For smaller and mid-sized manufacturers, the burden is heavier as they lack the scale to negotiate bulk deals or absorb sudden cost increases. This unpredictability also complicates long-term supply contracts with OEMs, who demand pricing stability. As a result, players in the automotive door sill market are pressured to either find alternative materials or develop more cost-efficient manufacturing techniques to remain viable in the face of raw material volatility.Key Market Trends

Surge in Illuminated and Smart Door Sills

Illuminated door sills, featuring LED lighting and brand logos, are becoming increasingly common across vehicle segments. These enhancements provide both functional and aesthetic value by improving visibility in low-light conditions and reinforcing brand identity. Premium models now include multicolor or sensor-activated sills that illuminate upon door opening. Some smart sills integrate proximity sensors or even battery status indicators in EVs. This trend aligns with consumer demand for tech-savvy, visually appealing interiors. Suppliers are innovating with flexible PCBs, energy-efficient LEDs, and easy plug-and-play systems to support retrofitting. Smart integration is particularly aligned with EVs and luxury interiors, where minimalism meets advanced functionality.Key Market Players

- Auto Ventshade (AVS)

- CIE Automotive

- Illinois Tool Works Inc. (ITW)

- Magna International Inc.

- Plastic Omnium

- Putco Inc.

- Sill Plates Inc.

- Toyota Boshoku Corporation

- U-Shin Ltd. (MinebeaMitsumi Group)

- Yanfeng Automotive Trim Systems Co., Ltd.

Report Scope:

In this report, the Global Automotive Door Sills Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Door Sills Market, By Sales Channel:

- Aftermarket

- OEM

Automotive Door Sills Market, By Type:

- Illuminated Door Sills

- Non-Illuminated Door Sills

Automotive Door Sills Market, By Material:

- Aluminum

- Carbon Fiber

- Others

- Plastic

- Stainless Steel

Automotive Door Sills Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- France

- U.K.

- Spain

- Italy

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Door Sills Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Auto Ventshade (AVS)

- CIE Automotive

- Illinois Tool Works Inc. (ITW)

- Magna International Inc.

- Plastic Omnium

- Putco Inc.

- Sill Plates Inc.

- Toyota Boshoku Corporation

- U-Shin Ltd. (MinebeaMitsumi Group)

- Yanfeng Automotive Trim Systems Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

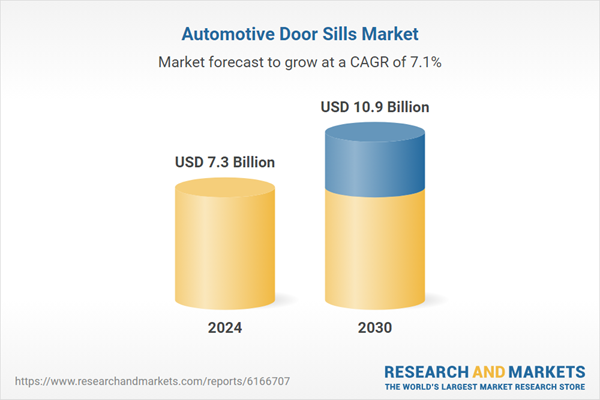

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |