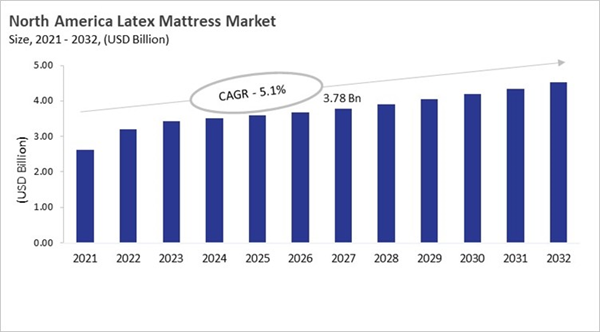

The US market dominated the North America Latex Mattress Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of USD 3.45 billion by 2032. The Canada market is experiencing a CAGR of 6.1% during 2025-2032. Additionally, the Mexico market is expected to exhibit a CAGR of 4.9% during 2025-2032. The US and Canada led the North America Latex Mattress Market by Country with a market share of 80.3% and 9% in 2024.

The North American latex mattress market has changed a lot because of new discoveries in material science, changing customer tastes, and more people becoming aware of the environment. At first, latex mattresses were seen as luxury items, but they became popular because they are durable, supportive, and hypoallergenic. Hybrid and synthetic foams also came onto the market. In the 2000s, the popularity of organic and natural products led to more people wanting certified latex mattresses. Companies like Avocado Green, PlushBeds, and Essentia focused on using eco-friendly materials and health benefits. Certifications like GOLS, GOTS, and GREENGUARD Gold helped build trust, and e-commerce and direct-to-consumer models made it easier for more people to buy.

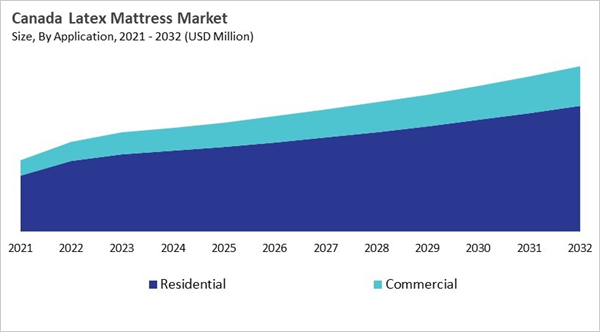

The market is divided into groups based on type, use, and where the products are sold. Hybrid or blended latex mattresses are the most popular because they are comfortable, affordable, and can be used in a variety of ways. Natural latex mattresses are popular with eco-conscious shoppers, and synthetic mattresses are popular with people who care about their budget. The biggest share of revenue comes from residential demand, which is driven by health-conscious homeowners. The commercial sector, which includes hotels and wellness centers, is also using latex more and more because it is long-lasting and easy to clean. Specialty stores make the most money because they offer personalized service, but online stores are growing quickly because they offer free trials, discounts, and convenience.

Application Outlook

Based on Application, the market is segmented into Residential and Commercial. With a compound annual growth rate (CAGR) of 5.7% over the projection period, the Residential Market, dominate the Canada Latex Mattress Market by Application in 2024 and would be a prominent market until 2032. The Commercial market is expected to witness a CAGR of 7.2% during 2025-2032.Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Specialty Stores, Online/E-commerce, Supermarkets & Hypermarkets, and Other Distribution Channel. The Specialty Stores market segment dominated the US Latex Mattress Market by Distribution Channel is expected to grow at a CAGR of 2.2 % during the forecast period thereby continuing its dominance until 2032. Also, The Supermarkets & Hypermarkets market is anticipated to grow as a CAGR of 3.5 % during the forecast period during 2025-2032.Country Outlook

The US is the biggest player in the North American latex mattress market. This is because people are very aware of health, sustainability, and sleep quality, and the retail and e-commerce infrastructure is well-developed. Eco-friendly Millennials and Gen Z want bedding that is organic and free of toxins, and there is also a growing interest in wellness and pressure-relieving mattresses. Avocado Green Mattress and PlushBeds are two examples of direct-to-consumer brands that are changing the market with trial periods, customization, and clear pricing. Hybrid latex models are also becoming more popular because they offer a good balance of support and comfort. Certifications like OEKO-TEX and GREENGUARD back up claims about health and the environment. There is a lot of competition from old and new brands, as well as memory foam and hybrid mattresses. To be successful in the market, you need to keep coming up with new ideas, eco-marketing, and teaching consumers.List of Key Companies Profiled

- PlushBeds Inc.

- Brooklyn Bedding, LLC (Cerberus Capital Management, L.P.)

- Avocado Mattress, LLC

- Sleep Number Corporation

- Resident Home, LLC (Awara)

- Miami Mattress

- Commerzilla, LLC (Turmerry)

- Latex Mattress Factory

- SleepEZ USA Inc.

- Savvy Rest, Inc.

Market Report Segmentation

By Application

- Residential

- Commercial

By Type

- Blended/Hybrid Mix

- Natural Latex

- Synthetic Latex

By Distribution Channel

- Specialty Stores

- Online/E-commerce

- Supermarkets & Hypermarkets

- Other Distribution Channel

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- PlushBeds Inc.

- Brooklyn Bedding, LLC (Cerberus Capital Management, L.P.)

- Avocado Mattress, LLC

- Sleep Number Corporation

- Resident Home, LLC (Awara)

- Miami Mattress

- Commerzilla, LLC (Turmerry)

- Latex Mattress Factory

- SleepEZ USA Inc.

- Savvy Rest, Inc.