Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This market is rising rapidly as governments and organizations worldwide prioritize digital transformation in public safety infrastructure. With increasing urbanization, rising crime rates, and growing threats of both physical and cyber incidents, agencies are adopting analytics solutions to gain actionable insights for quicker and more accurate decision-making. The integration of artificial intelligence and machine learning is enabling predictive policing, real-time threat detection, and resource optimization. Additionally, advanced technologies such as cloud computing and Internet of Things are enhancing interoperability across different departments, allowing a unified and coordinated response.

The future growth of the Global Public Safety Analytics Market will be fueled by the expanding use of smart city initiatives, which emphasize citizen safety through technology-driven approaches. Governments are investing heavily in surveillance, data platforms, and advanced analytics to ensure proactive risk mitigation and preparedness. Furthermore, increasing collaboration between the public and private sectors, coupled with the rising deployment of connected devices, will expand the scope of data collection and analysis. These factors, combined with the growing emphasis on predictive intelligence and real-time monitoring, will ensure that the Global Public Safety Analytics Market experiences sustained growth in the coming years, shaping safer and smarter societies globally.

Key Market Drivers

Increasing Need for Predictive Policing and Crime Prevention

Law enforcement agencies across the globe are increasingly adopting predictive analytics to prevent crimes before they occur. By leveraging historical crime data, social media activity, and geographic information, agencies can forecast potential crime hotspots and allocate resources efficiently. This proactive approach reduces response times and enhances public safety while improving trust in law enforcement. As urban populations grow, the demand for such predictive capabilities becomes critical to maintaining order and reducing operational costs for police departments.The growing sophistication of criminal activities, including cybercrimes, organized crime, and terrorism, necessitates advanced analytics solutions. Public safety analytics allows law enforcement agencies to identify patterns, anomalies, and emerging threats, enabling timely intervention. Integration with real-time surveillance, IoT devices, and emergency response systems ensures that authorities can act decisively.

Governments worldwide are prioritizing investments in smart policing programs that rely on data-driven decision-making to enhance operational efficiency and community safety. A metropolitan city in the United States reported a 25% reduction in property crimes over three years after implementing predictive policing analytics combined with real-time surveillance integration. This highlights how data-driven approaches can significantly improve public safety outcomes.

Key Market Challenges

Data Privacy and Security Concerns

The rapid adoption of public safety analytics has generated massive volumes of sensitive data, including personal information, biometric records, and location-based tracking details. While these datasets provide critical insights for law enforcement, emergency response, and urban planning, they also pose significant privacy risks. Citizens are increasingly concerned about how their data is collected, stored, and shared, particularly in the context of surveillance technologies. Any misuse or breach of such data could lead to reputational damage, legal liabilities, and erosion of public trust. Governments and agencies must ensure that analytics solutions comply with privacy regulations and ethical standards, which can be a complex and costly process.In addition, cyber threats targeting public safety data are becoming more sophisticated and frequent. Malicious actors may attempt to manipulate analytics systems, compromise real-time decision-making, or exfiltrate sensitive information. Ensuring the integrity, confidentiality, and availability of data requires continuous investment in cybersecurity infrastructure, robust encryption protocols, and secure data governance frameworks. These requirements often create additional operational burdens for public safety organizations, which may lack the technical expertise or financial resources to implement comprehensive safeguards. Balancing the benefits of advanced analytics with stringent privacy and security mandates remains a persistent challenge for the Global Public Safety Analytics Market, potentially slowing adoption and market growth.

Key Market Trends

Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence and machine learning into public safety analytics is significantly transforming the market. By leveraging predictive modeling, anomaly detection, and natural language processing, agencies can anticipate potential threats, optimize emergency response, and allocate resources more efficiently. Machine learning algorithms can process vast volumes of structured and unstructured data from multiple sources, including CCTV cameras, IoT sensors, social media feeds, and emergency call logs. This enables authorities to identify patterns and trends that would otherwise remain undetected, enhancing situational awareness and reducing response times. The continuous learning capability of these systems ensures that predictive accuracy improves over time, making public safety operations increasingly proactive rather than reactive.Artificial intelligence-driven analytics supports strategic planning by identifying high-risk zones, forecasting crime trends, and optimizing patrol schedules. The technology also facilitates automated alerts and decision-making, reducing reliance on manual interpretation of complex datasets. As agencies strive to improve efficiency while maintaining citizen safety, investments in AI and machine learning solutions are rising. Quantitative data suggests that over 60 percent of new public safety analytics deployments in major metropolitan areas now incorporate AI-driven modules, reflecting a shift toward intelligent, data-centric safety operations. The market is expected to continue its trajectory of adopting advanced analytics to enhance predictive capabilities, operational efficiency, and strategic decision-making.

Key Market Players

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise

- Oracle Corporation

- Palantir Technologies Inc.

- Motorola Solutions, Inc.

- Verint Systems Inc.

- Hexagon AB

- Siemens AG

Report Scope:

In this report, the Global Public Safety Analytics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Public Safety Analytics Market, By Component:

- Solutions

- Services

Public Safety Analytics Market, By Analytics Type:

- Predictive

- Prescriptive

- Descriptive

Public Safety Analytics Market, By Application:

- Pattern Recognition

- Incident Detection

- Person of Interest Screening

- Surveillance

- Others

Public Safety Analytics Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- South America

- Brazil

- Colombia

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Public Safety Analytics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Public Safety Analytics market report include:- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise

- Oracle Corporation

- Palantir Technologies Inc.

- Motorola Solutions, Inc.

- Verint Systems Inc.

- Hexagon AB

- Siemens AG

Table Information

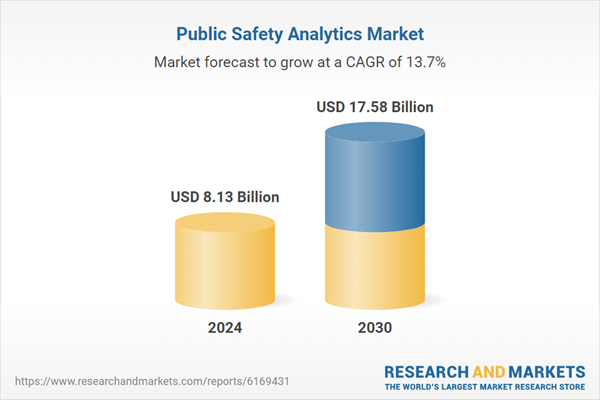

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.13 Billion |

| Forecasted Market Value ( USD | $ 17.58 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |