Key Highlights:

- The North America market dominated Global SaaS-based Core Banking Software Market in 2024, accounting for a 40.5% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 9.32 billion by 2032.

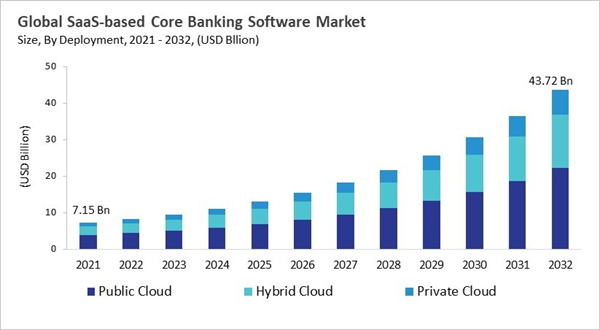

- Among the various Deployment, the Public Cloud segment dominated the global market, contributing a revenue share of 52.62% in 2024.

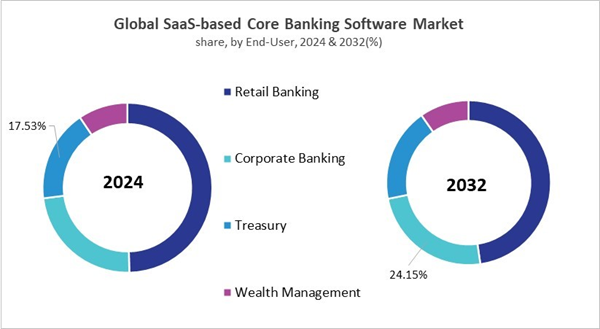

- In terms of End-User, Retail Banking segment are expected to lead the global market, with a projected revenue share of 47.71% by 2032.

- The Large Banks emerged as the leading Banking Type in 2024, capturing a 30.49% revenue share, and is projected to retain its dominance during the forecast period.

The Saas-based core banking market has transformed to cloud native platforms that provide banking services as on-demand solutions. This transformation is supported by enhancement in cloud computing, the rising need of efficiency and flexibility across the banking sector, and the support from regulatory bodies for digital transformations. SaaS cores have gained popularity amongst traditional institutions aiming to modernize operations, and cater the regulatory requirements for inclusion and resilience, which previously were limited to fintech and digital-only banks. The transformation to modular, API-driven platforms have enabled banks to adopt real-time processing and work on digital-first strategies while decreasing reliance on old infrastructure.

Some of the major market trends are rising regulatory clarity across cloud adoption, transition from IT-driven advancements to business-focused transformation, and growth of modular, composable systems. Banks are integrating SaaS cores to reduce costs along with accelerating product launches, and allow customization. Key market players are introducing API-rich platforms, managed services designed for institutions with fewer IT resources, and integrated compliance features. Market expansion is highly dependent on measurable business outcomes, comprehensive systems that support modernization, along with control and governance.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2025, Mambu B.V announced the partnership with Light Frame to deliver a next-generation, cloud-native core banking solution for private banking and wealth management. Combining Mambu’s SaaS core banking platform with Light Frame’s investment technology, the solution helps wealth institutions modernize operations, boost efficiency, ensure compliance, and scale quickly. Additionally, In May, 2025, nCino, Inc announced the partnership with Banque Raiffeisen to modernize its loan and credit management with a cloud-based platform. The new system streamlines workflows, automates processes, and boosts regulatory compliance, supporting the bank’s digital-first approach across various lending services.

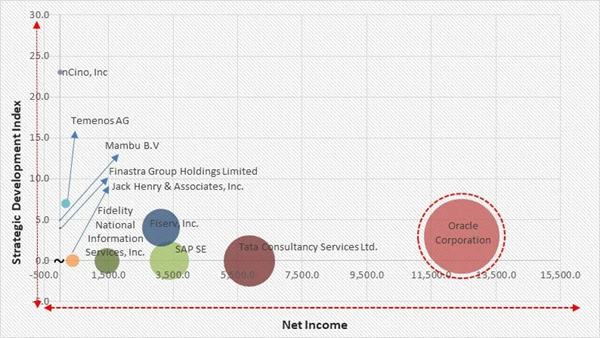

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the SaaS-based Core Banking Software Market. Companies such as Tata Consultancy Services Ltd., SAP SE, and Fiserv, Inc. are some of the key innovators in SaaS-based Core Banking Software Market.

COVID-19 Impact Analysis

The global market for SaaS-based core banking software is quickly moving away from old on-premise systems and toward flexible, cloud-native platforms. These solutions make it possible to process data in real time, integrate digital systems without any problems, and come up with new ideas more quickly. Adoption is being driven by a growing need for cost-effectiveness, modular API-driven architectures, and fast product launches. More confidence comes from clearer rules, better security, and more resilient operations. Both established vendors and new cloud-first companies offer flexible solutions for the digital age. Thus, COVID-19 had positive impact on the market.Driving and Restraining Factors

Drivers- Growing Demand for Digital Transformation in Banking

- Cost Efficiency and Operational Scalability

- Regulatory Compliance and Security Requirements

- Rising Adoption of Cloud and API-driven Banking Models

- Data Security and Privacy Concerns

- Integration Challenges with Legacy Systems

- High Dependence on Vendor Reliability and Service Quality

- Expansion into Underserved and Niche Banking Segments

- Integration of Emerging Technologies for Next-Generation Banking

- Growth of Banking-as-a-Service (BaaS) and White-Label Banking Models

- Achieving Standardization While Meeting Diverse Market Needs

- Building and Maintaining Customer Trust in a Shared Infrastructure Model

- Managing the Complexity of Continuous Innovation and Feature Delivery

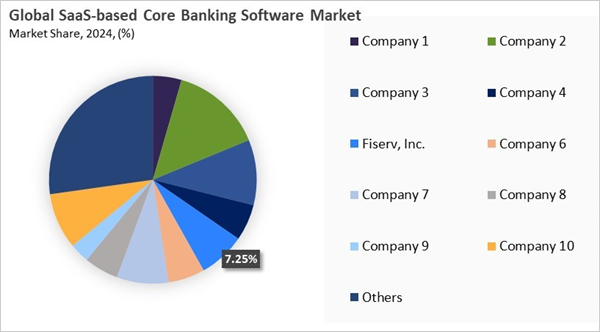

Market Share Analysis

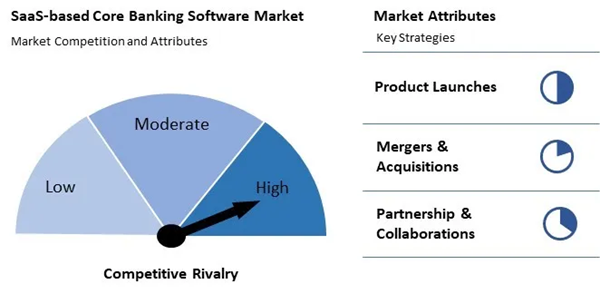

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Deployment Outlook

Based on deployment, the global Saas-based core banking software Market is segmented into Public Cloud, Hybrid Cloud, and Private Cloud. The hybrid cloud segment procured 32.5% revenue share in the market in 2024. Hybrid cloud solutions enable banks to maintain sensitive data on private infrastructure while leveraging the public cloud for less critical applications. This model provides a balance between control, security, and scalability, which is particularly important for institutions operating in highly regulated environments.End-User Outlook

On the Basis of End-User, the global Saas-based core banking software market is segmented into Retail Banking, Corporate Banking, Treasury, and Wealth Management. The corporate banking segment recorded 23.4% revenue share in the market in 2024. The corporate banking segment focuses on providing financial services to businesses, including business loans, lines of credit, and cash management. Cloud-based core banking solutions are gaining popularity in corporate banking due to their ability to handle complex financial transactions, integrate with enterprise resource planning (ERP) systems, and provide real-time data analytics.Regional Outlook

Region-wise, the global Saas-based core banking software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America segment recorded 40.5% revenue share in the market in 2024. In North America, the SaaS-based core banking software market is experiencing substantial growth supported by the rapid acceptance of cloud technologies, the shift to digital transformation among credit unions and banks. The presence of key major fintech giants, developed digital banking ecosystem, and increasing consumer demand for mobile-first banking, customized experiences are resulting in increased adoption across the North America region. Furthermore, Europe is predicted to capture promising growth in the SaaS-based core banking software market. This is owing to the regulatory frameworks like GDPR and PSD2, which are resulting in a shift towards compliant, scalable, and cloud-native solutions. Regional nations are focusing on cross-border financial integration, cybersecurity readiness, and open-banking, which is further resulting in the expansion of the market.The Asia-Pacific and LAMEA region are projected to have prominent growth in the SaaS-based core banking software market during the forecast period. The market is driven by supportive government policies, increasing digital banking adoption, and numerous financial inclusion initiatives. Expanding fintech ecosystem and cloud adoption in the developing nations such as Indonesia, the Philippines, and India are resulting in growth opportunities for the regional market. In the LAMEA region, banks are integrating SaaS-based solutions to decrease costs, overcome infrastructure challenges. Additionally, the Middle East region is investing in digital transformation initiatives and cost-efficient, agile, and consumer-centric financial services, thus enabling market growth.

Market Competition and Attributes

The SaaS-based core banking software market is experiencing intense competition. This dynamic environment is characterized by a surge of innovative startups and emerging fintech companies offering agile, cloud-native solutions. These challengers are rapidly gaining traction by delivering cost-effective, scalable, and customizable platforms that cater to the evolving needs of financial institutions. Their ability to swiftly adapt to market demands and regulatory changes positions them as formidable competitors, driving continuous innovation and transformation within the banking sector.

Recent Strategies Deployed in the Market

- May-2025: Temenos AG unveiled the Temenos Product Manager Copilot, a Generative AI tool integrated with Microsoft Azure OpenAI Service. Embedded in its core banking solutions, this AI assistant helps banks design, test, and launch financial products faster, enhancing innovation, efficiency, and customer relevance in a competitive banking landscape.

- May-2025: Mambu B.V unveiled Mambu Payments, expanding its composable SaaS cloud banking platform to include modern payment capabilities. Following its 2024 acquisition of Numeral, Mambu Payments enables financial institutions to modernize payment infrastructure, integrate seamlessly with core banking, and automate workflows, boosting innovation across lending, deposits, and payments.

- May-2025: Oracle Corporation unveiled its Banking Retail Lending Servicing Cloud Service and Collections Cloud Service as part of its modular Banking Cloud Services portfolio. These new SaaS solutions help retail financial institutions modernise loan servicing and collections, automate processes, reduce risk, optimise costs, and deliver improved digital lending experiences.

- May-2025: Finastra Group Holdings Limited announced the partnership with CARITech to speed up the adoption of Finastra’s Essence core banking solution across banks in the MENA region. Combining CARITech’s regional delivery expertise with Finastra’s modular, cloud-enabled platform, the partnership aims to help financial institutions modernize operations efficiently and meet local requirements smoothly.

- Feb-2025: nCino, Inc acquired Sandbox Banking, a software company, aiming to boost its data connectivity and operational efficiency for banks and credit unions through Sandbox’s Glyue integration platform-as-a-service (iPaaS). The deal will help nCino simplify digital transformation, reduce manual processes, and enhance core and ancillary banking system integrations.

List of Key Companies Profiled

- nCino, Inc

- Temenos AG

- Mambu B.V

- Oracle Corporation

- Fiserv, Inc.

- Jack Henry & Associates, Inc.

- Finastra Group Holdings Limited (Vista Equity Partners)

- Tata Consultancy Services Ltd.

- SAP SE

- Fidelity National Information Services, Inc.

Market Report Segmentation

By Deployment

- Public Cloud

- Hybrid Cloud

- Private Cloud

By End-User

- Retail Banking

- Corporate Banking

- Treasury

- Wealth Management

By Banking Type

- Large Banks

- Midsize Banks

- Small Banks

- Community Banks

- Credit Unions

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- nCino, Inc

- Temenos AG

- Mambu B.V

- Oracle Corporation

- Fiserv, Inc.

- Jack Henry & Associates, Inc.

- Finastra Group Holdings Limited (Vista Equity Partners)

- Tata Consultancy Services Ltd.

- SAP SE

- Fidelity National Information Services, Inc.