Consumers, developers, and contractors increasingly prefer sustainable and energy-efficient options, spurring demand for products made from natural or recycled materials. Regulatory frameworks and green building certifications, such as LEED and BREEAM, further promote energy-efficient insulation, while financial incentives like tax rebates encourage adoption. As a result, investment in energy-efficient homes and commercial structures continues to rise, making insulation a critical component in reducing energy costs and minimizing environmental impact. The market’s growth reflects a collective focus on building more sustainable structures.

The market is segmented by material into open-cell and closed-cell types. Open-cell materials have gained substantial traction, contributing USD 12.96 billion in 2024 and projected to reach USD 23.84 billion by 2034. These materials are cost-effective and widely adopted in residential and commercial applications, especially in budget-conscious projects. They also enhance soundproofing and support green construction with eco-friendly options made from recycled materials. Open-cell materials are favored for their ease of installation and strong thermal performance, making them a preferred choice for retrofitting older buildings to improve energy efficiency.

By distribution channel, the market is divided into direct and indirect sales. Indirect channels led the market with a 45.01% share in 2024 and are expected to reach USD 19.69 billion by 2034. Manufacturers benefit from the extensive networks of distributors, wholesalers, and retailers, who streamline product availability and customer reach. These intermediaries reduce logistical challenges and improve market penetration, helping manufacturers focus on product development and branding. Indirect channels also cater to the growing demand through online platforms, enhancing accessibility and convenience for buyers.

The United States accounted for 53.5% of the global market’s revenue in 2024 and is projected to grow at a CAGR of 6.3% through 2034. The nation’s diverse construction industry and stringent energy-efficiency regulations drive demand for advanced insulation solutions. Government initiatives, including tax credits and green certifications, further support the use of thermal insulation. The country’s emphasis on innovation in insulation technologies and the need for energy-saving solutions across varying climate zones continue to bolster market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Building Thermal Insulation market report include:- Armacell

- Burnett & Co

- Firestone Building Products

- GLT Products

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Mapei

- NICHIAS Corporation

- Owens Corning

- Recticel Insulation

- Rockwool International

- Saint-Gobain Isover

- Siltherm

- URSA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

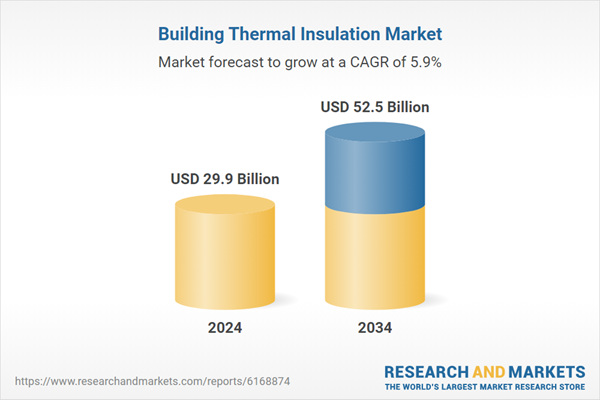

| Estimated Market Value ( USD | $ 29.9 Billion |

| Forecasted Market Value ( USD | $ 52.5 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |