PET catalysts play a critical role in improving polymer quality, production efficiency, and recyclability, enabling manufacturers to meet both regulatory standards and consumer expectations. A key market driver is the shift toward recycled PET (R-PET) and bio-based PET, supported by technological advancements in catalyst formulations that enhance polymer performance while reducing environmental impact. Consumer demand for transparency, product safety, and recognizability in packaging, especially in food contact applications, further boosts the need for high-quality PET resins, which rely on efficient and specialized catalysts.

Additionally, PET’s superior barrier and mechanical properties, coupled with ongoing innovation in recycling technologies (such as converting PET bottles into textile fibers), reinforce its position in the packaging sector. Strategic investments in catalyst technology to improve recyclability, reduce energy consumption, and lower greenhouse gas emissions are increasingly important. Growing consumer and stakeholder awareness, along with global educational campaigns promoting effective recycling, are expected to sustain long-term demand for PET catalysts in both virgin and recycled PET production.

In the automotive sector, polyethylene terephthalate (PET) derived from PET catalyst technology is extensively used in seat cover applications due to its exceptional performance and cost-effectiveness. Modern automobile seats are typically manufactured in a three-layer structure: the top layer being the seat cover, a middle foam layer, and a bottom scrim backing, all bonded together with adhesive layers. PET is the dominant fiber used in woven, warp-knitted, or circular-knitted seat cover fabrics, with its adoption reaching nearly 95% since the late 1990s. This popularity is attributed to PET’s high tensile strength and modulus, excellent resistance to abrasion, UV radiation, and heat, superior anti-aging properties, shape retention, dimensional stability, and low production cost.

While PET is often used in its pure form, it may also be blended with wool for enhanced properties. Additional advantages include high tear resistance, easy maintenance, and wrinkle resistance, although its low moisture absorption (~0.4%) can reduce thermal comfort in hot climates.

In the polyethylene terephthalate (PET) catalyst market, aluminum-based catalysts are emerging as a promising alternative to traditional antimony- and titanium-based options, driven by their lower cost, lightweight nature, and minimal environmental and health impact. Sharing the same active sites as trivalent metals, these catalysts garnered significant research interest for their role in PET polycondensation. The shift toward aluminum-based catalysts is supported by growing environmental regulations and the industry's push to replace antimony due to toxicity concerns.

However, restraint in the polyethylene terephthalate (PET) catalyst market is the stringent environmental and health regulations imposed on antimony-based catalysts. Antimony trioxide, one of the most used catalysts in PET production, comes under increasing regulatory scrutiny due to concerns over its potential toxicity and environmental persistence.

Global Polyethylene Terephthalate Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. The analyst has segmented the global polyethylene terephthalate catalyst market report based on product, application, and region- Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018-2033)

- Antimony-Based

- Aluminum

- Titanium-based

- Germanium-based

- Other Catalysts

- Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018-2033)

- Packaging

- Textile & Apparel

- Automotive

- Medical

- Other Applications

- Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018-2033)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- UK

- Spain

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the industry across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segmental and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Polyethylene Terephthalate Catalyst market report include:- TOYOBO

- Teijin

- Catalytic Technologies Ltd

- Iwatani Corporation

- Evonik Industries AG

- Wellman Introduces

- Indorama Ventures

- SAKAI CHEMICAL INDUSTRY CO.,LTD.

- Amerex Hubei Decon Polyester Co., Ltd.

- NAN YA PLASTICS CORPORATION

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | August 2025 |

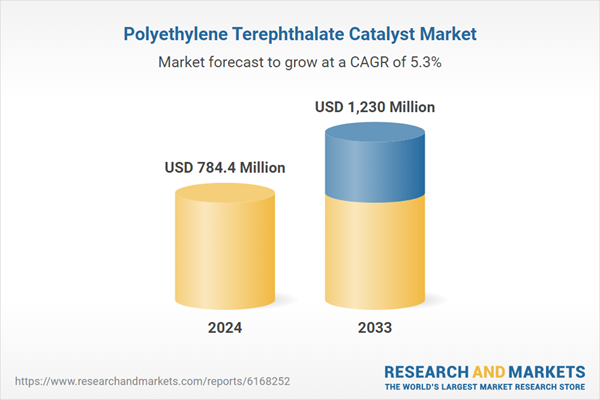

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 784.4 Million |

| Forecasted Market Value ( USD | $ 1230 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |