The electric pumps for rocket market plays a pivotal role in transforming modern space propulsion by offering a simpler, more cost-effective, and sustainable alternative to traditional turbopump systems. Electric pump-fed engines, powered by advanced batteries, have become central to the evolution of small-lift rockets and upper stages due to their reduced complexity, enhanced reliability, and restart capabilities. As the adoption of commercial satellite launches, reusable space systems, and hybrid propulsion accelerates, the need for efficient electric pumps has never been more critical. Electric pumps ensure precise propellant delivery, lower maintenance needs, and improved mission flexibility, making them a cornerstone of emerging space missions. Effective adoption supports lower launch costs, green propellant integration, and the advancement of reusable platforms, positioning electric pumps as a key enabler of the next phase of the global space economy.

Market Introduction

The market's growth trajectory is expected to be fueled by several factors, including the rising demand for satellite constellations, the push for deep-space exploration, and the growing role of private launch providers.Technological advancements in battery energy density, additive manufacturing, and hybrid-electric propulsion designs are enabling the scaling of electric pumps into new mission profiles. While adoption is currently concentrated in small-lift vehicles such as Rocket Lab’s Electron, future integration into medium-class launchers and orbital transfer stages is becoming increasingly feasible.

Key stakeholders in the market include commercial launch companies, government space agencies, propulsion system developers, and aerospace research institutions. Collectively, they are driving innovations to expand the role of electric pumps beyond niche applications, while addressing challenges such as battery mass limitations and competition from established turbopump architectures.

Market Impact

The electric pumps for rocket market is poised to make a substantial impact on both the economy and the environment. As the demand for small-satellite launches, CubeSats, and deep-space missions continues to rise, the adoption of efficient electric pumps becomes increasingly critical.Economic Impact

The market will contribute to innovation and competitiveness by lowering propulsion system complexity and development costs.Startups and new entrants gain opportunities through modular pump architectures and reduced barriers to entry.

Supports the expansion of satellite launches and orbital transfer missions, enhancing the commercial space economy.

Environmental Impact

- Facilitates the adoption of green propellants such as methane and hydrogen, reducing carbon footprint.

- Enhances reusability and modularity, reducing material waste in launch systems.

- Improves operational sustainability by enabling multiple restarts and efficient mission flexibility.

Industrial Impact

Electrically driven pump-fed architectures are reshaping propulsion development workflows, vendor ecosystems, and qualification pathways. On the hardware side, the bill of materials is pivoting toward high-speed electric machines, cryogenic-capable bearings and seals, ruggedized power electronics, and battery systems qualified for rapid discharge and extreme thermal cycling. That shift is accelerating additive manufacturing for impellers, housings, and tight-tolerance interfaces, shortening iteration loops and compressing lead times from prototype to hot-fire. The result is a supply chain that increasingly combines precision machining + AM, high-reliability electronics, and subsystem bundling (motor-pump, controller, and thermal interfaces as an integrated kit) to de-risk program schedules.At the same time, test and certification activity is migrating upstream; more flow benches, cryo-loops, and endurance rigs are being added at the pump supplier level so launch primes can accept “pre-qualified” line-replaceable units. This unlocks a lighter integration burden at the stage/vehicle level, especially for small-lift and upper-stage modules that value modular, restartable units over bespoke turbomachinery. The model favors specialist pump houses and motor-drive firms partnering closely with launch primes and stage integrators, while opening space for new entrants, particularly those with AM competencies and COTS-hardened power electronics to participate in orbital-class propulsion programs.

Market Segmentation

Segmentation 1: by End User

- Commercial Launch Providers

- Government / Civil Space Programs

Commercial Launch Providers to Lead the Electric Pumps for Rocket Market (by End User)

Commercial launch providers remain the anchor customer, rising from $30.9 million in 2024 to $62.8 million by 2035. The segment’s leadership reflects a pragmatic calculus; small-lift programs need reliable, restartable propulsion for constellation buildout, rideshare dispersion, and precise injection maneuvers. Electrically driven pump-fed architectures reduce moving-part counts and eliminate hot-gas plumbing, shortening design cycles and easing integration into tightly packaged upper stages. For providers under schedule and cost pressure, that combination of modularity, restartability, and manufacturability is decisive.A second growth engine is the standardization of motor-pump kits, pre-qualified, cryo-capable units bundled with controllers and thermal interfaces. This enables repeatable propulsion stacks across vehicle variants and block upgrades without re-engineering turbomachinery, so teams can scale flight cadence with fewer unique parts and faster subsystem swaps. Commercial teams also benefit from COTS-hardened power electronics and additive manufacturing (AM) of impellers/housings, which reduce lead times for spares and iterative tweaks discovered during flight ops. The net effect is a virtuous loop; more launches are expected to drive more reuse and learning, which will compress non-recurring engineering and sustain the commercial segment’s lead through 2035.

Segmentation 2: by Rocket Class

- Small-Lift Launch Vehicles

- Medium and Heavy-Lift Vehicles

Small-Lift Launch Vehicles to Dominate the Electric Pumps for Rocket Market (by Rocket Class)

Small-lift launch vehicles lead the class mix, expanding from $33.5 million in 2024 to $69.1 million by 2035. Electric pumps are naturally suited to this thrust regime; they deliver precise throttling, clean restarts, and multi-burn profiles without hot-gas turbines, making them ideal for agile staging, constellation phasing, and responsive launch. For developers, moving from pressure-fed systems to electric-pump cycles elevates chamber pressure and performance without inheriting full turbopump complexity, an attractive middle ground for fast-moving programs where mass, volume, and integration time are precious.As constellation deployment proliferates and upper stages shoulder more on-orbit maneuvering, small-lift platforms remain the primary beachhead for electric pump-fed cycles. Meanwhile, early beachheads in medium/heavy-lift roles will likely emerge in upper stages and specialty modules as pack-level energy density and thermal mitigation improve. This progression keeps small-lift dominant through the forecast while allowing selective migration upward as engineering trade-offs evolve.

Segmentation 3: by Pump Type

- Fuel Feed Pumps

- Engine Cooling Pumps

Fuel Feed Pumps to Lead the Electric Pumps for Rocket Market (by Pump Type)

Fuel feed pumps are the dominant product, growing from $25.2 million in 2024 to $54.7 million by 2035. Feed pumps sit at the heart of electric pump-fed engines; they set chamber pressure, enable throttling windows, and support multi-restart profiles across both liquid and hybrid engines. Their centrality to the propulsion bill of materials and the path to modularization via pre-qualified motor-pump + controller kits explains the segment’s scale and resilience.By contrast, engine-cooling pumps remain a smaller niche, increasing from $8.3 million to $16.3 million. Many architectures route regenerative cooling through the main feed loop or rely on hybrid designs where dedicated cooling pumps are unnecessary, especially in small-lift stages where simplicity and mass efficiency are paramount. The growth that does occur is tied to longer burns and higher chamber heat flux, where independent thermal circuits buy extra margin for reusable upper stages.

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America to Lead the Electric Pumps for Rocket Market (by Region)

North America retains regional leadership, supported by the only commercially operational electric-pump orbital vehicle, a dense cluster of stage integrators and motor-pump specialists, and sustained public-private investment in small-lift services. Regional activity is underpinned by test/qualification infrastructure, strong AM capacity, and supply networks for cryogenic hardware and electronics. North America is expected to scale from $29.20 million in 2024 to $58.21 million by 2035, while Europe and Asia-Pacific expand off rising small-lift activity, upper-stage concepts, and hybrid-electric propulsion pilots through the 2030s.Crucially, the region’s certification and operations ecosystem, from vacuum and vibration labs to range access and on-orbit operations, reduces integration risk and time-to-flight for pump-fed stacks. As commercial providers push cadence and multi-mission flexibility, North America’s combination of industrial depth + program throughput maintains its lead while other regions close the gap via targeted upper-stage and OTV deployments.

Demand: Drivers, Limitations, and Opportunities

Market Demand Drivers: Constellations, Upper-Stage Maneuvering, and Modularization

The primary pull is constellation logistics, frequent, precise insertions, and phasing maneuvers that reward restartable, throttleable upper stages. Electric pumps simplify engine plumbing, reduce moving-part counts, and support multi-burn operations without hot-gas turbines, which is compelling for small-lift and OTV missions where packaging space, fast turnarounds, and mission agility dominate. For manufacturers, AM-enabled impellers/housings, COTS-hardened drives, and pre-qualified subassemblies compress schedule risk, allowing faster debug cycles and more launches per year. As agencies and primes prioritize responsive launch, electric pumps’ plug-and-play behavior fits quick-turn stage ops and modular upper-stage stacks that can be mixed, matched, and serviced with minimal re-engineering.The second driver is modularity, Modular motor-pump units and clean, electrically driven plumbing reduce refurbishment touch labor between sorties. Combined with maturing thermal mitigation and controller health monitoring, programs can extend useful life and restart counts, improving economics for high-cadence commercial services and deepening the business case for electric pumps in upper-stage fleets.

Market Challenges: Pack-Level Energy Density, Thermal Management, and Turbopump Heritage

The binding constraint remains pack-level specific energy; while cell chemistries trend upward, complete battery packs (cooling, containment, safety, BMS) lag, limiting burn duration and thrust scalability for larger cores. High-rate discharge drives thermal and lifetime stresses that must be mitigated by cooling and protective structures, adding mass and eroding the benefits at higher thrust classes. In parallel, entrenched turbopump heritage with decades of flight records and a deep vendor ecosystem sets a formidable benchmark for reliability, especially in medium/heavy-lift environments where energy density shortfalls are most acute. In the near term, this confines most electric-pump roles to small-lift vehicles and upper stages while the tech matures.Engineering headwinds also include cavitation control at cryogenic inlets, high-speed bearing durability, and controller fault-tolerance across long burns. Each solution tends to trade mass for margin (e.g., additional cooling, shielding, or redundancy), which can dilute the system-level gains for bigger vehicles unless pack performance advances in tandem.

Market Opportunities: Small-Lift Standardizations, Hybrid-Electric Upper Stages, and Regional Ecosystems

Standardized small-lift motor-pump kits with proven cryo performance, restart matrices, and life-test artifacts can be replicated across families and block upgrades, amplifying fleet commonality and spare pooling. In upper stages, hybrid-electric concepts (electric feeds + regenerative cooling or hybrid motors) offer a tractable bridge into higher-energy missions while pack technologies catch up, enabling precise delta-V trim, long loiter, and multi-destination profiles. Regionally, North America’s large test base and AM footprint, Europe’s cryogenic pump R&D, and Asia-Pacific’s growing small-lift cohort open JV and licensing pathways that share NRE and accelerate commercialization of cryo-capable electric pumps through 2035. These partnerships are already visible in the supplier and program maps captured in the report’s regional and product breakouts.How can this report add value to an organization?

Product/Innovation Strategy: This report offers valuable insights into advancements in electric pump-fed propulsion technologies and solutions. By gaining a comprehensive understanding of the market and evaluating the associated challenges and opportunities, stakeholders can assess the potential impact on their operations. It enables organizations to identify emerging technologies and trends in electric pump development, allowing them to align their innovation strategies and stay competitive in this evolving market.Growth/Marketing Strategy: The electric pumps for rocket market is growing steadily, driven by the rising adoption of small satellite launch vehicles and hybrid propulsion solutions. Companies are forming strategic partnerships and expanding operations to capture this demand. By offering advanced propulsion solutions that emphasize efficiency, sustainability, and modularity, organizations can tap into new markets, optimize mission architectures, and enhance brand positioning in the global space industry.

Competitive Strategy: The report provides detailed analysis and profiling of key players in the electric pumps for rocket market, including Rocket Lab, Innospace, Ebara Corporation, Sierra Space, and Gilmour Space Technologies. It thoroughly examines market dynamics and the competitive landscape, enabling readers to understand positioning and strategies across the industry. This allows organizations to refine competitive strategies and identify opportunities for differentiation and growth.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the electric pumps for rocket market analysis is the US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- The information in this report is based on in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently in use are expected to persist, with no major breakthroughs assumed during the forecast horizon.

Market Estimation and Forecast

The electric pumps for rocket market research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the market.The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the electric pumps for rocket market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of report segmentations and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for the market type

- percentage split of individual markets for geographical analysis

Secondary Research

The electric pumps for rocket market research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.Secondary research has been done to obtain crucial information about the industry’s value chain, revenue models, the market’s monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- market segmentations and shares

- data for market value

- key industry trends of the top players in the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Table of Contents

Companies Mentioned

- Rocket Lab USA, Inc.

- Inpraise Systems

- Ebara Corporation

- Sierra Space Corporation

- Innospace Co., Ltd.

- Kratos Defense & Security Solutions, Inc.

- Nammo AS

- P3 Technologies, LLC

- Concept NREC

- Gilmour Space Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | September 2025 |

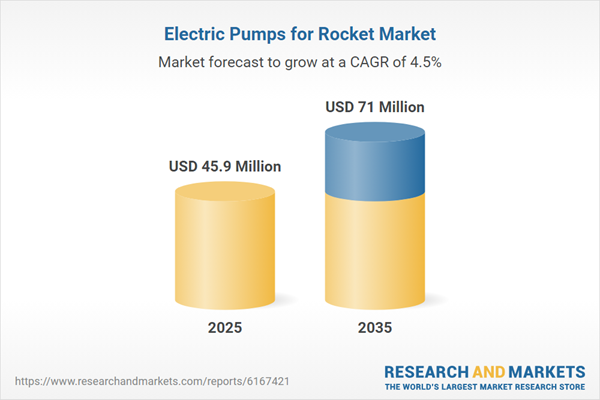

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 45.9 Million |

| Forecasted Market Value ( USD | $ 71 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |