Key Highlights:

- The Asia Pacific market dominated Global Power Electronics Software Market in 2024, accounting for a 40.30% revenue share in 2024.

- The China market is projected to maintain its leadership in North America, reaching a market size of USD 849.20 million by 2032.

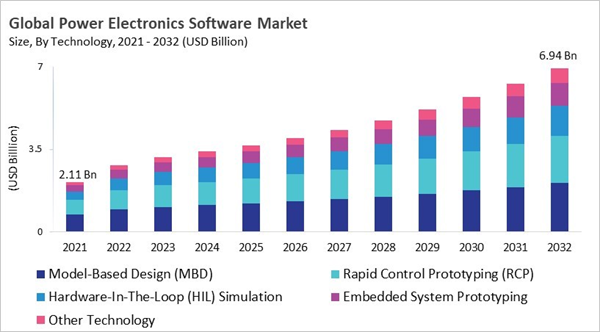

- Among the various Technology, the Model-Based Design (MBD) segment dominated the global market, contributing a revenue share of 33.07% in 2024.

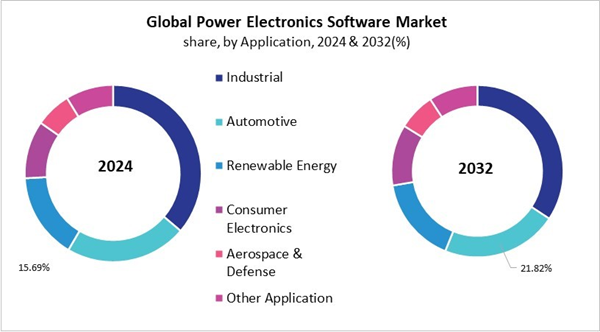

- In terms of Application, Industrial segment are expected to lead the global market, with a projected revenue share of 34.28% by 2032.

- The Simulation Software market emerged as the leading Type in 2024, capturing a 33.21% revenue share, and is projected to retain its dominance during the forecast period.

The global power electronics software market has evolved from hardware-pivotal solutions to modern tools for simulation, digital twin modeling, predictive maintenance, and embedded control. Growth is being driven by a growing need for energy efficiency, electrification, smart infrastructure, and digital transformation, as well as strong government programs. OEMs and Tier-1 suppliers are using AI, machine learning, edge computing, and cloud platforms to create end-to-end software ecosystems for EVs, renewable energy, and automation. These platforms let them monitor things in real time, optimize the grid, and follow the rules.

Some of the most important trends are simulation-based design, platforms that are modular and can work with other platforms, and energy management software that works with the Internet of Things (IoT). As more people use smart grids, e-mobility, and renewable energy, industry leaders are pushing for unified platforms, open-source collaborations, and innovations that are good for the environment. The competitive landscape is changing as big multinational OEMs offer integrated ecosystems and smaller companies focus on renewables, SCADA, and grid intelligence. This shows a move toward digital intelligence and ecosystem-based innovation.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2025, Infineon Technologies AG announced the partnership with Typhoon HIL to provide a real-time, hardware-in-the-loop (HIL) testing platform for xEV power electronics systems. This integrated solution supports AURIX TC3x/TC4x microcontrollers and streamlines development of motor drives, BMS, chargers, and converters, accelerating design, testing, and time-to-market for automotive engineers. Additionally, In November, 2024, The MathWorks, Inc. announced the partnership with NXP Semiconductors, a Semiconductor manufacturing company to introduce a Model-Based Design Toolbox to streamline Battery Management System (BMS) development for EVs. Compatible with MATLAB and Simulink, it enables automatic C code generation, real-time testing with hardware, and simulation of scenarios, helping accelerate safer, more efficient battery solutions for the electric vehicle market.

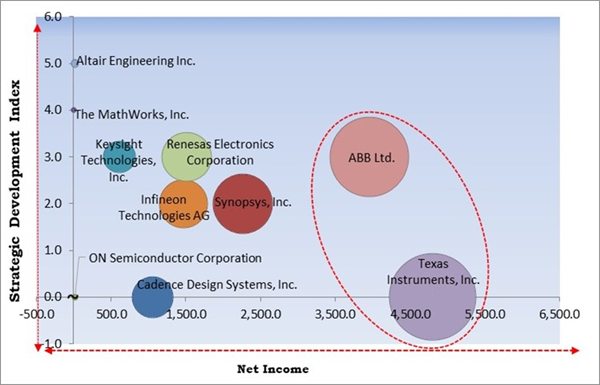

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Texas Instruments, Inc., and ABB Ltd. are the forerunners in the Power Electronics Software Market. Companies such as Synopsys, Inc., Renesas Electronics Corporation, and Infineon Technologies AG are some of the key innovators in Power Electronics Software Market.

COVID-19 Impact Analysis

The COVID-19 pandemic negatively impacted the power electronics software market by disrupting manufacturing, supply chains, and project timelines. Lockdowns and travel restrictions delayed the production of hardware like inverters and converters, slowing related software integration. Companies shifted capital expenditure toward essential operations, postponing investments in advanced software and digital transformation. Small and medium enterprises were particularly affected due to limited financial flexibility. R&D efforts also suffered, as remote work hindered lab-based hardware-software co-development and slowed innovation. These challenges collectively delayed new software releases and adoption, restraining market growth during the pandemic period.Driving and Restraining Factors

Drivers

- Rising Adoption of Electric Vehicles (EVs)

- Growing Integration of Renewable Energy Systems

- Advancements in Semiconductor Technologies

- Demand for Smart Grids and Intelligent Power Management

Restraints

- High Cost of Licensing, Integration, and Training

- Interoperability Challenges and Fragmented Software Ecosystem

- Cybersecurity and IP Protection Concerns

Opportunities

- Emergence of Digital Twin Technology in Power Electronics

- Customization and Low-Code/No-Code Software Platforms

- Expansion of Software Applications in Aerospace and Defense Sectors

Challenges

- Complexity in Modeling Multiphysics Interactions

- Scalability of Software for Real-Time Embedded Systems

- Bridging the Talent and Knowledge Gap in Software-Driven Design

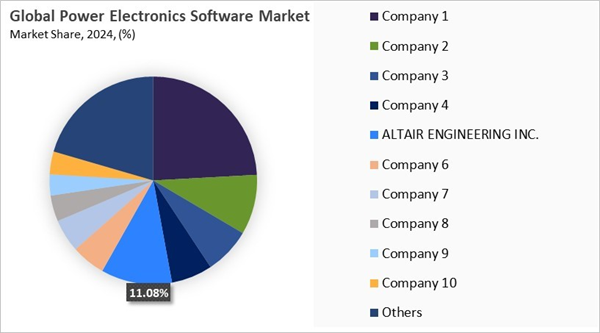

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Type Outlook

Based on Type, the market is segmented into Simulation Software, Design Software, Control Software, and Analysis Software. The design software segment attained 28% revenue share in the power electronics software market in 2024 Design software plays a vital role in creating the architecture and layout of power electronic systems. It supports engineers in developing circuits, schematics, and power management frameworks with precision and efficiency.Application Outlook

Based on Application, the market is segmented into Industrial, Automotive, Renewable Energy, Consumer Electronics, Aerospace & Defense, and Other Application. The automotive segment gained 22% revenue share in the power electronics software market in 2024. In the automotive sector, power electronics software plays a central role in supporting the growing complexity of modern vehicles, particularly in electric and hybrid models. These solutions oversee critical functions such as motor control, battery management, power conversion, and thermal regulation.Regional Outlook

Region-wise, the power electronics software market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment gained 40% revenue share in the power electronics software market in 2024. The North American power electronics software market is the biggest, thanks to the widespread use of simulation-driven design, digital twin modeling, and predictive maintenance tools. Strong demand for integrating renewable energy, optimizing smart grids, and electrifying transportation, along with government efforts to improve energy efficiency and digital transformation, are driving growth. Europe is also a big market because of strict rules about emissions, policies that promote sustainability, and requirements to use renewable energy. Germany, the UK, and France are ahead of the rest of the world when it comes to using cloud-enabled platforms, AI-driven analytics, and modular software architectures. OEMs and utilities are putting a lot of money into smart infrastructure and localized software development.The Asia-Pacific region is growing the fastest because of rapid industrialization, strong manufacturing bases for cars and electronics, and government incentives for electric vehicles, IoT-enabled energy management, and grid modernization. China, India, Japan, and South Korea are becoming global centers for battery management software, simulation platforms, and digital engineering ecosystems, with growth rates in the double digits. At the same time, LAMEA are becoming more open to SCADA systems, grid intelligence, and localized energy software solutions. LAMEA's position is expected to get stronger in the next few years, even though it is taking longer to adopt new technologies. This is because more money is going into renewable energy projects, digitalizing infrastructure, and making power electronics tools more affordable.

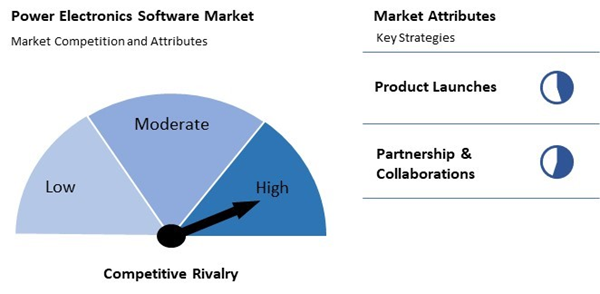

Market Competition and Attributes

The Competition in the power electronics software market would be highly intense. Numerous regional and emerging firms would aggressively compete on pricing, innovation, and customization to capture market share. The absence of established leaders would reduce brand loyalty, fostering fragmented competition, rapid technological experimentation, and frequent partnerships, intensifying overall market rivalry significantly.

Recent Strategies Deployed in the Market

- May-2025: ABB Ltd. acquired French power electronics firm BrightLoop to enhance its electrification offerings for industrial vehicles and marine vessels. BrightLoop’s compact, efficient DC/DC converters support sustainable transportation. The acquisition strengthens ABB’s capabilities in rugged, high-performance energy systems, advancing its clean energy transition strategy.

- Feb-2025: Altair Engineering Inc. unveiled HyperWorks 2025, an advanced simulation platform that integrates AI, HPC, and multiphysics tools to support a zero-prototype design approach. The platform enhances electronics design with improved thermal, electromagnetic, and power simulation capabilities, cloud scalability, automation, and digital thread connectivity for faster, smarter product development.

- Oct-2024: Keysight Technologies, Inc. unveiled the PathWave Advanced Power Application Suite, unifying key tools for battery testing and design. It simplifies workflows, enhances data accuracy, supports real-time emulation, and enables seamless data transfer. This integrated platform accelerates development, improves test repeatability, and streamlines power solution validation for engineers.

- Mar-2024: Renesas Electronics Corporation acquired Altium, a Software company to enhance its digital device design and software capabilities. This move supports Renesas’ digitalization strategy, integrating Altium’s advanced PCB design tools with Renesas’ embedded solutions to offer a unified platform for electronics system design and innovation.

- Mar-2023: The MathWorks, Inc. announced the partnership with Green Hills Software, an Embedded system company to integrate Simulink and Embedded Coder with Infineon AURIX TC4x microcontrollers. This enables automotive engineers to design, test, and deploy safety-critical applications more efficiently, meeting ISO 26262 standards through automated code generation, simulation, and debugging for electric vehicles and embedded systems.

List of Key Companies Profiled

- The MathWorks, Inc.

- Keysight Technologies, Inc.

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Altair Engineering Inc.

- Infineon Technologies AG

- Texas Instruments, Inc.

- ABB Ltd.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

Market Report Segmentation

By Technology

- Model-Based Design (MBD)

- Rapid Control Prototyping (RCP)

- Hardware-In-The-Loop (HIL) Simulation

- Embedded System Prototyping

- Other Technology

By Application

- Industrial

- Automotive

- Renewable Energy

- Consumer Electronics

- Aerospace & Defense

- Other Application

By Type

- Simulation Software

- Design Software

- Control Software

- Analysis Software

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- The MathWorks, Inc.

- Keysight Technologies, Inc.

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Altair Engineering Inc.

- Infineon Technologies AG

- Texas Instruments, Inc.

- ABB Ltd.

- ON Semiconductor Corporation

- Renesas Electronics Corporation