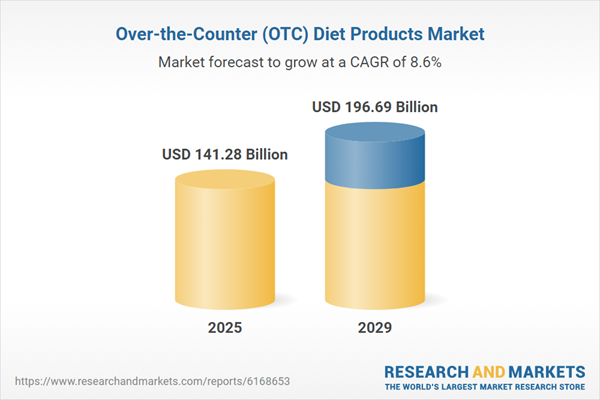

The over-the-counter (OTC) diet products market size is expected to see strong growth in the next few years. It will grow to $196.69 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to increasing interest in natural and plant-based OTC diet supplements, expanding online sales, growth in personalized nutrition, the rising prevalence of sedentary lifestyles, and a surge in health-conscious millennials and Gen Z consumers. Major trends during this period include a shift toward clean-label formulations, the expansion of digital wellness ecosystems, the popularity of keto, intermittent fasting, and low-carb product lines, heightened regulatory scrutiny alongside consumer demand for transparency, and the convergence of beauty and weight management.

The increasing health consciousness is expected to drive the growth of the over-the-counter (OTC) diet products market moving forward. Health consciousness refers to an individual's awareness and proactive approach to maintaining and improving their physical and mental health. This growing awareness is fueled by a better understanding of how unhealthy lifestyle choices contribute to disease, motivating people to adopt healthier habits. OTC diet products support this health consciousness by providing accessible weight management options, encouraging individuals to take proactive measures toward improved nutrition and fitness. These products promote healthy living by enabling informed decisions and self-managed wellness. For example, in May 2022, the International Food Information Council, a US-based non-profit organization, reported that about 52% of Americans followed a specific diet or eating pattern, up from 39% in 2021. Hence, rising health consciousness is propelling the growth of the OTC diet products market.

Key companies in the OTC diet products market are focusing on creating advanced offerings, such as weight-loss solutions tailored for women, designed to enhance fat burning, suppress appetite, and support effective weight management. Women’s weight-loss solutions encompass various methods, programs, products, and lifestyle strategies aimed at helping women lose and maintain a healthy weight. For instance, in October 2024, Wisp, a US-based women’s telehealth company, launched a new weight care vertical providing access to GLP-1 medications, including both FDA-approved and compounded semaglutide options. This initiative targets women facing hormonal imbalances related to menopause, polycystic ovary syndrome (PCOS), and endometriosis by offering OTC weight-loss solutions. The program includes personalized online consultations, eligibility screening, and options for pharmacy pickup or discreet delivery, addressing the unique weight management needs of women across 20 states.

In January 2025, Nutrabay, an India-based nutrition supplement company, partnered with Zepto to improve the accessibility of its products for fitness enthusiasts and athletes nationwide. This collaboration aims to facilitate rapid delivery of sports nutrition and wellness products, ensuring convenience and timely access for health-conscious consumers through Zepto’s quick-commerce platform. Zepto is an India-based quick-commerce company specializing in fast delivery of OTC diet products, providing convenient access to weight management solutions.

Major players in the over-the-counter (OTC) diet products market are Novo Nordisk A/S, GSK plc, Nestlé Health Science, Herbalife Nutrition Ltd., Perrigo Company plc, Nature's Bounty Co., GNC Holdings LLC, Swanson Health Products, Applied Nutrition, Bluebonnet Nutrition, H&H Group plc, Genesis Today, Pendulum Therapeutics Inc., NOW Foods, Absolute Nutrition, Dherbs Inc., Fermentis Life Sciences, Nutrabay, Orthomol, Wisp, Capsiplex, and Supergut.

North America was the largest region in the over-the-counter (OTC) diet products market in 2024. The regions covered in over-the-counter (OTC) diet products report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the over-the-counter (OTC) diet products market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The over-the-counter (OTC) diet products market consists of sales of appetite suppressants, fat burners, metabolism boosters, meal replacement shakes, and detox teas. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the pharmaceutical companies contend with tariffs on APIs, glass vials, and lab equipment inputs with few alternative sources. Generic drug makers, operating on razor-thin margins, are especially vulnerable, with some reducing production of low-profit medicines. Biotech firms face delays in clinical trials due to tariff-related shortages of specialized reagents. In response, the industry is expanding API production in India and Europe, increasing inventory stockpiles, and pushing for trade exemptions for essential medicines.

The over-the-counter (OTC) diet products market research report is one of a series of new reports that provides over-the-counter (OTC) diet products market statistics, including the over-the-counter (OTC) diet products industry global market size, regional shares, competitors with the over-the-counter (OTC) diet products market share, detailed over-the-counter (OTC) diet products market segments, market trends, opportunities, and any further data you may need to thrive in the over-the-counter (OTC) diet products industry. This over-the-counter (OTC) diet products market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Over-the-counter (OTC) diet products are non-prescription supplements or formulations intended to aid weight loss or weight management. These products work by suppressing appetite, enhancing fat burning, or decreasing fat absorption. They are often used alongside healthy eating habits and regular exercise to improve overall effectiveness. The primary purpose of these products is to assist individuals in losing weight and enhancing overall health without requiring a doctor's prescription.

The primary types of over-the-counter (OTC) diet products include weight loss pills and diet supplements. Over-the-counter weight loss pills are non-prescription items designed to support weight loss by suppressing appetite, increasing metabolism, or inhibiting fat absorption. They come in various forms such as tablets, hard capsules, powders, ointments, soft capsules, liquids, and more, and are available through multiple channels including drugstores, online retailers, weight loss agencies, and others.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Over-The-Counter (OTC) Diet Products Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on over-the-counter (otc) diet products market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for over-the-counter (otc) diet products? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The over-the-counter (otc) diet products market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Over the Counter Weight Loss Pill; Over the Counter Diet Supplements2) By Dosage Form: Tablets; Hard Capsules; Powders; Ointments; Soft Capsules; Liquids; Other Dosage Forms

3) By Application: Drugstore; Online Sales; Weight Loss Agency; Other Applications

Subsegments:

1) By Over the Counter Weight Loss Pill: Appetite Suppressants; Fat Blockers; Thermogenic Fat Burners; Carb Blockers; Diuretics; Metabolism Boosters2) By Over the Counter Diet Supplements: Herbal Supplements; Protein Supplements; Fiber Supplements; Meal Replacement Products; Probiotic Supplements; Green Tea Extract; Conjugated Linoleic Acid Supplements

Companies Mentioned: Novo Nordisk a/S; GSK plc; Nestlé Health Science; Herbalife Nutrition Ltd.; Perrigo Company plc; Nature's Bounty Co.; GNC Holdings LLC; Swanson Health Products; Applied Nutrition; Bluebonnet Nutrition; H&H Group plc; Genesis Today; Pendulum Therapeutics Inc.; NOW Foods; Absolute Nutrition; Dherbs Inc.; Fermentis Life Sciences; Nutrabay; Orthomol; Wisp; Capsiplex; Supergut

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Over-the-Counter (OTC) Diet Products market report include:- Novo Nordisk A/S

- GSK plc

- Nestlé Health Science

- Herbalife Nutrition Ltd.

- Perrigo Company plc

- Nature's Bounty Co.

- GNC Holdings LLC

- Swanson Health Products

- Applied Nutrition

- Bluebonnet Nutrition

- H&H Group plc

- Genesis Today

- Pendulum Therapeutics Inc.

- NOW Foods

- Absolute Nutrition

- Dherbs Inc.

- Fermentis Life Sciences

- Nutrabay

- Orthomol

- Wisp

- Capsiplex

- Supergut

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 141.28 Billion |

| Forecasted Market Value ( USD | $ 196.69 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |