Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Liquid Fertilizer market report include:- Nutri-Tech Solutions Pty Ltd

- FoxFarm Soil & Fertilizer Co

- CSBP

- ICL

- Compo Expert

- Nutrien Ltd.

- BMS Micro-Nutrients NV

- EuroChem Group

- IFFCO

- K+S Aktiengesellschaft

- Yara International ASA

- AgroLiquid

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | August 2025 |

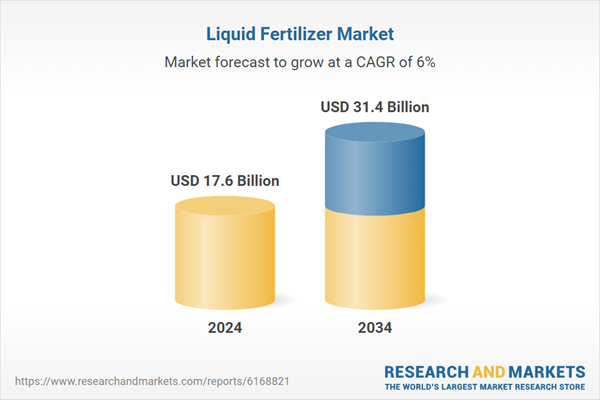

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 17.6 Billion |

| Forecasted Market Value ( USD | $ 31.4 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |