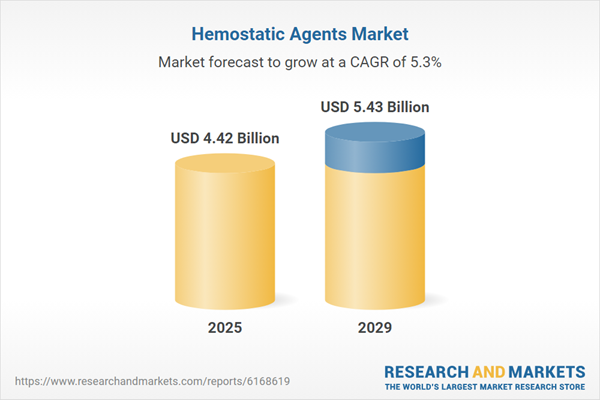

The hemostatic agents market size is expected to see strong growth in the next few years. It will grow to $5.43 billion in 2029 at a compound annual growth rate (CAGR) of 5.3%. The growth expected in the forecast period can be attributed to the rising number of surgical procedures, growth in minimally invasive surgeries, increased demand for orthopedic surgeries, a surge in cosmetic and aesthetic surgeries, and a growing need for effective hemostasis in dental surgeries. Key trends during this period include advancements in hemostatic agent formulations, the introduction of bioengineered and recombinant agents, improved product shelf-life and stability, development of combination products, and innovation in synthetic and absorbable hemostats.

The growing number of surgical procedures is anticipated to drive the expansion of the hemostatic agents market moving forward. Surgical procedures involve medical operations carried out by healthcare professionals using specialized tools to treat, repair, or remove parts of the body for health purposes. This increase in surgeries is mainly due to the rising incidence of chronic conditions that often require surgical intervention to address health problems and improve patient outcomes. Hemostatic agents play a crucial role in surgeries by quickly stopping bleeding, minimizing blood loss, and enhancing visibility in the surgical field for more precise work. For example, in March 2023, the British Association of Aesthetic Plastic Surgeons (BAAPS), a UK professional body, reported 31,057 cosmetic procedures performed in 2022, marking a 102% increase from the previous year. Women accounted for 93% of these procedures, showing a 101% rise compared to 2021. Thus, the growing number of surgical procedures is fueling the growth of the hemostatic agents market.

Key players in the hemostatic agents market are developing innovative products, such as collagen-based hemostats, designed to provide rapid and effective bleeding control and tissue sealing in both open and minimally invasive surgeries. Collagen-based hemostats consist of purified collagen materials that aid hemostasis by enhancing the body’s natural clotting at wound or incision sites. For instance, in March 2025, Baxter, a US healthcare company, introduced HEMOPATCH Sealing Hemostat, an absorbable collagen-based pad. This advanced pad features a dual-action system that combines a collagen matrix with an NHS-PEG layer, which forms a hydrogel when it contacts moisture, enabling fast sealing of bleeding areas. It adheres strongly to wet tissues, making it effective in both open and minimally invasive surgical procedures where other agents may fall short. The patch achieves hemostasis in less than two minutes without requiring temperature-controlled storage or special preparation, simplifying surgical workflows. It naturally dissolves within 6 to 8 weeks and can be stored at room temperature for up to three years, meeting critical clinical and storage needs.

In May 2025, Merit Medical Systems Inc., a US medical device manufacturer, acquired Biolife Delaware LLC for an undisclosed sum. This acquisition positions Merit to offer a wider range of products that enhance consistency and efficiency in post-procedure care. It also strengthens Merit’s portfolio with specialized hemostatic solutions suitable for various clinical applications, including bleeding management from vascular closures and indwelling catheters. Biolife Delaware LLC is a US-based producer of hemostatic agents.

Major players in the hemostatic agents market are Pfizer Inc., Johnson & Johnson Services Inc., Becton, Dickinson & Co., CSL Ltd., Baxter International Inc., Teleflex Inc., Integra LifeSciences Holdings Corp., Gelita Medical, Artivion Inc., B. Braun Melsungen AG, Advanced Medical Solutions Group Plc, Z‑Medica, Marine Polymer Technologies Inc., MedTrade Products Ltd., Samyang Holdings Corp., Vascular Solutions Pc, BioCer Entwicklungs GmbH, Starch Medical Inc., Arch Therapeutics Inc., Medcura Inc., and Biom’Up SAS.

North America was the largest region in the hemostatic agents market in 2024. The regions covered in hemostatic agents report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the hemostatic agents market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The hemostatic agents market consists of sales of chitosan-based hemostats, flowable hemostats, synthetic polymer-based hemostats, topical absorbable hemostats, and adhesive hemostatic films. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

The hemostatic agents market research report is one of a series of new reports that provides hemostatic agents market statistics, including hemostatic agents industry global market size, regional shares, competitors with a hemostatic agents market share, detailed hemostatic agents market segments, market trends and opportunities, and any further data you may need to thrive in the hemostatic agents industry. This hemostatic agents market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Hemostatic agents are specialized substances designed to assist the body’s natural blood clotting process by controlling and stopping bleeding. They work by interacting with different components of the coagulation system to promote the formation of a stable clot at the site of vascular injury.

The primary types of hemostatic agents include thrombin-based, gelatin-based, collagen-based, oxidized regenerated cellulose-based, combination hemostats, fibrin sealants, and others. Thrombin-based hemostats use thrombin, a natural blood enzyme, to quickly halt bleeding by accelerating clot formation. These agents are used in trauma care, cardiovascular surgery, general surgery, plastic surgery, orthopedic surgery, neurosurgery, and more, serving end users such as hospitals, surgical centers, nursing homes, and others.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Hemostatic Agents Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hemostatic agents market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hemostatic agents? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The hemostatic agents market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Thrombin-Based Hemostats; Gelatin-Based Hemostats; Collagen-Based Hemostats; Oxidized Regenerated Cellulose-Based Hemostats; Combination Hemostats; Fibrin Sealants; Other Types2) By Application: Trauma; Cardiovascular Surgery; General Surgery; Plastic Surgery; Orthopedic Surgery; Neurosurgery; Other Applications

3) By End-User: Hospitals; Surgery Centers; Nursing Homes; Other End Users

Subsegments:

1) By Thrombin-Based Hemostats: Bovine Thrombin; Human Thrombin; Poxidized Regenerated Cellulose (Orc)Ine Thrombin; Combined Thrombin Products2) By Gelatin-Based Hemostats: Absorbable Gelatin Sponges; Gelatin Powder; Gelatin Paste; Gelatin With Thrombin

3) By Collagen-Based Hemostats: Collagen Sponges; Collagen Powder; Collagen With Thrombin; Collagen Sheets or Patches

4) By Oxidized Regenerated Cellulose-Based Hemostats: Oxidized Regenerated Cellulose (ORC) Pads; Oxidized Regenerated Cellulose (ORC) Mesh; Oxidized Regenerated Cellulose (ORC) Powder; Oxidized Regenerated Cellulose (ORC) With Other Active Agents

5) By Combination Hemostats: Gelatin and Thrombin Combinations; Collagen and Thrombin Combinations; Oxidized Regenerated Cellulose (ORC) And Thrombin Combinations; Multi-Agent Combinations

6) By Fibrin Sealants: Human Plasma-Derived Fibrin Sealants; Recombinant Fibrin Sealants; Sprayable Fibrin Sealants; Liquid Fibrin Sealants; Fibrin Sealants With Antimicrobials

7) By Other Types: Polysaccharide-Based Hemostats; Synthetic Polymer-Based Hemostats; Microfibrillar Collagen Hemostats; Chitosan-Based Hemostats; Calcium-Based Hemostats

Companies Mentioned: Pfizer Inc.; Johnson & Johnson Services Inc.; Becton, Dickinson & Co.; CSL Ltd.; Baxter International Inc.; Teleflex Inc.; Integra LifeSciences Holdings Corp.; Gelita Medical; Artivion Inc.; B. Braun Melsungen AG; Advanced Medical Solutions Group Plc; Z‑Medica; Marine Polymer Technologies Inc.; MedTrade Products Ltd.; Samyang Holdings Corp.; Vascular Solutions Pc; BioCer Entwicklungs GmbH; Starch Medical Inc.; Arch Therapeutics Inc.; Medcura Inc.; Biom’Up SAS.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Hemostatic Agents market report include:- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Becton, Dickinson & Co.

- CSL Ltd.

- Baxter International Inc.

- Teleflex Inc.

- Integra LifeSciences Holdings Corp.

- Gelita Medical

- Artivion Inc.

- B. Braun Melsungen AG

- Advanced Medical Solutions Group Plc

- Z‑Medica

- Marine Polymer Technologies Inc.

- MedTrade Products Ltd.

- Samyang Holdings Corp.

- Vascular Solutions Pc

- BioCer Entwicklungs GmbH

- Starch Medical Inc.

- Arch Therapeutics Inc.

- Medcura Inc.

- Biom’Up SAS.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.42 Billion |

| Forecasted Market Value ( USD | $ 5.43 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |