Market growth is fueled by strong national policy frameworks, rising interest in sustainable development, and the rapid pace of urbanization. China’s shift toward greener infrastructure and environmentally responsible construction is creating solid demand for recycled plastic materials. With robust support from the government through circular economy strategies and strict construction waste management regulations, the adoption of recycled plastic is gaining significant momentum. A combination of green building initiatives and infrastructure expansion programs, particularly in high-density urban centers, is creating favorable conditions for the integration of post-consumer and construction-derived plastic into building applications. Ongoing reforms and economic guidelines under China's Five-Year Plan are setting the stage for further market acceleration, encouraging manufacturers to invest in eco-friendly production models.

The wood-plastic composites (WPC) segment generated USD 289.7 million in 2024. Its market strength comes from its versatile use across decking, façade battens, outdoor furnishings, and landscaping structures. Provinces like Jiangsu, Zhejiang, and Shanghai are experiencing major urban upgrades, making these WPC materials especially relevant. The adaptability of WPC in outdoor and semi-structural projects continues to drive demand, with regional construction authorities increasingly endorsing these materials as part of their sustainable project pipelines.

In 2024, the post-consumer plastic waste segment was valued at USD 365.4 million. Materials recovered from demolition and renovation activities form the bulk of the feedstock in this space. The rise in reconstruction efforts across aging residential districts and outdated infrastructure networks is feeding consistent raw material supply into recycling systems. As older buildings are dismantled and inefficient structures replaced, more plastic waste becomes available for reuse in composite boards, pipework, wall panels, and plastic-based aggregate substitutes, allowing for closed-loop use within the same sector.

East China Recycled Plastic Construction Materials Market held a 25.2% share and generated USD 272.1 million in 2024. The region's dominance stems from its well-established industrial base and large-scale green construction projects. Meanwhile, North China is seeing faster growth at a CAGR of roughly 8%, with strong momentum driven by regulatory action in Beijing and sustainable urban transformation initiatives in Tianjin and Hebei. The rise of prefabricated buildings and environmentally conscious public sector investments is encouraging builders to opt for recycled plastic in insulation, roof coverings, and pipeline systems, further broadening market potential.

Major companies operating in the China Recycled Plastic Construction Materials Market include China State Construction Engineering Corporation, Sinopec, Guangdong Provincial Construction Group, China National Building Material Group Corporation, China Resources Group, Shanghai Construction Group, and Shandong Hi-Speed Group. Companies in China's recycled plastic construction materials sector are investing in localized manufacturing units to optimize logistics and meet regional demand. To expand their footprint, leading players are securing long-term procurement deals with municipal bodies for consistent access to post-consumer and C&D plastic waste. The focus on innovation is growing, with firms developing new composite blends for structural and semi-structural applications.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this China Recycled Plastic Construction Materials market report include:- China National Building Material Group Corporation

- China Resources Group

- China State Construction Engineering Corporation

- CRDC Global

- Guangdong Provincial Construction Group

- Shandong Hi-Speed Group

- Shanghai Construction Group

- Sinopec

- Zhejiang Provincial Energy Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

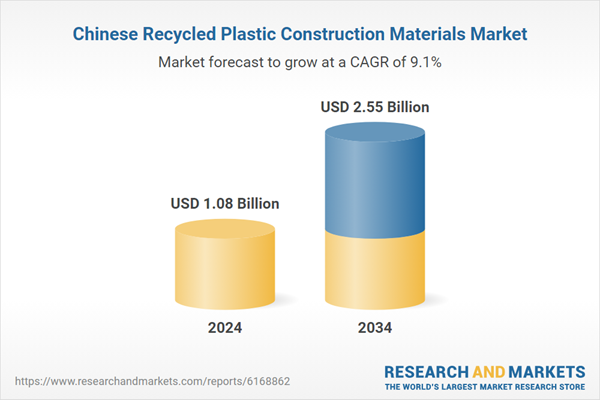

| Estimated Market Value ( USD | $ 1.08 Billion |

| Forecasted Market Value ( USD | $ 2.55 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | China |

| No. of Companies Mentioned | 9 |