The increasing integration of data-intensive technologies such as artificial intelligence (AI), machine learning (ML), and industrial IoT is significantly transforming the U.S. industrial cooling systems market. As manufacturing facilities, logistics hubs, and smart factories adopt automated systems for real-time monitoring and predictive maintenance, the need for precise and efficient thermal management is becoming paramount. High-performance computing infrastructure, robotics, and sensor-heavy environments generate substantial heat loads, requiring advanced industrial cooling systems to ensure equipment reliability, minimize downtime, and extend operational lifespan. This digital transformation is creating robust demand for scalable, energy-efficient cooling solutions, thereby accelerating the expansion of the U.S. industrial cooling systems industry.

Additionally, the accelerated growth of hyperscale data centers and cloud infrastructure providers is further propelling the demand for the U.S. industrial cooling systems. The shift toward liquid cooling, immersion cooling, and hybrid air-liquid systems reflects a growing emphasis on sustainability, energy efficiency, and regulatory compliance. Government initiatives promoting green building standards and energy-efficiency incentives are also bolstering investments in advanced cooling architectures, thereby shaping the future trajectory of the U.S. industrial cooling systems market.

Furthermore, the rising focus on clean energy production and decarbonization efforts across industrial sectors is driving innovation in the U.S. industrial cooling systems. Facilities in power generation, chemical processing, and steel manufacturing are modernizing legacy systems to support heat recovery, water reuse, and emissions control. The transition to low-carbon technologies such as hydrogen production, carbon capture and storage (CCS), and electrified furnaces necessitates highly specialized cooling infrastructure to handle complex thermal dynamics and enhance process safety. This alignment with broader environmental, social, and governance (ESG) goals is positioning industrial cooling systems as an enabler of sustainable industrial operations in the U.S.

U.S. Industrial Cooling Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. The analyst has segmented the U.S. industrial cooling systems market report based on product and end use:Product Outlook (Revenue, USD Billion, 2021-2033)

- Hybrid Cooling

- Water Cooling

- Air Cooling

- Evaporative Cooling

End Use Outlook (Revenue, USD Billion, 2021-2033)

- Utility & Power

- Chemical

- Food & Beverage

- Pharmaceutical

- Oil & Gas

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the industry across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segmental and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this U.S. Industrial Cooling Systems market report include:- Johnson Controls.

- Trane Technologies plc

- Carrier.

- SPX Cooling Tech, LLC

- Baltimore Aircoil Company, Inc.

- EVAPCO, Inc.

- DAIKIN APPLIED

- Lennox International Inc.

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- Delta Cooling Towers, Inc.

Table Information

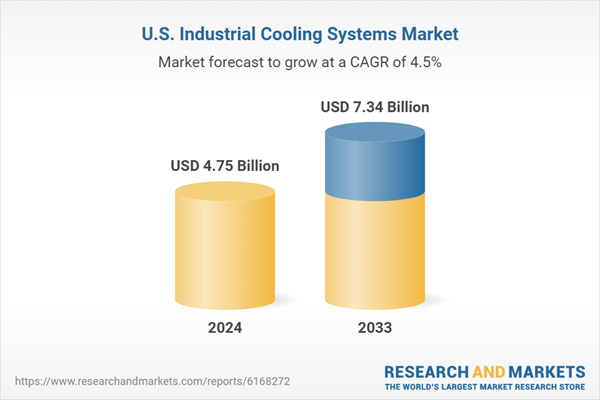

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.75 Billion |

| Forecasted Market Value ( USD | $ 7.34 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |