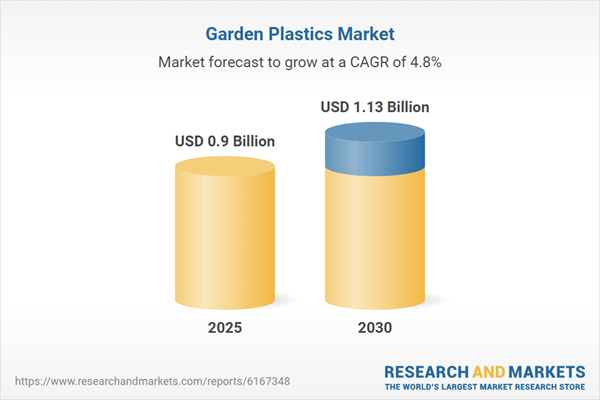

Most of this growth is attributed to the overall increase of DIY landscaping and container gardening for urban customers and limited mobility or space. In addition, the increased availability of plastic-based planters, fencing, storage bins, and garden accessories, made mostly from polyethylene, polypropylene, and recycled plastics, are addressing consumer interests for low-maintenance and durable products.

Innovations in plastic formulations that offer improved UV resistance, color retention, and eco-friendliness are widening the market potential. The continued outlook for the market is also aided by the growing availability of recycled and post-consumer plastic garden products, regulatory pressure for sustainable design, and manufacturer's efforts to embrace circular economy design. Demand should also grow in modular garden systems, smart irrigation plastics, and premium decorative containers, especially in developed markets with aging populations that spend on high levels on garden plastics.

Glass-fiber-reinforced plastics to be second-fastest-growing composition segment

Glass-fiber-reinforced plastics (GFRPs) is the second-highest expanding composition segment of the garden plastics market because of their robust mechanical properties, together with their enduring resistance to weathering. These reinforced materials are increasingly used for premium garden furniture, structural planters, fencing panels, and tool handles that require enhanced load-bearing and impact resistance capabilities.The growing interest among consumers for enduring garden solutions with esthetic value positions GFRP as an ideal solution that balances structural strength and design adaptability. These materials duplicate the appearance of wood and metal yet deliver reduced weight, together with superior corrosion protection which makes them desirable for upscale outdoor applications. The design-focused landscaping trend, combined with functional complexity drives the rising use of GFRP across premium product categories.

Unfilled plastics segment to be fastest-growing in the garden plastics market

The unfilled plastics industry has experienced significant growth throughout the garden plastics sector and is expected to benefit further during the forecast period. Because they are not reinforced and have no added fillers, unfilled plastics are a central part of the garden plastic packaging supply chain, because unfilled plastics are cheaper, easy to process, and recyclable. Usage of unfilled plastics continues to grow in the production of plant pots, garden borders, outdoor bins, and lightweight containers, especially where low structural integrity is not an issue.Because the molding processes can be varied and there are no composite formulations to consider, unfilled plastics provide fabrication versatility and composite input savings. Sustainability will remain a major issue for manufacturers and consumers as low-cost alternatives and unfilled plastics are filling a major gap in DIY gardening and small garden horticulture. Their comparative ease of use along with the growing acceptance of consumers to consider unfilled plastics as part of their eco-friendly gardening solution will continue to expedite the market growth of unfilled plastics.

HDPE to be second-largest plastic type in the garden plastics market

In tree planting in 2024, high-density polyethylene (HDPE) represented the second-largest plastic type to create products available in the garden plastics sector. The most relevant benefits of HDPE are that it is extensively available, regarded by some as a commodity-type plastic, and has the widest range of performance characteristics. HDPE is used in a wider variety of garden products such as garden furniture, pots, planters, and watering cans. HDPE has a unique combination of flexibility, durability, and weathering. HDPE is very suited for garden products intended for durable lifespans. HDPE is inexpensive compared to virgin raw granules, cheap to process, easy to process, and can be recycled. HDPE is a cheap, and environmentally sustainable option for manufacturers in garden plastics.North America to be second-largest regional market in 2024

In 2024, North America was the second-largest regional market in the world garden plastics market. There is a consistent, strong demand for landscaping plastic products in the residential and commercial landscaping markets, particularly in the US and Canada. After the pandemic, there was an increase in home improvement projects, Do-It-Yourself (DIY) gardening, and a growing interest in sustainable landscaping practices. As a consequence, there has also been a rise in plastic gardening products, such as composters, raised garden beds, deck boxes, and outdoor furniture.Additionally, the growing environmental awareness of North American consumers has created higher motivation for regional producers of plastic products to promote innovation to produce plastic products. Due this, they are now using UV stabilized plastic and recyclable plastic products as these products can satisfy consumer needs for eco-conscious gardening. Furthermore, the larger retail brands that align with national and regional distributors, provide an extensive product distribution network that allows extensive product reach into the region.

- By Company Type: Tier 1: 22%, Tier 2: 45%, and Tier 3: 33%

- By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

- Tier 1: More than USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: Less than USD 500 million.

Research Coverage

This research report categorizes the garden plastics market, based on plastic type (commodity plastics and engineering plastics and performance plastics), application (pots & containers, irrigation systems, greenhouse & tunnel coverings, raised beds & garden liners, and mulch films), composition (unfilled, mineral filled, and glass fiber-reinforced) and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa).The report’s scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the garden plastics market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products offered, and key strategies, such as partnerships, agreements, product launches, and acquisitions associated with the garden plastics market. This report covers a competitive analysis of the upcoming startups in the garden plastics market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall garden plastics market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.The report provides insights into the following points:

- Assessment of primary drivers (Rising popularity of home gardening and urban landscaping, Increasing consumer preference for lightweight, weather-resistant plastic products, Growth in residential construction and outdoor living spaces, Cost-effectiveness and ease of manufacturing of plastic garden products.) restraints (Fluctuating prices of raw plastic materials such as PP and PE, and Limited biodegradability of conventional plastics), opportunities (Rising demand for recycled and bio-based plastics in garden products, Growth in smart gardening tools and modular plastic planters, Innovation in UV-resistant and esthetic-enhanced garden plastics and Expansion into emerging markets with rising urban green space initiatives), and challenges (Increasing competition from biodegradable and natural alternatives, such as clay, metal, and wood, Balancing cost vs. sustainability in material selection, and Managing product durability against prolonged sun and moisture exposure).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the garden plastics market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the garden plastics market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the garden plastics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Keter (Israel), THE HC COMPANIES, INC. (US), Scheurich GmbH & Co. KG (Germany), Elho B.V. (Netherlands), Horst Brandstätter Group (Germany), The AMES Companies (US), Berry Global Inc. (US), RKW Group (Germany), BASF (Germany), and Armando Alvarez Group (Spain).

Table of Contents

Companies Mentioned

- Keter

- The Hc Companies, Inc.

- Scheurich GmbH & Co. KG

- Elho B.V.

- Horst Brandstätter Group

- Griffon Corporation Inc.

- Berry Global Inc.

- Rkw Group

- BASF

- Armando Alvarez Group

- Landmark Plastic Inc.

- East Jordan Plastics, Inc.

- Creo Group

- T.O. Plastics, Inc.

- Capi Europe

- Harshdeep India

- Euro3Plast Spa

- SA Plastikor (Pty) Ltd.

- Cosmoplast UAE

- Finolex Plasson

- Kisan

- Taizhou Shengerda Plastic Co. Ltd.

- Hosco India

- Taizhou Kedi Plastic Co. Ltd.

- Vip Plastics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 254 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 0.9 Billion |

| Forecasted Market Value ( USD | $ 1.13 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |