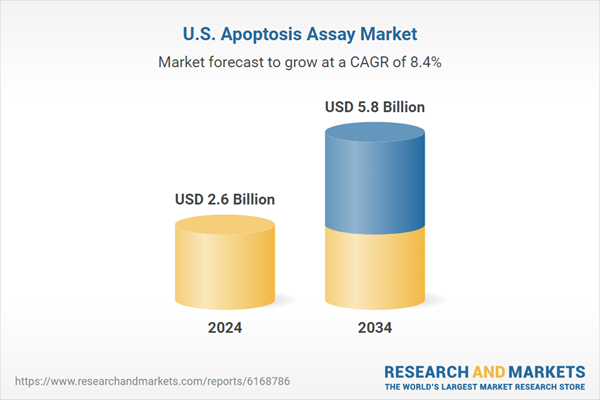

Market Size & Growth:

- 2024 Market Size: USD 2.6 billion

- 2025 Market Size: USD 2.8 billion

- 2034 Forecast Market Size: USD 5.8 billion

- CAGR (2025-2034): 8.4%

Regional Insights:

Country Covered: United States

The United States has an unparalleled share of the worldwide apoptosis assay market, given the established life sciences infrastructure (laboratory space and equipment), world-class biotech and pharma industries, and both public and private research funding in the life sciences sector. Moreover, as cancer personalized medicine and immunotherapy increase in importance, there remains a significant requirement for reliable probes in assessing cell viability and apoptosis assays.Key Drivers:

Increasing R&D of oncology agents: Apoptosis assays will be critical for anti-cancer agents and will be included in the preclinical and clinical phases.Increasing demand for high-throughput technologies: Multiplexed analyses and automation will favor the adoption of these technologies in screening platforms.

Growth of biotechnology and CRO industries: Anticipation of more biotech start-ups and contracting with contract research organizations (CROs) will lead to more assay usage.

Advancements in assay sensitivity and specificity technologies: Newer fluorometric and luminescent detection advances will continue to improve assay reproducibility.

Key Players:

- Some of the major players in the U.S. apoptosis assay market are Thermo Fisher Scientific, BD Becton Dickinson and Company, Agilent Technologies, Bio-Rad Laboratories, Promega, Merck, Sartorius, Takara Bio, Biotium, Abcam, GeneCopoeia, Danaher, PerkinElmer, and G Biosciences.

- Leading firms like Thermo Fisher Scientific, Danaher, Merck, Bio-Rad Laboratories, and BD (Becton, Dickinson and Company) combined represent 69% of the U.S. market.

Key Challenges:

- Assay protocol complexity and interpretation: Multiparametric assays require careful handling and analysis tools.

- High cost of equipment: There is a large capital requirement for technologies such as flow cytometry and live-cell imaging platforms.

- Variability in assays and standardization: Some variability in the laboratory can come from using different cell lines, assay conditions, or quality of reagents that have affected reproducibility.

Browse key industry insights spread across 90 pages with 22 market data tables and figures from the report, along with the table of contents:

By Product - Consumables were the largest segment

In the U.S. market in 2024, consumables, which include kits, reagents, and probes, accounted were the largest segment. They are always in demand because of their single usage and periodic requirement in academic, clinical, and industrial research settings.By Technology - Flow Cytometry Leads

Flow cytometry was the leading technology segment in 2024. Its quantitative, multiparameter real-time cell analysis capability makes it the standard for apoptosis detection in basic and translational research.By Assay Type - Caspase Assays in Focus

Caspase assays accounted for the greatest proportion by assay type. Given their roles as prime enzymes of the apoptosis cascade, detection of caspases is most fundamental to mechanisms of action in cancer drugs and toxicity.Pharmaceutical and biotechnology firms were the major end users in 2024, utilizing apoptosis assays for backing drug screening, preclinical validation, and therapeutic profiling. Their continuous investment in R&D ensures they are the major growth drivers for this segment.

Major players in the U.S. apoptosis assay market are Thermo Fisher Scientific, BD Becton, Dickinson and Company, Agilent Technologies, Bio-Rad Laboratories, Promega, Merck, Sartorius, Takara Bio, Biotium, Abcam, GeneCopoeia, Danaher, PerkinElmer, and G Biosciences.

To strengthen their market position, key players are investing in the development of assay portfolios, collaborative research, and automation integration. Thermo Fisher Scientific introduced advanced caspase detection kits with enhanced fluorescence intensity recently. Promega and Agilent Technologies have both broadened their apoptosis platforms with the addition of real-time, live-cell imaging capabilities. Bio-Rad and BD are also focusing on the U.S. academic and pharma market with easy-to-use flow cytometry kits. The increased collaborations of assay developers and biopharma companies are paving pathways to biomarker discovery and precision diagnostics for oncology.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this U.S. Apoptosis Assay market report include:- Abcam

- Agilent Technologies

- BD Becton, Dickinson and Company

- Bio-Rad Laboratories

- Biotium

- Danaher

- G Biosciences

- GeneCopoeia

- Merck

- PerkinElmer

- Promega

- Sartorius

- Takara Bio

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 5.8 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 15 |