Executive Summary and Market Analysis

The wire and cable plastics market in North America is poised for substantial growth during the forecast period, driven by the expansion of various sectors such as energy and power, electronics, telecommunications, aerospace, and automotive. Both government and private sectors are making significant investments in smart city initiatives, renewable energy projects, and the modernization of electric grids, all of which necessitate extensive wire and cable infrastructure. Key plastic materials, including polyvinyl chloride (PVC), polyethylene, and fluoropolymers, are crucial for insulating and sheathing these cables, providing durability, flexibility, and resistance to environmental factors.The demand for high-performance communication cables is also on the rise, fueled by the growth of high-performance computing, data centers, electric vehicles (EVs), 5G infrastructure, and consumer electronics in North America. These applications require advanced plastic materials capable of supporting higher data transfer rates while minimizing electromagnetic interference. Furthermore, advancements in fiber optic and coaxial cables, which heavily rely on plastic for insulation and sheathing, are essential to meet the increasing data transmission demands in the region. According to the GSM Association, by 2030, 5G technology is expected to account for 90% of connections in North America, contributing approximately US$ 210 billion to the economy. This technological evolution is creating new opportunities for manufacturers of high-quality wire and cable plastics, particularly in the automotive sector, which is also driving demand.

Market Segmentation Analysis

The wire and cable plastics market can be segmented based on material, voltage, and end-use industry.- By Material: The market is divided into several categories, including polyethylene, polyvinyl chloride, polypropylene, cross-linked polyethylene, thermoplastic elastomers, and others. In 2023, polyvinyl chloride held the largest market share.

- By Voltage: The market is categorized into low, medium, high, and extra-high voltage segments, with the low voltage segment dominating in 2023.

- By End-Use Industry: The market is segmented into construction, automotive, electrical and electronics, aerospace and defense, telecommunications, oil and gas, energy and power, and others. The construction sector accounted for the largest share in 2023.

Market Outlook

The energy and power sector is experiencing a significant increase in demand for wire and cable plastics, driven by the global transition towards advanced energy infrastructure, the integration of renewable energy sources, and the modernization of outdated power systems. Plastics such as polyethylene (PE), polyvinyl chloride (PVC), and cross-linked polyethylene (XLPE) are vital for the insulation, sheathing, and protection of wires and cables. These materials offer unique advantages, including flexibility, electrical resistance, durability, and cost-effectiveness, making them essential for meeting the industry's growing needs.As the use of renewable energy sources like solar, wind, and hydropower rises, the demand for reliable and robust cabling solutions is increasing. These energy systems often operate in harsh environments, requiring cables that can withstand extreme temperatures, UV exposure, and moisture. Additionally, the focus on electrification in remote and underserved regions, particularly in developing countries, is further driving this demand. Long-distance power transmission lines and off-grid renewable energy systems necessitate durable and lightweight cables, where plastic materials play a crucial role in simplifying installation and enhancing efficiency. In April 2024, a partnership between the World Bank Group and the African Development Bank Group was announced, aiming to provide electricity access to at least 300 million people in Africa by 2030.

Country Insights

The North America wire and cable plastics market includes the United States, Canada, and Mexico, with the United States holding the largest market share in 2023.Wire and cable plastics are essential for supporting the increasingly complex and high-performance electronic devices across various industries, including consumer electronics, automotive, telecommunications, and aerospace. The rise of consumer electronics, such as smartphones, laptops, and wearable devices, has led to a growing need for high-quality wiring systems. These devices require intricate cabling solutions that can endure heat, abrasion, and bending while ensuring efficient data and power transmission. The superior properties of plastic-insulated wires make them ideal for meeting these stringent requirements.

The construction industry is a significant contributor to the US economy, generating approximately US$ 1.4 trillion in structures annually. According to the US Department of Commerce, residential construction spending reached US$ 934.0 billion in October 2024, up from US$ 920.3 billion in October 2023. The surge in both residential and commercial developments necessitates extensive wiring systems for electrical and communication networks. Plastics are widely utilized in cables due to their resistance to heat, moisture, and wear, ensuring reliability and safety in wiring systems. Major companies like Twitter, Google, Meta, and Microsoft are integrating 5G, artificial intelligence (AI), edge computing, and other emerging technologies that require advanced data center capabilities.

Table of Contents

Companies Mentioned

- Dow Inc

- Exxon Mobil Corp

- LyondellBasell Industries NV

- Solvay SA

- Borealis AG

- BASF SE

- Saudi Basic Industries Corp

- LG Chem Ltd

- Arkema SA

- Celanese Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | July 2025 |

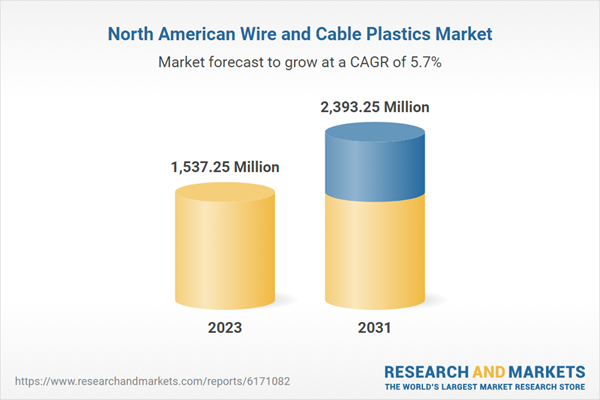

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 1537.25 Million |

| Forecasted Market Value by 2031 | 2393.25 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |