Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Unlike conventional terrestrial solar panels, satellite solar arrays must endure the extreme conditions of space, including vacuum, microgravity, high radiation levels, and large temperature fluctuations, necessitating the use of highly durable, lightweight, and high-efficiency materials. The market covers multiple array types, such as rigid, flexible, deployable, and concentrator-based solar panels, each tailored to specific satellite classes, including small satellites (smallsats), medium and large geostationary satellites, and deep-space exploration vehicles.

Key Market Drivers

Increasing Demand for Satellite-based Communication and Earth Observation

The rapid expansion of satellite-based communication and Earth observation services is a primary driver for the satellite solar panels array market. With the global demand for high-speed internet, broadband connectivity, and real-time data transmission growing exponentially, governments, telecommunication companies, and private space enterprises are deploying more satellites in low Earth orbit (LEO), medium Earth orbit (MEO), and geostationary orbit (GEO). These satellites require highly efficient and reliable power sources to operate continuously, particularly in missions that involve high-bandwidth data transmission and long-duration Earth observation.Satellite solar panel arrays provide a sustainable and lightweight energy solution capable of delivering consistent power to onboard systems, including communication transponders, sensors, and navigation payloads. Furthermore, advancements in solar panel efficiency, including multi-junction cells and flexible photovoltaic materials, have enabled satellites to generate greater power from limited surface areas, enhancing the operational capabilities of satellites while reducing overall launch mass.

The increasing reliance on satellite networks for applications such as remote sensing, weather forecasting, defense surveillance, and global navigation has led to a surge in demand for advanced solar panel arrays that can withstand harsh space environments, including extreme temperatures, radiation, and micrometeoroid impacts.

Additionally, the rise of mega-constellations, with hundreds or even thousands of small satellites working in unison to provide global coverage, has amplified the need for modular and scalable solar array solutions that can support large fleets efficiently.

Space agencies and private operators are also prioritizing sustainability and long-term mission reliability, making solar-powered systems an indispensable component for uninterrupted satellite operations. As satellite technology continues to evolve with higher energy requirements for sophisticated payloads, onboard AI processing, and enhanced communication modules, the adoption of advanced solar panel arrays is projected to grow steadily, creating significant opportunities for manufacturers, technology innovators, and integrators in the space energy sector. Over 5,500 active satellites currently orbit the Earth, with communication and Earth observation accounting for the largest share.

More than 60 countries are actively investing in satellite-based communication and observation programs. By 2027, over 1,000 new Earth observation satellites are expected to be launched globally. Satellite communication supports over 3 billion mobile and internet users in remote and underserved regions worldwide. Around 40% of new satellite launches are focused on Earth monitoring, disaster management, and climate research. Global demand for satellite internet services projected to expand to cover over 90% of rural populations by 2030.

Key Market Challenges

High Initial Capital Expenditure and Complex Manufacturing Requirements

One of the most pressing challenges facing the satellite solar panels array market is the high initial capital expenditure required for the design, development, and deployment of solar arrays for satellites, coupled with the intricate manufacturing processes involved. Producing high-efficiency solar panels suitable for space applications demands the use of advanced materials, such as multi-junction photovoltaic cells, lightweight composite structures, and radiation-resistant coatings, all of which significantly increase production costs. Beyond materials, the manufacturing process requires state-of-the-art precision engineering and stringent quality control measures to ensure that each panel can withstand the harsh conditions of outer space, including extreme temperatures, cosmic radiation, and micrometeoroid impacts.Even minor defects in solar arrays can lead to catastrophic failures, making the tolerance for error extremely low. Additionally, the process of integrating these solar panels into satellites involves complex assembly procedures and extensive testing protocols, including vacuum chamber simulations and vibration tests, which further escalate costs and extend development timelines. The financial burden is not limited to manufacturing alone; launch costs add another layer of expense, as every kilogram of payload into orbit involves substantial expenditure, and solar panels, despite being lightweight, contribute significantly to satellite mass due to structural and support components.

Smaller players and new entrants often face challenges in raising sufficient capital to compete with established aerospace firms that benefit from economies of scale and long-standing supplier networks. This high-cost barrier can limit market participation and slow overall industry growth, particularly in emerging regions where investment in satellite technology is still nascent. Furthermore, the rapid pace of technological evolution in photovoltaic materials and deployment mechanisms creates additional risk for investors, as arrays designed today may become partially obsolete by the time they are deployed, requiring continuous R&D investment.

The challenge is compounded by the need for collaboration between satellite manufacturers, panel suppliers, and launch service providers, which requires strong contractual and logistical coordination. In essence, the combination of high capital expenditure, complex manufacturing, and integration requirements presents a significant hurdle for market expansion, making it a critical factor that companies must strategically manage to remain competitive and sustain profitability in the evolving satellite solar panel landscape.

Key Market Trends

Growing Adoption of High-Efficiency and Lightweight Solar Panels for Next-Generation Satellites

The global satellite solar panels array market is witnessing a marked shift toward the adoption of high-efficiency, lightweight, and compact solar panels to meet the growing demands of next-generation satellite platforms, particularly in low Earth orbit (LEO) and medium Earth orbit (MEO) applications. With the rapid expansion of satellite constellations for broadband connectivity, Earth observation, and defense applications, there is an increasing need for power systems that maximize energy output while minimizing weight and volume. Lightweight solar panels reduce launch costs, improve payload efficiency, and allow satellites to carry more instruments or payloads without compromising on performance.Manufacturers are investing heavily in multi-junction solar cells, flexible solar arrays, and advanced photovoltaic materials that provide higher conversion efficiencies, often exceeding 30%, compared to conventional panels. This trend is further accelerated by the rise of small satellites and CubeSats, which demand compact, foldable, and highly efficient solar arrays to sustain operations over long periods with minimal space requirements. Additionally, the market is moving toward the integration of deployable and roll-out solar panel technologies, which enable larger energy-generating surfaces without increasing launch volume.

Aerospace and defense organizations are emphasizing reliability and durability under harsh space conditions, including radiation, temperature extremes, and micro-meteoroid impacts. The focus on lightweight and high-efficiency panels also aligns with environmental and cost considerations, as reduced mass and volume directly translate to lower fuel consumption during launches and more sustainable satellite missions.

As satellite operators and manufacturers increasingly prioritize energy-dense and flexible solar solutions, the market is experiencing an accelerated pace of research and development, with continuous improvements in panel efficiency, mechanical robustness, and long-term performance.

Consequently, high-efficiency, lightweight solar panels are becoming the standard for both commercial and government satellite programs, enabling new mission profiles and enhancing overall satellite system capability. This trend is expected to continue as more constellations are deployed globally, with a strong focus on enabling high-performance, cost-effective, and energy-efficient satellite operations across communication, remote sensing, scientific, and defense applications.

Key Market Players

- Maxar Technologies Inc.

- Northrop Grumman Corporation

- Airbus Defence and Space

- Ball Aerospace & Technologies Corporation

- Boeing Defense, Space & Security

- Thales Alenia Space

- Lockheed Martin Corporation

- RUAG Space AG

- Mitsubishi Electric Corporation

- Tethers Unlimited, Inc.

Report Scope:

In this report, the Global Satellite Solar Panels Array Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Satellite Solar Panels Array Market, By Type:

- Rigid Solar Array

- Multi-Junction Solar Array

- Thin-Film Solar Array

Satellite Solar Panels Array Market, By Orbit:

- LEO Orbit

- MEO Orbit

- GEO Orbit

Satellite Solar Panels Array Market, By Application:

- Communication Satellites

- Earth Observation Satellites

- Navigation Satellites

- Remote Sensing Satellites

- Others

Satellite Solar Panels Array Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Satellite Solar Panels Array Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Satellite Solar Panels Array market report include:- Maxar Technologies Inc.

- Northrop Grumman Corporation

- Airbus Defence and Space

- Ball Aerospace & Technologies Corporation

- Boeing Defense, Space & Security

- Thales Alenia Space

- Lockheed Martin Corporation

- RUAG Space AG

- Mitsubishi Electric Corporation

- Tethers Unlimited, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

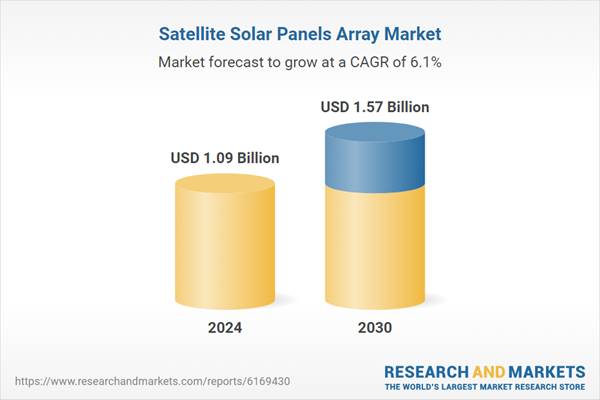

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.09 Billion |

| Forecasted Market Value ( USD | $ 1.57 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |

![LEO Satellite Market by Subsystem [Satellite Bus (Command & Data Handling, Electric Power System), Payload (Optical, Infrared, Radar), Solar Panel, Satellite Antenna], Satellite Mass, Application, End Use, Frequency, and Region - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12240/12240064_60px_jpg/leo_satellite_market.jpg)