This growth is driven by solar PV and energy storage integration, the rise of EVs and e-mobility, expansion of distributed renewables and microgrids, and Industry 4.0/predictive maintenance initiatives. North American demand is led by residential and commercial systems, while Europe sees a more balanced split across residential, industrial, and utility segments. Single-phase inverters dominate, but three-phase systems are gaining ground in commercial and microgrid use. North America is led by small-scale units (< 10 kW), whereas Europe is shifting toward medium-power inverters (10-100 kW). Opportunities lie in grid modernization, renewables storage integration, and advanced inverter functions, especially in industrial and microgrid applications, and medium- to higher-voltage systems. Key challenges include high upfront costs, fragmented standards, regulatory delays, evolving grid codes, supply chain disruptions, and total cost of ownership issues.

Introduction of North America and Europe Low-Voltage Inverters Market

The study identifies the North America and Europe low-voltage inverters market as a pivotal enabler of clean-energy and electrification infrastructure. These inverter platforms are rapidly evolving into multifunctional assets capable of delivering efficient power conversion, grid stabilization, and intelligent energy management across residential, commercial, industrial, and utility domains. Their role is rising amid accelerating renewable deployment, EV integration, distributed microgrids, and Industry 4.0 initiatives that demand real-time responsiveness and predictive control. With advances in AI-driven controls, smart inverter functionalities, and compact power electronics, these systems are becoming increasingly autonomous, agile, and adaptable. Modular and scalable designs support rapid customization for applications like rooftop solar, energy storage, EV charging, microgrids, and industrial systems. As utilities and policymakers embrace distributed, network-centric energy models, these inverter ecosystems offer a competitive edge through enhanced grid support, bidirectional communication, and swift deployment. Supported by evolving regulatory frameworks and ongoing technology innovation, the market in North America and Europe is well-positioned for continued expansion.Market Introduction

The North America and Europe low-voltage inverters market is becoming a cornerstone of modern clean energy and electrification infrastructure, driven by the increasing demand for efficient power conversion, grid stabilization, and intelligent energy management across residential, commercial, industrial, and utility domains. As renewable energy adoption accelerates and electrification expands, low-voltage inverters, from residential microinverters to industrial-grade string and central inverters, deliver essential power conversion and grid support across diverse applications. Advancements in AI-driven controls, smart inverter functionalities, and compact power electronics are enhancing autonomy and adaptability, while the integration of energy storage systems, electric vehicle charging infrastructure, and smart grid technologies is expanding operational reach. Amid rising energy demands and the need for sustainable solutions, governments and industries are accelerating investments in low-voltage inverter technologies. With continued innovation, low-voltage inverters are set to play a vital role in the future of decentralized, networked energy systems.Industrial Impact

The North America and Europe low-voltage inverters market is transforming the energy and industrial sectors through rapid advancements in clean energy integration, electrification, and intelligent power management technologies. Low-voltage inverters, ranging from residential microinverters to industrial-grade string and central inverters, enable efficient power conversion, grid stabilization, and energy management across renewables, e-mobility, and industrial drives.The market growth is driven by the surge in EV and e-mobility adoption, expansion of distributed renewables and micro-grids, and the rise of Industrial 4.0 predictive maintenance. These factors are fueling demand for modular, AI-enabled inverter systems that enhance efficiency and grid resilience. Meanwhile, high upfront costs of wide-bandgap devices and fragmented standards pose challenges to market adoption.

As governments and industries invest in sustainable and intelligent energy solutions, the North America and Europe low-voltage inverters market is poised to play a vital role in the region’s transition toward decentralized and smart energy systems.

Market Segmentation:

Segmentation 1: by Voltage

- 48V

- 72V

- 96V to 120V

96V to 120V Segment to Dominate the North America and Europe Low-Voltage Inverters Market (by Voltage)

The North America and Europe low-voltage inverters market is expanding rapidly, driven by renewable energy adoption, electrification, and advancements in energy storage. The 96V-120V segment is set to lead, growing from $2.15 billion in 2024 to over $6.09 billion by 2035, propelled by demand in industrial and high-capacity energy systems that require efficient power conversion.The 48V segment, favored in residential solar and small-scale energy storage, is also on the rise, from $592 million to $1.27 billion. Meanwhile, the 72V segment will grow steadily from $180 million to $374 million, supported by applications in EV charging, automation, and backup power solutions.

Policy support, expanding EV infrastructure, and distributed energy needs are driving momentum, though challenges like high costs, integration complexity, and competition remain. Still, innovations in semiconductor materials and power electronics are paving the way for more efficient, compact, and reliable inverter systems.

With strategic collaborations and continued investment, low-voltage inverters are poised to become a key building block in the region’s push toward decentralized, sustainable energy networks.

Segmentation 2: by Type

- Single-Phase

- Three-Phase

Three-Phase to Maintain Dominance in the North America and Europe Low-Voltage Inverters Market (by Type)

According to recent market data, three-phase low-voltage inverters are projected to dominate the North America and Europe low-voltage inverters market, maintaining the largest share through 2035. Valued at $2.24 billion in 2025, the segment is expected to reach $6.09 billion by 2035, growing at a CAGR of 10.48%. This growth is driven by their widespread use in industrial motor drives, renewable energy systems, and commercial infrastructure, where high efficiency, reliability, and the capacity to handle large loads are critical. These inverters are favored for their role in supporting grid integration, energy independence, and the shift to clean energy, particularly in large-scale solar and backup systems. Demand is further reinforced by advancements in power electronics, automation, and government incentives for industrial decarbonization.In contrast, single-phase low-voltage inverters, primarily used in residential and small commercial applications, are also witnessing steady growth, from $931.1 million in 2025 to $1.64 billion by 2035, at a CAGR of 5.87%, fueled by rising solar adoption, energy efficiency upgrades, and backup power needs.

Growing adoption of rooftop solar, demand for uninterruptible power supply (UPS) systems, and emphasis on energy efficiency in homes further support the segment. However, three-phase systems are expected to maintain their lead, driven by accelerating demand from industrial sectors, commercial microgrids, and renewable energy installations that require more robust and scalable power conversion solutions.

Segmentation 3: by Power Rating

- Upto 1 kW

- 1-10 kW

- 10-100 kW

- Above 100 kW

Segmentation 4: by Region

- North America: U.S. and Canada

- Europe: Germany, France, U.K., Italy, Netherlands, Spain, and Rest-of-Europe

Europe, while slightly behind in total market share, is set to grow even faster, from $1.54 billion in 2025 to $4.09 billion by 2035, at a CAGR of 10.21%. The region’s growth is being fueled by aggressive decarbonization goals, expansion of microgrid infrastructure, and strong policy support for renewable integration and energy independence. Together, North America and Europe are expected to drive the global transition toward efficient, low-voltage inverter technologies through 2035.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Surge in E-Mobility, Distributed Renewables, and Industry 4.0

The North America and Europe low-voltage inverters market is witnessing robust demand growth, fueled by structural changes in energy use, electrification, and industrial modernization. A primary driver is the surge in electric vehicles (EVs) and e-mobility adoption, which is significantly increasing the demand for compact, efficient, and scalable inverter systems to support vehicle electrification, charging infrastructure, and related energy management needs.At the same time, the rapid growth of distributed renewable energy systems, including rooftop solar, community microgrids, and localized wind installations, is creating a heightened need for low-voltage inverters capable of grid integration and bidirectional power conversion. These systems play a critical role in ensuring the smooth and efficient transfer of power between decentralized generation assets and the grid, particularly in residential, commercial, and small industrial applications.

Another key driver is the widespread adoption of Industrial 4.0 and predictive maintenance technologies, which require advanced power control solutions and real-time system monitoring. Low-voltage inverters support this shift by enabling flexible, reliable, and intelligent energy distribution across digitally connected manufacturing and industrial operations.

Together, these trends are transforming the energy and industrial landscape of North America and Europe, positioning low-voltage inverters as a foundational technology in the transition toward clean energy, e-mobility, and intelligent infrastructure.

Market Challenges: High Costs, Regulatory Fragmentation, and Supply Chain Pressure

The North America and Europe low-voltage inverters market faces several critical challenges that may slow its growth trajectory despite strong underlying demand. One of the most pressing issues is the high upfront cost of wide-bandgap (WBG) semiconductor devices, such as silicon carbide (SiC) and gallium nitride (GaN), which are essential for enhancing inverter efficiency and thermal performance. These advanced materials, while technologically superior, remain cost-prohibitive for widespread deployment, particularly in price-sensitive residential and small commercial applications.Additionally, the market contends with fragmented standards and prolonged certification processes across regions, making it difficult for manufacturers to streamline product development and achieve cross-border compliance. This regulatory inconsistency creates delays in time-to-market and limits scalability for both local and international suppliers.

Compounding these challenges is ongoing raw material price inflation, which is driving up manufacturing costs and squeezing profit margins across the value chain. Key materials such as copper, aluminum, and semiconductor components remain volatile in pricing due to geopolitical factors, supply chain constraints, and growing global demand.

Together, these challenges highlight the need for targeted policy support, harmonized regulations, and innovations in cost reduction to ensure that low-voltage inverter adoption can scale effectively across North America and Europe.

Market Opportunities: Legacy Upgrades, Data Center Efficiency, and Recurring Revenue Models

The North America and Europe low-voltage inverters market is well-positioned to capitalize on a range of emerging opportunities that extend beyond traditional applications. One major area of growth is the adoption of 48V DC bus architectures in data centers and telecom infrastructure, aimed at improving energy efficiency and reducing conversion losses. As these sectors scale to meet increasing digital demand, low-voltage inverters will play a critical role in stabilizing power supply and enhancing operational resilience.In parallel, the retrofitting and upgrading of legacy inverter systems across industrial, commercial, and residential sectors offer a strong pathway for growth. As grid requirements evolve and renewable energy integration deepens, demand is rising for smarter, more efficient inverter solutions that can replace outdated equipment without overhauling entire systems.

Additionally, service and maintenance contracts are emerging as a lucrative, recurring revenue stream, particularly in commercial and industrial segments where reliability and uptime are paramount. By offering ongoing support and predictive maintenance under long-term agreements, manufacturers and service providers can build stable revenue models while delivering added value to end users. Together, these opportunities are expected to significantly boost market penetration, foster innovation, and enhance lifecycle value across the inverter ecosystem in North America and Europe.

How can this report add value to an organization?

Product/Innovation Strategy: The North America and Europe low-voltage inverters market report offers detailed insights into the evolving landscape of the North America and Europe low-voltage inverters market, helping organizations align their product development strategies with emerging trends and application demands. It examines innovations in three-phase inverter systems, 48V DC architectures, and the integration of smart control systems for use in industrial automation, renewable energy, and e-mobility infrastructure. With growing demand for predictive maintenance, high-efficiency inverters, and retrofit-friendly solutions, the report helps R&D teams identify technological opportunities and prioritize modular, scalable designs suited for residential, commercial, and industrial environments.Growth/Marketing Strategy: Organizations can use the North America and Europe low-voltage inverters market report to build targeted growth strategies across sectors such as distributed renewable energy, industrial motor drives, and EV charging infrastructure. The North America and Europe Low-Voltage Inverters Market report explores key regional drivers, such as policy incentives in Europe and electrification trends in North America, and evaluates high-growth areas including retrofit markets and off-grid energy solutions. Strategies such as geographic expansion, service contract models, and vertical integration are examined to help companies strengthen market share and revenue resilience.

Competitive Strategy: The North America and Europe low-voltage inverters market report provides a comprehensive overview of the competitive landscape, benchmarking key players, and identifying whitespace opportunities in under-served market segments. It analyzes market dynamics by voltage category (single-phase vs. three-phase), application area, and regional demand patterns, allowing organizations to refine their positioning. With an increasing shift toward service-based revenue models and digital monitoring capabilities, companies can leverage the North America and Europe low-voltage inverters market report to enhance value propositions and differentiate in a market shaped by both technological performance and regulatory alignment.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the North America and Europe Low-Voltage Inverters Market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to March 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the North America and Europe low-voltage inverters market.The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the North America and Europe low-voltage inverters market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of report segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for the market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.Secondary research was done to obtain crucial information about the industry’s value chain, revenue models, the market’s monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the North America and Europe low-voltage inverters market have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.Some of the prominent names in the North America and Europe low-voltage inverters market are:

- DANA TM4 INC.

- Enphase Energy

- ZAPI GROUP

- Schneider Electric

Table of Contents

Companies Mentioned

- Curtis Instruments, Inc.

- Parker Hannifin Corp

- DANA TM4 INC.

- EXELTECH

- Enphase Energy

- Northern Electric Power Technology Inc.

- Turntide

- ZAPI GROUP

- Victron Energy

- Studer Innotec

- Schneider Electric

- CE+T Power

- Mastervolt

- Danfoss

- Valeo

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | September 2025 |

| Forecast Period | 2025 - 2035 |

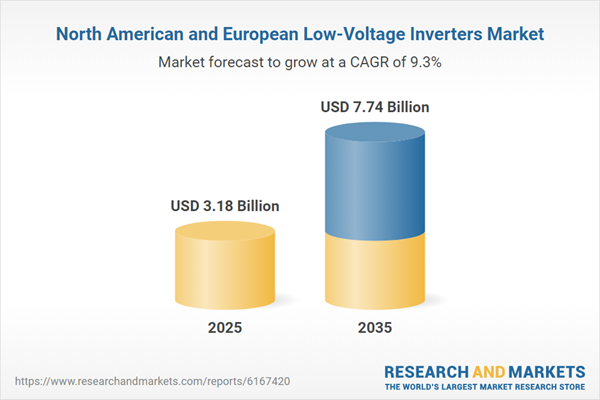

| Estimated Market Value ( USD | $ 3.18 Billion |

| Forecasted Market Value ( USD | $ 7.74 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Europe, North America |

| No. of Companies Mentioned | 15 |