Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

PTC resettable devices are increasingly deployed across multiple sectors, including automotive, consumer electronics, industrial machinery, telecommunications, medical equipment, and renewable energy systems, due to their compact size, low maintenance requirements, and ability to enhance safety and device longevity. The market is driven by the growing need for circuit protection in high-performance electronics as devices become more complex and energy-dense, alongside the rising adoption of electric and hybrid vehicles, where PTC devices safeguard battery packs, power modules, and control systems from damage caused by excessive current.

Furthermore, industrial automation and smart manufacturing initiatives are accelerating the integration of PTC resettable devices into control panels, robotic systems, and high-power equipment, where they ensure operational reliability while reducing downtime and maintenance costs. Technological advancements, such as the development of devices with faster response times, higher current ratings, and improved thermal stability, are further expanding market applications, enabling their use in demanding environments such as aerospace, defense, and advanced computing systems.

Key Market Drivers

Increasing Adoption in Consumer Electronics and Automotive Applications

The rising demand for consumer electronics and automotive products is a primary driver fueling the growth of the PTC resettable device market. With the proliferation of smartphones, laptops, wearable devices, and smart home appliances, there is an increasing need for reliable overcurrent and thermal protection to ensure device safety and longevity.PTC resettable devices act as self-resetting fuses that safeguard circuits against overcurrent situations without the need for replacement, offering convenience and reduced maintenance costs. In the automotive sector, the rapid growth of electric vehicles (EVs), hybrid vehicles, and connected car technologies has intensified the requirement for advanced circuit protection solutions capable of handling high voltage and current levels while maintaining operational reliability.

Modern vehicles incorporate a multitude of electronic control units (ECUs), infotainment systems, battery management systems, and advanced driver-assistance systems (ADAS), all of which rely heavily on robust overcurrent protection to prevent damage from short circuits or unexpected surges. As automakers increasingly adopt electrification and digitalization in vehicles, the deployment of PTC resettable devices is rising significantly.

Furthermore, consumers’ expectations for longer-lasting, maintenance-free electronics are driving manufacturers to integrate these devices as a standard safety feature across a wide array of products. The growing penetration of smart appliances, portable medical devices, gaming consoles, and audio-visual equipment also amplifies the need for reliable thermal and overcurrent protection, further boosting the adoption of PTC resettable devices.

Additionally, the shift toward miniaturized and energy-efficient components has prompted engineers to select protection solutions that can be seamlessly integrated without compromising performance. This trend is particularly evident in wearable electronics and compact automotive modules, where space is at a premium, and reliable protection is non-negotiable. Overall, the convergence of rising consumer demand, technological advancements in electronics, and the automotive industry’s push toward electrification is creating a substantial market opportunity for PTC resettable devices, positioning them as a critical component in modern electrical and electronic systems.

Global consumer electronics adoption of surge arresters projected to reach USD 1.2 billion by 2025, driven by rising demand for smartphones, laptops, and smart home devices. Automotive segment expected to account for over 30% of total market share by 2026, fueled by EVs and connected vehicle technologies. CAGR of around 7-8% anticipated for surge arrester deployment across consumer and automotive applications between 2024-2030. Asia-Pacific region projected to lead growth, contributing nearly 40% of global market demand by 2026. Increasing integration of surge protection in electric vehicle charging stations expected to drive additional revenue of USD 250-300 million by 2027.

Key Market Challenges

Intense Competition and Price Sensitivity in the Global Market

The PTC resettable device market faces a significant challenge in the form of intense competition among global and regional manufacturers, which creates substantial pressure on pricing, product differentiation, and profit margins. The market is characterized by a large number of established players and smaller regional vendors, all vying for share across industries such as automotive, consumer electronics, industrial equipment, and telecommunications. This competitive environment forces manufacturers to constantly innovate while maintaining cost efficiency, often leading to high R&D expenditures, aggressive pricing strategies, and frequent product upgrades.Moreover, end-users are becoming increasingly price-conscious, demanding cost-effective solutions without compromising on reliability, safety, or performance. This price sensitivity particularly affects high-volume segments such as automotive and consumer electronics, where procurement decisions are heavily influenced by cost per unit.

Companies are therefore challenged to balance quality, performance, and affordability, which can strain operational resources and supply chains. In addition, as global markets expand, manufacturers are required to comply with diverse international standards and certifications for safety, performance, and environmental compliance.

The need for localized manufacturing, distribution, and technical support further increases operational complexity and cost. The competition is not only based on price but also on technological differentiation, including faster response times, higher endurance, lower tripping currents, and miniaturization of devices. Market players must invest heavily in R&D to meet evolving industry requirements, such as supporting higher power electronics in electric vehicles or advanced communication networks. Failure to keep pace with technological trends or maintain cost competitiveness can result in a loss of market share and reduced profitability.

Additionally, the entry of low-cost manufacturers from emerging regions intensifies the competitive landscape, creating further pressure on pricing strategies and margins for established players. Companies must therefore develop innovative strategies, such as value-added services, superior product reliability, and collaborative partnerships with OEMs and distributors, to maintain market leadership while managing the persistent challenge of price sensitivity in a highly competitive global environment.

Key Market Trends

Growing Adoption in Consumer Electronics and IoT Devices

The global PTC resettable device market is witnessing significant momentum driven by the rapid proliferation of consumer electronics and IoT devices. As smart homes, wearable technologies, and connected devices become increasingly mainstream, the demand for reliable overcurrent protection solutions has surged. PTC devices offer the advantage of automatic reset after fault conditions, making them ideal for consumer applications where minimizing downtime and ensuring user safety are critical. Manufacturers of smartphones, laptops, smart appliances, and IoT sensors are increasingly incorporating PTC resettable devices into their designs to safeguard sensitive components against voltage surges, short circuits, and thermal stress.This trend is further reinforced by the miniaturization of electronic circuits, which requires compact yet highly effective protection solutions capable of operating within tight form factors. Additionally, the growing awareness among consumers and manufacturers about the risks of electrical hazards and device failure is prompting a proactive shift toward integrating advanced protection mechanisms, including PTC devices, as standard design elements.

With the rising number of connected devices in households and workplaces, the market is expected to witness continuous growth, with manufacturers emphasizing enhanced device reliability, extended lifespan, and compliance with international safety standards.

Over time, the integration of PTC devices into next-generation IoT platforms and smart electronics is likely to become a normative requirement, driving further product innovations, including devices with faster response times, higher current handling capabilities, and lower resistance characteristics, thereby solidifying PTC resettable devices as a crucial component in consumer-focused electronics globally.

Key Market Players

- Littelfuse, Inc.

- TE Connectivity Ltd.

- STMicroelectronics N.V.

- Panasonic Corporation

- Bourns, Inc.

- Eaton Corporation plc

- Schurter AG

- Vishay Intertechnology, Inc.

- Seiko Instruments Inc.

- Honeywell International Inc.

Report Scope:

In this report, the Global PTC Resettable Device Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:PTC Resettable Device Market, By Material Type:

- Polymeric Type

- Ceramic Type

- Others

PTC Resettable Device Market, By Application:

- Telecom

- Alarm Systems

- Automotive

- Set-top Boxes

- Battery Packs

- Others

PTC Resettable Device Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global PTC Resettable Device Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this PTC Resettable Device market report include:- Littelfuse, Inc.

- TE Connectivity Ltd.

- STMicroelectronics N.V.

- Panasonic Corporation

- Bourns, Inc.

- Eaton Corporation plc

- Schurter AG

- Vishay Intertechnology, Inc.

- Seiko Instruments Inc.

- Honeywell International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

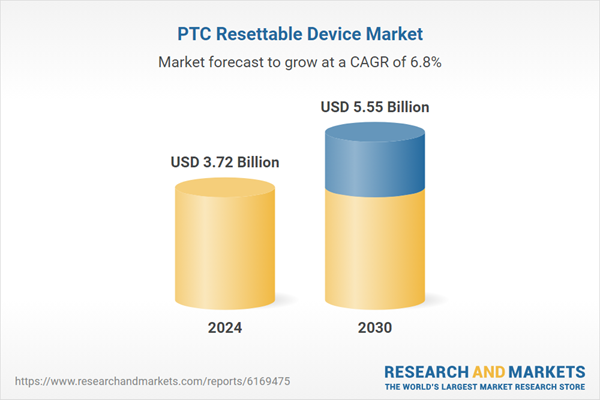

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.72 Billion |

| Forecasted Market Value ( USD | $ 5.55 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |