Key Highlights:

- The North America market dominated Global AI Shopping Assistant Market in 2024, accounting for a 39.70% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 5.47 billion by 2032.

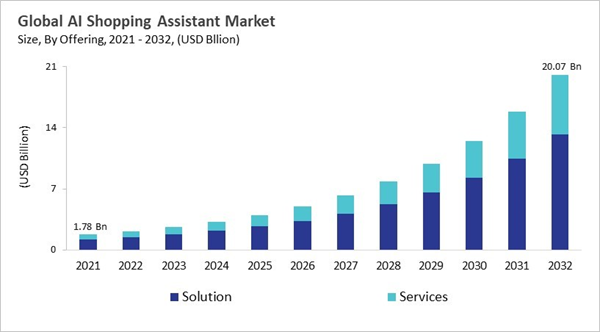

- Among the various Offering, the Solution segment dominated the global market, contributing a revenue share of 67.66% in 2024.

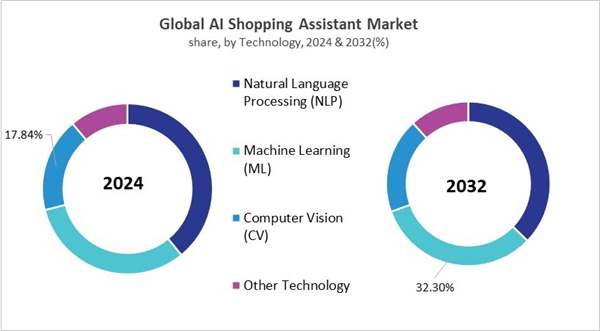

- In terms of Technology, Natural Language Processing (NLP) segment are expected to lead the global market, with a projected revenue share of 37.19% by 2032.

- The Retail & E-Commerce market emerged as the leading End-use in 2024, capturing a 56.21% revenue share, and is projected to retain its dominance during the forecast period.

- By Type the Text Segment captured the market size of USD 1.42 billion in 2024 and this segment will maintain its position during the forecast period.

The AI shopping assistant market is expected to witness substantial growth as a result of retail digitalization, enhancements in AI, and conversational commerce. AI shopping assistants have emerged as advanced assistants having the capability of voice commerce, customized recommendations, real-time support, and market-driven pricing. Innovations from major OEMs such as Walmart, Amazon, Google, and Alibaba, and global policies like India’s National AI strategy and the EU’s Coordinated Plan on AI have supported the expansion across physical and digital retail stores. Regional growth varies, with North America and Europe focused on hyper-customization and the Asia-Pacific region dominating in emotion-detection AI and live-commerce integration. Furthermore, the players across the globe are using artificial intelligence for operational effectiveness using automated checkouts, supply chain optimization, and predictive analytics.

Moreover, competition is increasing in the market as retailers, tech giants, and developing startups employ AI to advance customization, real-time interaction, and cross-platform integration. Key players like Google, Alibaba, Walmart, Apple, and Amazon are using broad data ecosystems to create emotionally intelligent, proactive assistants capable of understanding consumer needs and modernize shopping journey. Strategies of key players is focused on voice & chat commerce, ethical AI practices, backend optimization, and data driven customization due to the increasing regulatory evaluation. Some players are also focusing on innovations such as emotionally responsive avatars, AR-based product visualization, and multilingual support. Alongside, partnerships with e-commerce platforms is supporting the steady deployment of the AI shopping assistant market. The integration of AI capabilities, user expectations, and retail infrastructure is emerging the AI shopping assistants as an important tool for the future of the e-commerce industry.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2025, Alibaba Group Holding Limited unveiled Qwen 3, its latest open-source large language model series, aiming to redefine AI benchmarks. With upgraded capabilities across text, vision, and function calling, Qwen 3 enhances applications like AI shopping assistants by offering faster, more personalized, and context-aware customer interactions in e-commerce and cloud-based services. Moreover, In June, 2025, Walmart, Inc. unveiled new AI-driven tools aimed at enhancing the efficiency and experience of 1.5 million store associates. These include generative AI capabilities in the Me@Walmart app, streamlining tasks like scheduling, inventory checks, and customer service, contributing to more personalized and responsive shopping experiences through AI-enabled support systems.

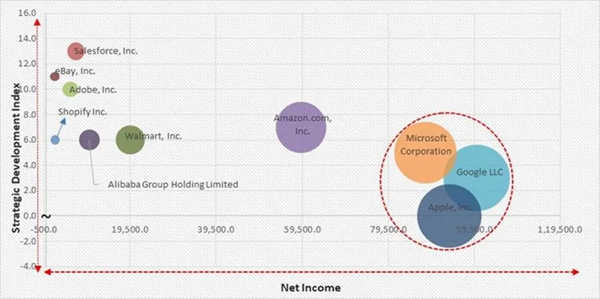

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Apple, Inc., Google LLC, and Microsoft Corporation are the forerunners in the AI Shopping Assistant Market. In May, 2025, Google LLC unveiled AI-driven tools to enhance product discovery, personalized recommendations, and a streamlined checkout process in Google Shopping. The updates aim to enhance user engagement and minimize purchase friction, signaling Google’s deeper commitment to AI-powered retail experiences and direct competition with Amazon and other e-commerce platforms. Companies such as Amazon.com, Inc., Alibaba Group Holding Limited, and Salesforce, Inc. are some of the key innovators in AI Shopping Assistant Market.

COVID-19 Impact Analysis

As customers turned to online shopping due to store closures and social distancing, the COVID-19 pandemic sped up the adoption of AI-powered shopping assistants. Personalized, round-the-clock shopping experiences, automated customer support, and handling growing web traffic all required these tools. Retailers like Walmart and Target utilized chatbots and virtual assistants to streamline backend operations and customer interactions, while major corporations such as Amazon, Google, and Microsoft expanded their AI ecosystems. The ease of use and engagement in online shopping have been improved by technological innovations such as AR-enabled virtual try-ons, real-time inventory updates, and natural language processing. Accessible AI platforms like Shopify and Azure helped small and medium-sized businesses, allowing for competitive parity in e-commerce. All things considered, the pandemic acted as a stimulant for the retail industry's long-term digital transformation, increased operational effectiveness, and improved customer relationships. Thus, the COVID-19 pandemic had a positive impact on the market.Driving and Restraining Factors

Drivers- Rising Consumer Demand For Hyper-Personalization In Shopping Experiences

- Accelerated Integration Of Conversational Interfaces And Voice Commerce

- Omnichannel Commerce And The Demand For Seamless Cross-Platform Engagement

- Increasing Complexity Of Product Ecosystems And Decision Fatigue

- Data Privacy Concerns And Regulatory Compliance Challenges

- High Implementation Costs And Integration Complexity For Businesses

- Limitations In AI Understanding And Contextual Relevance

- Expansion Into B2B And Enterprise Procurement Channels

- AI Shopping Assistants In Sustainability And Ethical Consumption

- Integration With AR/VR Platforms For Immersive Shopping Experiences

- Ensuring Consistent User Experience Across Omnichannel Environments

- Balancing Personalization With User Control And Transparency

- Real-Time Inventory, Pricing, And Supply Chain Synchronization

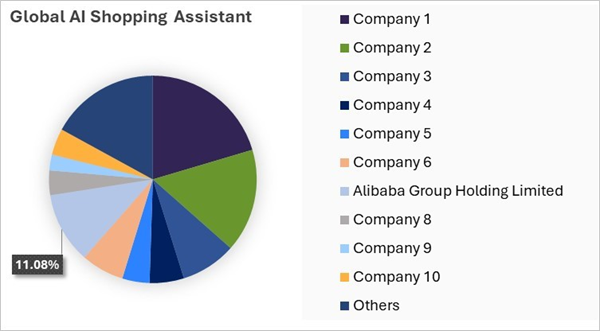

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Offering Outlook

Based on Offering, the market is segmented into Solution, and Services. The Services segment acquired 32 % revenue share in the market in 2024. This reflects a growing trend of retailers relying on external expertise to successfully deploy and manage AI shopping assistant solutions. As AI technologies become more complex, demand is rising for consulting, implementation, and managed services to tailor solutions to specific business needs. A notable trend is the increasing preference for subscription-based and outcome-driven service models, enabling businesses to scale AI adoption without heavy upfront investments.Technology Outlook

Based on Technology, the market is segmented into Natural Language Processing (NLP), Machine Learning (ML), Computer Vision (CV), and Other Technology. The Machine Learning (ML) segment witnessed a 31% revenue share in the market in 2024. ML is a core technology behind personalized shopping experiences, enabling systems to learn from user behavior and make accurate recommendations. By analyzing data such as past purchases, browsing history, and customer preferences, ML algorithms help deliver relevant content and offers to individual users. In addition to personalization, ML supports dynamic pricing, fraud detection, inventory forecasting, and customer segmentation.Regional Outlook

Region-wise, the AI shopping assistant market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America segment recorded the 39% revenue share in the market in 2024. In North America, the AI shopping assistant market is experiencing steady growth majorly supported by the enhancements in e-commerce ecosystems, the presence of key tech-giants, and growing digital adoption rates across nations like the US and Canada. Players in the retail sector are deploying AI assistants all across multi-channel platforms in order to provide customized regulations, streamlined checkout experiences, and real-time inventory updates. Moreover, Europe has also captured substantial growth in the market due to strict data privacy rules that raise trust in AI-driven tools. Rising adoption across electronics, grocery, and fashion retailers, aiming to increase customer engagement, is further supporting the expansion in the regional market.The Asia-Pacific AI shopping assistant market is growing at a steady pace, supported by growing usage of super apps, mobile-first shopping behaviour, and the rising deployment of AI assistants across e-commerce platforms, mainly in Japan, China, and India. In addition to this, the AI shopping assistant market has witnessed promising development in the LAMEA region, fueled by rising acceptance in urban areas with the support of internet penetration. Retailers in nations such as the United Arab Emirates, Brazil, and Saudi Arabia are increasingly adopting AI shopping assistants to enhance customer service, expand their reach, and overcome language barriers, resulting in market expansion.

Market Competition and Attributes

The AI shopping assistant market is growing rapidly. This growth comes from advances in artificial intelligence and shifts in consumer behavior. Companies now use AI to enhance customer experiences, offer personalized recommendations, and simplify shopping. As a result, competition has intensified. Industry players compete by innovating and focusing on user-centric solutions. Staying ahead now means investing in technology and understanding consumers. The landscape remains dynamic. There are many opportunities for those who can use AI to meet modern shoppers' needs.

Recent Strategies Deployed in the Market

- Jul-2025: Amazon.com, Inc. announced the acquisition of Humane, an AI wearable startup, known for its voice-first AI device that acts as a digital assistant. The move suggests Amazon's push into next-gen AI shopping assistants, integrating hands-free, intelligent interfaces to enhance customer experience and possibly compete with other emerging AI hardware in retail.

- Jun-2025: Walmart, Inc. unveiled "Sparky," a generative AI assistant designed to aid employees in daily operations by answering questions, improving workflows, and enhancing decision-making. This innovation supports real-time assistance, boosting store productivity and ultimately refining the customer shopping journey through more informed and efficient in-store support.

- May-2025: Shopify Inc. unveiled conversational AI shopping agents that guide customers in real-time. These agents provide personalized assistance, enhancing the user experience and increasing conversion rates. This launch strengthens Shopify's AI strategy and positions it as a key player in the growing AI-powered e-commerce space.

- May-2025: Shopify unveiled “Vibe,” an AI-powered shopping interface, and partnered with Perplexity to enhance search and discovery. This aims to deliver more intuitive shopping experiences, positioning Shopify to lead innovations in AI-driven commerce and compete in the evolving landscape of AI shopping assistants.

- May-2025: Salesforce, Inc. announced the acquisition of Convergence AI, the maker of Agentforce, to boost its generative AI capabilities in retail. The deal aims to strengthen Salesforce’s position in the AI shopping assistant market by integrating Agentforce’s intelligent agents for more personalized, automated customer engagement across commerce, marketing, and service channels.

- May-2025: eBay, Inc. unveiled an AI-powered shopping assistant designed to simplify product discovery and purchasing. The assistant uses conversational AI to help users find specific items, compare listings, and navigate categories. This innovation enhances the customer experience and positions eBay within the growing AI-driven e-commerce landscape.

List of Key Companies Profiled

- Amazon.com, Inc.

- Google LLC

- Shopify Inc.

- Salesforce, Inc.

- Apple, Inc.

- Microsoft Corporation

- Alibaba Group Holding Limited

- eBay, Inc.

- Adobe, Inc.

- Walmart, Inc.

Market Report Segmentation

By Offering

- Solution

- Services

By Technology

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision (CV)

- Other Technology

By End-use

- Retail & E-Commerce

- BFSI

- Healthcare

- Travel & Hospitality

- Media & Entertainment

- Other End-use

By Type

- Text

- Voice

- Multimodal

- Visual

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Amazon.com, Inc.

- Google LLC

- Shopify Inc.

- Salesforce, Inc.

- Apple, Inc.

- Microsoft Corporation

- Alibaba Group Holding Limited

- eBay, Inc.

- Adobe, Inc.

- Walmart, Inc.