Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Energy storage converters serve as the interface between energy storage devices - such as batteries, flywheels, supercapacitors, and pumped hydro systems - and electrical networks, enabling bidirectional energy flow, voltage regulation, frequency stabilization, and power quality management.

These systems are increasingly essential due to the growing penetration of renewable energy sources like solar and wind, which are inherently intermittent and variable in nature, creating challenges for grid reliability and stability. ESCs convert stored energy into usable alternating current (AC) or direct current (DC) power depending on the application requirements and ensure that energy is delivered efficiently and safely to residential, commercial, and industrial consumers.

In addition to conventional power management, modern energy storage converters are integrated with advanced digital controls, communication protocols, and smart grid capabilities, enabling real-time monitoring, predictive maintenance, and automated load management. The adoption of ESCs is driven by several factors, including the global push toward decarbonization, increasing deployment of distributed energy resources, the rising need for grid flexibility, and the expansion of microgrid and off-grid energy solutions.

Key Market Drivers

Rising Demand for Renewable Energy Integration

The increasing global adoption of renewable energy sources such as solar, wind, and hydroelectric power is a key driver for the energy storage converter market. As countries worldwide strive to reduce carbon emissions and transition toward cleaner energy, utilities and independent power producers are integrating renewable energy into power grids at an accelerated pace. Renewable energy sources are inherently intermittent, creating fluctuations in supply that can destabilize electricity grids.Energy storage converters, including bi-directional converters and power electronics systems, play a critical role in stabilizing these grids by efficiently managing energy storage systems, balancing load, and ensuring reliable power delivery. Additionally, the growth of distributed energy systems, microgrids, and off-grid renewable installations is further fueling demand for advanced energy storage converters that can seamlessly integrate with diverse energy assets.

Technological advancements in converter efficiency, power density, and smart control capabilities are also enhancing the reliability of renewable energy integration, thereby promoting the deployment of large-scale and decentralized energy storage solutions.

The shift toward decarbonization and the adoption of net-zero targets by governments and corporations are creating additional incentives for investment in energy storage infrastructure. This includes incentives such as tax credits, feed-in tariffs, and renewable energy certificates that indirectly stimulate demand for high-performance energy storage converters capable of handling multi-MW systems.

As utilities and industrial players increasingly focus on grid stability, energy arbitrage, and peak load management, the need for robust, reliable, and scalable energy storage converters is expected to grow substantially. Consequently, the renewable energy integration trend not only drives immediate demand but also stimulates long-term research, development, and deployment of next-generation converter technologies, positioning the energy storage converter market for sustained growth over the next decade.

Over 30% of global electricity generation now comes from renewable sources, with the share expected to rise steadily in the coming years. More than 100 countries have announced renewable energy integration targets to achieve carbon neutrality by mid-century. Around 1,500 GW of renewable energy capacity has been installed globally in the past decade, with solar and wind leading adoption. Over 70% of new power generation capacity additions worldwide each year are from renewable sources. Close to 50 million households globally are already powered through renewable-integrated systems, including microgrids and hybrid storage solutions.

Key Market Challenges

High Capital Costs and Initial Investment Requirements

One of the primary challenges restraining the growth of the energy storage converter market is the substantial capital cost associated with deploying advanced converter technologies. Energy storage converters, which include power electronic devices designed to manage and regulate energy flow between storage systems and the grid, require sophisticated components such as IGBTs, MOSFETs, and advanced control systems. These components, coupled with the need for precise engineering, high-efficiency designs, and integration with large-scale energy storage solutions, significantly elevate upfront expenditures for manufacturers, utilities, and end-users.In addition to hardware costs, substantial investment is required for system design, testing, installation, and commissioning to ensure seamless compatibility with existing energy storage infrastructures, whether they are lithium-ion, flow batteries, or other emerging storage technologies.

For industrial and utility-scale projects, these expenses can reach several million dollars per installation, which can be a considerable barrier for small and medium enterprises as well as emerging market players. Furthermore, the rapid pace of technological evolution in power electronics and energy management solutions introduces a risk of early obsolescence, where newly deployed converters may require upgrades or replacements sooner than anticipated, further impacting return on investment.

This challenge is compounded by the financial risk perceptions of stakeholders, especially in regions where regulatory frameworks, incentive schemes, and grid modernization programs are still evolving. Potential investors often weigh the long-term benefits of operational efficiency, grid stabilization, and renewable energy integration against the high initial outlay, sometimes resulting in delayed project approvals or scaled-down implementations.

Additionally, for distributed energy storage applications, such as residential or commercial rooftop energy systems, the high cost of energy storage converters limits adoption despite growing consumer interest in energy independence and sustainability.

The need for reliable financing models, government subsidies, or incentive programs to offset the initial expenditure is critical to accelerating market penetration. In markets with fluctuating energy tariffs, unstable policy support, or lack of awareness regarding lifecycle cost savings, high capital costs remain a significant barrier to large-scale deployment.

Consequently, while energy storage converters offer critical functionality in optimizing energy storage utilization, the challenge of managing upfront investment requirements continues to influence adoption rates and overall market growth, necessitating innovative business models, cost-reduction strategies, and supportive policy interventions to mitigate financial barriers for end-users and system integrators.

Key Market Trends

Increasing Integration of Renewable Energy Sources with Energy Storage Systems

The energy storage converter market is witnessing significant growth driven by the global shift toward renewable energy integration, particularly solar and wind power, which are inherently intermittent in nature. As utilities, commercial enterprises, and residential consumers seek to stabilize power supply and enhance grid reliability, energy storage converters play a crucial role in bridging the gap between variable generation and consistent demand. Modern converters are designed to efficiently manage bi-directional energy flows, ensuring seamless interaction between battery storage, microgrids, and distributed energy resources.The deployment of large-scale solar farms and offshore wind projects has necessitated the adoption of high-capacity converters capable of handling diverse voltage ranges and providing real-time grid support. Additionally, energy storage converters are increasingly being paired with hybrid systems that combine lithium-ion batteries, flow batteries, and other emerging storage technologies, optimizing system performance and lifespan. This integration trend is further strengthened by government incentives, renewable portfolio standards, and corporate sustainability initiatives encouraging clean energy adoption.

In emerging economies, rapid industrialization and urbanization are driving demand for off-grid and microgrid solutions, where energy storage converters are critical for managing load fluctuations and ensuring reliable power access. Furthermore, advancements in power electronics, digital monitoring, and smart inverters are enabling predictive maintenance, real-time energy management, and improved conversion efficiency.

Companies are leveraging these trends to develop modular and scalable converter solutions that can be deployed across utility-scale, commercial, and residential applications. By facilitating the seamless incorporation of renewables into existing infrastructure, energy storage converters are enhancing energy security, reducing dependency on fossil fuels, and supporting global decarbonization targets, solidifying their role as a pivotal component of modern energy systems.

Key Market Players

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company (GE)

- Hitachi Energy

- Eaton Corporation plc

- Toshiba Corporation

- Huawei Technologies Co., Ltd.

- BYD Company Ltd.

- SMA Solar Technology AG

Report Scope:

In this report, the Global Energy Storage Converter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Energy Storage Converter Market, By Application:

- Renewable Energy Integration

- Electric Vehicles

- Uninterruptible Power Supply

- Grid Storage

- Consumer Electronics

Energy Storage Converter Market, By Converter Type:

- DC to AC Converter

- AC to DC Converter

- DC to DC Converter

- Multilevel Converter

- Bidirectional Converter

Energy Storage Converter Market, By Energy Storage Type:

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Flow Batteries

- Supercapacitors

- Others

Energy Storage Converter Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Energy Storage Converter Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Energy Storage Converter market report include:- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company (GE)

- Hitachi Energy

- Eaton Corporation plc

- Toshiba Corporation

- Huawei Technologies Co., Ltd.

- BYD Company Ltd.

- SMA Solar Technology AG

Table Information

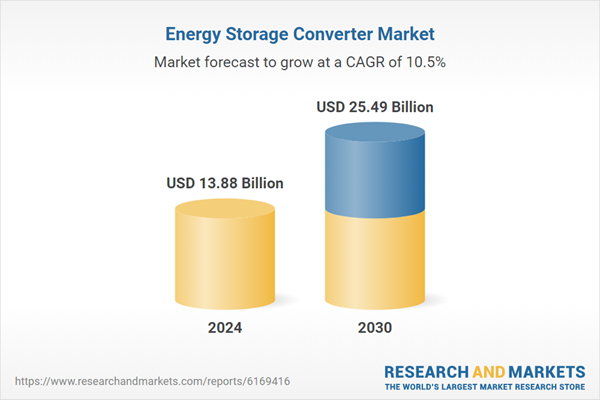

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.88 Billion |

| Forecasted Market Value ( USD | $ 25.49 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |