Key Highlights:

- The North America market dominated Global AI Assistant Software Market in 2024, accounting for a 39.35% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 7.5 billion by 2032.

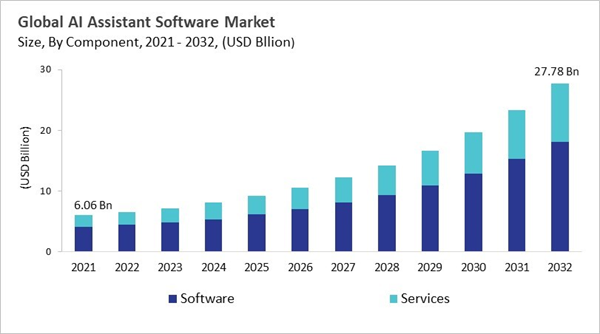

- Among the Component Type, the Software segment dominated the global market, contributing a revenue share of 66.72% in 2024.

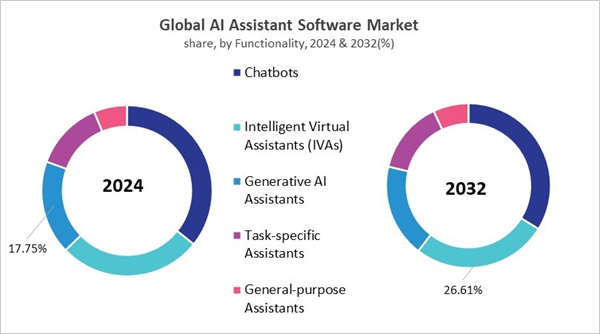

- In terms of Functionality, Chatbots segment are expected to lead the global market, with a projected revenue share of 33.82% by 2032.

- The Customer Service & Support market emerged as the leading Application in 2024, capturing a 37.55% revenue share, and is projected to retain its dominance during the forecast period.

Over the past ten years, the AI assistant software market has swiftly expanded from simple chatbots to advance generative AI platforms, propelled by key OEMs such as Google, Microsoft, Oracle, IBM, and SAP. These corporates have incorporated reasoning, modern NLP, and task automation into business systems, meanwhile digital transformation plans of government in regions such as U.S., Europe, and Asia have increased the usage of AI assistant software in sector like healthcare, finance, education, and smart cities. Furthermore, advanced AI architectures-integrated cloud-hosted LLMs with edge-deployed models- are proven to be major approach, balancing latency, privacy, and compliance requirements. This transformation is completed by the input of voice and text across devices providing flexible multimodal interaction across consumer and enterprise application.

Furthermore, as Big Tech uses ecosystem integration and scale to its advantage, and enterprise software vendors focus on compliance and automation features that are specific to their industries, competition is heating up. Companies can improve their generative AI features and move into new verticals thanks to strategic partnerships, mergers, and targeted acquisitions. For example, IBM has worked with Oracle, SoundHound has expanded into automotive, and Oracle has worked with Cohere. Startups that make assistants for specific fields are also putting pressure on the market, especially in customer service, HR, and industrial operations. AI assistants are moving from being support tools to being important strategic systems for businesses all over the world due to government support, changing rules, and faster integration of businesses.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Salesforce, Inc. unveiled Einstein Copilot, a new generative AI conversational assistant built into every Salesforce app, boosting productivity by handling tasks using secure company data. With Einstein Copilot Studio, companies can customize AI assistants for sales, service, or marketing, enhancing customer experiences with trusted, integrated AI tools. Moreover, In July, 2025, Amazon.com, Inc. unveiled Bedrock AgentCore, new AI agent tools in AWS Marketplace, and an extra $100 million for its Generative AI Innovation Center. These advancements help companies securely build, deploy, and scale powerful AI agents, driving enterprise-level agentic AI innovation across industries.

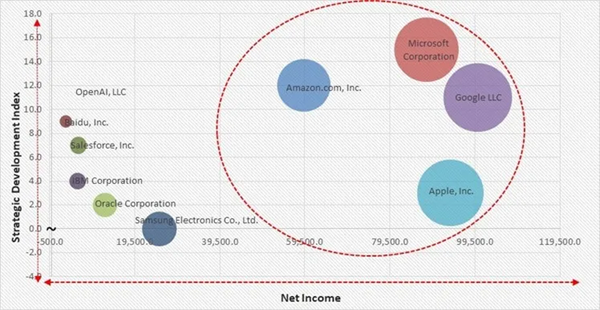

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC, Apple, Inc., Microsoft Corporation, and Amazon.com, Inc. are the forerunners in the AI Assistant Software Market. In July, 2025, Google LLC unveiled Gemini Drops, an online feed highlighting new features, tips, and community stories about its Gemini AI assistant. This hub helps users stay updated on Gemini’s capabilities, offering practical guides and showcasing real-life use cases to maximize productivity and creativity with Google’s AI tools. Companies such as Samsung Electronics Co., Ltd., Oracle Corporation, and Salesforce, Inc. are some of the key innovators in AI Assistant Software Market.

COVID-19 Impact Analysis

Globally, the COVID-19 pandemic changed digital transformation strategies by dramatically speeding up the adoption of AI assistant software across industries. Companies, governments, and healthcare providers have resorted to AI-powered virtual agents to maintain operational continuity, handle a surge in inquiries, and provide real-time information as lockdowns and social distancing have limited in-person interactions. Chatbot-based helplines were implemented by governments and health organizations to improve citizen engagement, alleviate call center stress, and distribute accurate updates. AI assistants incorporated into collaboration platforms within businesses helped the remote workforce by streamlining HR, workflow management, and scheduling procedures. Conversational AI in healthcare enabled telemedicine, symptom tracking, and virtual consultations, guaranteeing continuous patient care. Thus, the COVID-19 had a positive impact on the market.Driving and Restraining Factors

Drivers- Rising Enterprise Demand For Intelligent Automation Across Functions

- Advancements In Multimodal And Conversational AI Models

- Consumer Adoption In Everyday Use Cases Via Smart Devices

- Strategic Investments And Ecosystem Expansion By Tech Giants

- Data Privacy Concerns And Regulatory Constraints

- High Dependence On Cloud Infrastructure And Latency Challenges

- Lack Of Contextual Understanding And Domain-Specific Intelligence

- Expansion Into Industry-Specific AI Assistant Solutions

- Integration Of AI Assistants Into Hardware Ecosystems And Smart Devices

- Multilingual And Multimodal Expansion For Global Accessibility

- Navigating Evolving User Expectations And Experience Complexity

- Maintaining Long-Term Accuracy And Relevance Amid Data Drift

- Balancing Ethical Decision-Making With Automation Goals

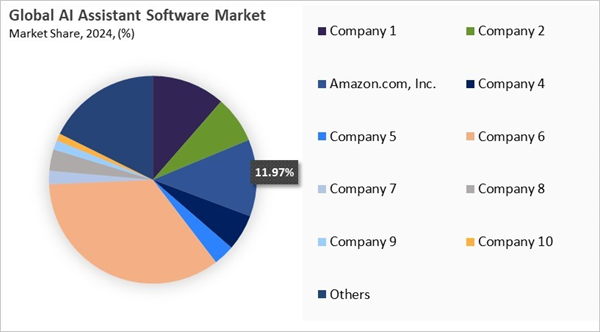

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches & Expansions.

Component Outlook

Based on Component, the market is segmented into Software and Services. The Services segment acquired 33% revenue share in the market in 2024. These services typically include consulting, integration, training, and post-deployment support that help organizations align AI assistants with their existing infrastructure and business objectives. Service providers assist companies in identifying suitable AI tools, optimizing implementation strategies, ensuring data compatibility, and monitoring system performance over time.Functionality Outlook

Based on Functionality, the market is segmented into Chatbots, Intelligent Virtual Assistants (IVAs), Generative AI Assistants, Task-specific Assistants, and General-purpose Assistants. The Intelligent Virtual Assistants (IVAs) segment witnessed a 27% revenue share in the market in 2024. These assistants are capable of handling multi-turn conversations, learning from past interactions, and performing a range of tasks such as scheduling meetings, fetching data, and facilitating transactions. They are increasingly embedded into enterprise workflows, mobile devices, automotive interfaces, and healthcare systems, enhancing productivity and enabling more intuitive user engagement.Regional Outlook

Region-wise, the AI Assistant Software Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America segment recorded a 39.35% revenue share in the market in 2024. North America is the largest and most advanced AI assistant software market, propelled by fast adoption, potent presence of key OEMs like Microsoft, IBM, Google, and Amazon and robust enterprise incorporation across sector as healthcare, BFSI, retail, and public services. The U.S. government has foresighted stance due to plans such as federal approvals of generative AI platforms. Digital transformation is very advance, advanced cloud infrastructure, high digital literacy and robust venture capital funding for AI startups is driving the growth of the market in the region. Furthermore, Canada is keeping pace, with focus on public-private collaborations and privacy-aware AI frameworks to install assistants in education, healthcare, and smart city projects.Likewise, to protect data sovereignty, Europe focuses on ethical AI, following the GDPR, and hybrid architectures. This has led to more use in regulated fields like finance and manufacturing. China, Japan, South Korea, and India are the fastest-growing countries in the Asia-Pacific region. Government-backed digital programs are driving strong growth in consumer electronics, cars, and industrial automation. LAMEA is a new market that is growing in banking, telecom, and public services. This is thanks to the growth of cloud computing and the spread of smartphones. Partnerships with global OEMs help with budget and infrastructure problems.

Market Competition and Attributes

The AI assistant software market is highly competitive, driven by rapid advancements in natural language processing, machine learning, and automation technologies. Numerous providers are innovating to enhance personalization, multilingual capabilities, and integration across devices and platforms. Intense competition pushes continuous improvements in accuracy, adaptability, and user experience. Market players differentiate through features like contextual understanding, privacy protection, and enterprise-focused solutions. With rising demand across industries, competition fosters accelerated innovation, frequent upgrades, and expanding applications in both consumer and business environments.

Recent Strategies Deployed in the Market

- Jul-2025: Google LLC teamed up with BBVA, a bank in Hing Kong by deploying Google Workspace with Gemini AI to boost productivity for 100,000 employees globally. This move aims to automate tasks, enhance collaboration, and support BBVA’s digital transformation, backed by mandatory AI training to ensure secure, responsible, and effective use.

- Jul-2025: Amazon.com, Inc. acquired Bee, an AI wearables startup that makes a bracelet and app to record conversations, create reminders, and manage tasks. Bee’s affordable devices act as a personal assistant, expanding Amazon’s AI footprint into wearables and ambient intelligence. The acquisition is pending final closure.

- Jun-2025: oogle LLC acquired Character AI, a fast-growing AI startup known for its personalized AI companions. This strategic move aims to strengthen Google’s AI capabilities, enhancing user experiences through more tailored interactions. The deal highlights Google’s commitment to advancing personalization in AI and staying ahead in the competitive market.

- Jun-2025: Apple, Inc. unveiled new AI features like live translation, visual search, and a Workout Buddy. These updates, under “Apple Intelligence,” integrate AI into apps like Messages, Wallet, and Reminders. Apple also opened its large language model to developers and promised upcoming improvements to Siri.

- May-2025: Microsoft Corporation unveiled a new Copilot AI coding agent that can handle tasks like fixing bugs and rewriting code. It submits its work for developer review and integration. This AI tool, used by over 15 million developers, aims to boost productivity by automating routine programming tasks.

- May-2025: IBM Corporation announced the partnership with Oracle, a computer software company to deliver AI agents and hybrid cloud solutions. By integrating IBM’s watsonx Orchestrate and Granite models with Oracle Cloud Infrastructure, they aim to help businesses deploy and manage AI agents, automate workflows, and modernize infrastructure, driving AI-driven growth and customer success.

List of Key Companies Profiled

- Google LLC

- Apple, Inc.

- Amazon.com, Inc.

- Microsoft Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- OpenAI, LLC

- IBM Corporation

- Baidu, Inc.

- Oracle Corporation

- Salesforce, Inc.

Market Report Segmentation

By Component

- Software

- Services

By Functionality

- Chatbots

- Intelligent Virtual Assistants (IVAs)

- Generative AI Assistants

- Task-specific Assistants

- General-purpose Assistants

By Application

- Customer Service & Support

- Sales & Marketing

- IT Service Management (ITSM)

- Human Resources (HR) & Talent Management

- Personal Assistance

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Google LLC

- Apple, Inc.

- Amazon.com, Inc.

- Microsoft Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- OpenAI, LLC

- IBM Corporation

- Baidu, Inc.

- Oracle Corporation

- Salesforce, Inc.