Key Highlights:

- The North America market dominated Global Synbiotic Product Market in 2024, accounting for a 33.91% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 457.48 million by 2032.

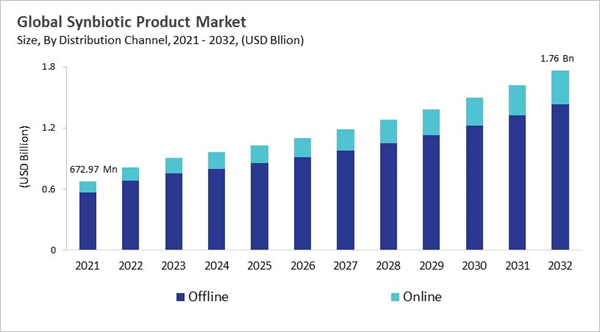

- Among the Distribution Channel, the Offline segment dominated the global market, contributing a revenue share of 83.15% in 2024.

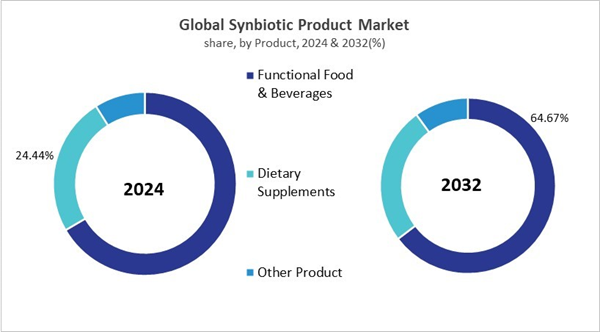

- In terms of Product, Functional Food & Beverages segment are expected to lead the global market, with a projected revenue share of 64.67% by 2032.

The synbiotics market has grown from an idea in the 1990s to a global industry based on microbiomescience, functional foods, and health prevention. It has come a long way due to new technologies like encapsulation and freeze-drying, as well as support from the FDA, EFSA, and Asian governments. Danone, Yakult, Chr. Hansen, and IFF are some of the companies that are leading the way by adding synbiotics to yogurts, drinks, and snacks. Some important trends are the widespread use of synbiotics in convenience foods, the rise of personalized nutrition through microbiome testing, and the demand for gut health, immune support, and overall wellness after COVID-19 pandemic. These trends put synbiotics at the center of the wellness economy.

There are food giants, ingredient specialists, and nimble startups that focus on niches like mental health, skin health, and weight loss. North America and Europe focus on scientific proof and strict rules, while Asia Pacific and new markets like India and China push growth by making things affordable and teaching people. To build trust and get an edge, leaders put money into clinical trials, strain innovation, digital health platforms, and D2C channels. With new developments in precision health, smart nutrition, and integrating consumer lifestyles, the industry is moving beyond digestion to overall health.

Driving and Restraining Factors

Drivers

- Rising Awareness Of Gut Health And Preventive Healthcare

- Strong Scientific Validation And Clinical Evidence

- Technological Innovation And Advanced Formulation

- Expansion Of Distribution Channels And Lifestyle Integration

Restraints

- Lack Of Consumer Awareness And Education

- High Production Costs And Pricing Pressures

- Regulatory And Scientific Validation Challenges

Opportunities

- Expansion Into Personalized Nutrition And Precision Health

- Penetration Into Functional Foods And Beverages

- Expansion Into Veterinary And Animal Nutrition Markets

Challenges

- Regulatory Complexity And Standardization Issues

- Scientific Validation And Clinical Evidence Gap

- Supply Chain And Scalability Constraints

COVID-19 Impact Analysis

The COVID-19 pandemic had a big effect on the synbiotic product market. This was mostly because of problems with the supply chain, factory closures, and delays in getting things where they needed to go. These problems made it harder to make and ship probiotics, prebiotics, and other raw materials. Uncertainty in the economy and lower household incomes made it even harder for people to buy dietary supplements. The fact that physical stores were closed temporarily also made it harder for people to get the products they needed. Online channels did get more popular, but they couldn't make up for the drop in offline sales right away. Furthermore, limitations on laboratory operations and regulatory delays hindered research, product development, and marketing efforts, stifling innovation and undermining competitive dynamics. All of these things together slowed market growth, even though people were becoming more interested in gut health at the time. Thus, the COVID-19 pandemic had a Negative impact on the market.Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Offline, and Online. The online segment held 17% revenue share in the market in 2024. This segment has also established its presence in the market, serving as a modern and increasingly popular platform for product availability. E-commerce platforms, brand-owned websites, and third-party online marketplaces enable consumers to access a wide variety of synbiotic products from the comfort of their homes. This channel benefits from advancements in digital technology, rising internet penetration, and the growing preference for doorstep delivery services.Product Outlook

Based on Product, the market is segmented into Functional Food & Beverages, Dietary Supplements, and Other Product. The dietary supplements segment witnessed 24% revenue share in the market in 2024. The segment has also gained strong traction in the market. Capsules, tablets, and powders containing synbiotics are widely adopted by health-conscious consumers seeking convenient and effective ways to maintain a balanced gut microbiome. The rise in preventive healthcare practices, coupled with the increasing popularity of probiotic and prebiotic blends in supplement form, has boosted the adoption of synbiotic dietary supplements.Regional Outlook

Region-wise, the synbiotic product market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the market in 2024. The synbiotics market in North America is growing because more people want functional foods, immune health, and preventive wellness. The FDA makes sure that products meet quality and labeling standards. Companies like Danone and Yakult are at the top with RTD Drinks and snack bars, which have been shown to work in clinical settings. In Europe, strict EFSA standards limit health claims but push companies to invest in strong R&D, strain innovation, and encapsulation technologies. This makes the region a hub for high-quality, science-backed synbiotic solutions.In Asia Pacific, Japan and South Korea are the leaders in functional food innovation. China and India, on the other hand, are driving growth by making functional foods more affordable and raising interest in microbiome health. Support from the government, like Japan's FOSHU framework, helps people adopt these products by making them part of their traditional diets. In LAMEA, demand is growing because more people are becoming aware of holistic wellness and functional drinks. The UAE and Saudi Arabia are both working on smart health initiatives, and Latin America is focusing on fortified foods that are easy to get.

List of Key Companies Profiled

- Sabinsa Corporation (Sami-Sabinsa Group Ltd.)

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Novozymes A/S (Novo Holdings A/S)

- Probiotical S.p.A.

- Lallemand Inc.

- Amway Corporation

- Kerry Group PLC

- Seed Health, Inc.

- Probi AB (Symrise AG)

Market Report Segmentation

By Distribution Channel

- Offline

- Online

By Product

- Functional Food & Beverages

- Dietary Supplements

- Other Product

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Sabinsa Corporation (Sami-Sabinsa Group Ltd.)

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Novozymes A/S (Novo Holdings A/S)

- Probiotical S.p.A.

- Lallemand Inc.

- Amway Corporation

- Kerry Group PLC

- Seed Health, Inc.

- Probi AB (Symrise AG)