The China market dominated the Asia-Pacific QR Code Payment Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of USD 7.38 billion by 2032. The Japan market is registering a CAGR of 18.3% during 2025-2032. Additionally, the India market is expected to showcase a CAGR of 20.3% during 2025-2032. The China and India led the Asia-Pacific QR Code Payment Market by Country with a market share of 36.9% and 24.5% in 2024.

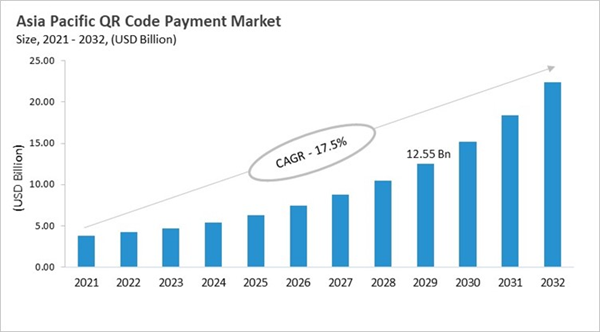

The QR code payment market in the Asia-Pacific region has grown quickly in the last ten years. This is because more people are using mobile phones, the government is supporting standardization, and there is a push for financial inclusion. China was the first country to use it, where super-apps added QR payments so that businesses could accept payments without having to buy expensive POS terminals. Countries like Thailand, Malaysia, Singapore, Indonesia, the Philippines, and India created national QR standards like PromptPay, DuitNow QR, SGQR, QRIS, and UPI QR to make it easier for merchants to use different systems and make payments. QR solutions have also been adopted in Japan and Oceania, with projects like JPQR and account-to-account integrations in Australia and New Zealand.

Interoperability, multi-service integration, security, and offline functionality are all important trends in the market right now. QR codes now support loyalty programs, digital receipts, financing offers, order-ahead features, and mini-app ecosystems. This makes it easier for merchants and consumers to connect with each other. Banks, e-wallets, and payment switches are some of the most important players in the market. They focus on scale, integration, and layered services, using strategies like zero-cost merchant onboarding, instant settlements, and built-in business tools. Super-apps make people want to use them all the time, and fraud detection, tokenization, and consumer protection make people trust them more. Different countries have different types of competition.

Transaction Channel Outlook

Based on Transaction Channel, the market is segmented into Face-to-Face and Remote. The Face-to-Face market segment dominated the China QR Code Payment Market by Transaction Channel is expected to grow at a CAGR of 17.6 % during the forecast period thereby continuing its dominance until 2032. Also, The Remote market is anticipated to grow as a CAGR of 18.8 % during the forecast period during 2025-2032.End User Outlook

Based on End-user, the market is segmented into Restaurant, Retail & E-commerce, E-ticket Booking, and Other End-user. Among various India QR Code Payment Market by End-user; The Restaurant market achieved a market size of USD $1.49 billion in 2024 and is expected to grow at a CAGR of 19.5 % during the forecast period. The E-ticket Booking market is predicted to experience a CAGR of 21.1% throughout the forecast period from (2025 - 2032).Offerings Outlook

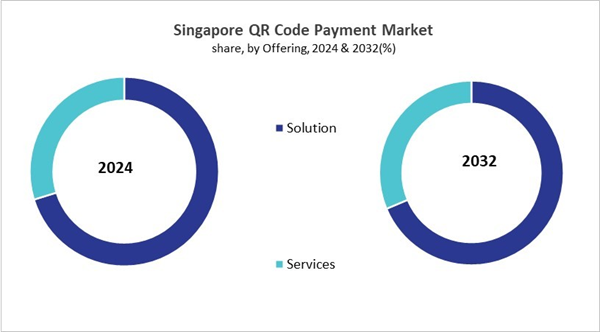

Based on Offerings, the market is segmented into Solution and Services. With a compound annual growth rate (CAGR) of 21.5% over the projection period, the Solution Market, dominate the Singapore QR Code Payment Market by Offerings in 2024 and would be a prominent market until 2032. The Services market is expected to witness a CAGR of 22.6% during 2025-2032.Country Outlook

China's QR-code payments market grew quickly thanks to strong government oversight. In 2017, the central bank set national QR standards to make sure the market was safe, consistent, and growing in an orderly way. This standardization made it possible for banks and non-bank providers to accept QR codes in more places, like stores, public transportation, and public services, while still keeping fraud and operational risks low. Widespread use of smartphones, low costs for merchants, and a continued focus on payment safety are some of the main factors. Some trends are moving from static to dynamic QR codes, tokenization, risk scoring, and more uses for QR codes, like paying bills, using them offline, and going on vacation across borders.List of Key Companies Profiled

- PayPal Holdings, Inc.

- One97 Communications Limited (Paytm Payments Services Limited)

- Google Pay (Google LLC)

- Square, Inc. (Block, Inc.)

- PaymentCloud Inc. (Electronic Merchant Systems, LLC)

- Ecentric Payment Systems (Pty) Ltd

- Revolut Ltd.

- Nearex Pte Ltd.

- ACI Worldwide, Inc.

- LINE Pay Taiwan Limited

Market Report Segmentation

By Offerings

- Solution

- Services

By Solution Type

- Dynamic QR code

- Static QR code

By Payment Type

- Push Payment

- Pull Payment

By Transaction Channel

- Face-to-Face

- Remote

By End User

- Restaurant

- Retail & E-commerce

- E-ticket Booking

- Other End-user

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia-Pacific

Table of Contents

Companies Mentioned

- PayPal Holdings, Inc.

- One97 Communications Limited (Paytm Payments Services Limited)

- Google Pay (Google LLC)

- Square, Inc. (Block, Inc.)

- PaymentCloud Inc. (Electronic Merchant Systems, LLC)

- Ecentric Payment Systems (Pty) Ltd

- Revolut Ltd.

- Nearex Pte Ltd.

- ACI Worldwide, Inc.

- LINE Pay Taiwan Limited