The industry is witnessing strong momentum, primarily driven by large-scale investments in power grid modernization and renewable energy integration. Governments are aggressively allocating funds to upgrade transmission infrastructure, India, for instance, allocated INR 3,03,758 crore under the Revamped Distribution Sector Scheme (RDSS) in February 2023 to strengthen grid reliability. Meanwhile, the European Union’s Fit-for-55 initiative, targeting a 55% emissions reduction by 2030, has accelerated demand for smart and efficient systems across distribution networks. These policy-led investments are creating robust switchgear market opportunities.

Another crucial factor is the rapid shift towards digital switchgear solutions. According to the International Energy Agency (IEA), global renewable capacity additions surged by 50% in 2023, reaching 666 GW in 2024, with solar and wind projects leading the transformation. Such renewable projects require highly reliable and flexible switchgear, making the deployment of vacuum and SF6-free solutions more critical. Furthermore, the United States Department of Energy’s Grid Resilience and Innovation Partnerships Program, which announced USD 3.46 billion in funding in October 2023, is reinforcing adoption of advanced solutions across transmission and distribution, boosting growth in the switchgear market. These trends show how policy frameworks and energy transition agendas are pushing demand beyond traditional equipment towards more intelligent, low-carbon alternatives.

Key Trends and Recent Developments

August 2025

Under its Lighting Solutions division, Bajaj Electricals announced the introduction of a new line of switchgear products. Distribution boards (DBs), Isolators, Changeover Switches, Miniature Circuit Breakers (MCB), and Residual Current Circuit Breakers (RCCB) are all part of the new switchgear line. This launch expands domestic and commercial LV distribution options, strengthening modular and compact solutions in the switchgear market.April 2025

In order to facilitate the installation of larger wind turbines with greater yields, ABB launched a comprehensive switchgear solution for wind turbines. By combining a 3200A AF Contactor and a 7200A Emax 2 air circuit breaker, the system provides the greatest power rating in the industry for a full switchgear solution, resulting in exceptional switching efficiency and dependability, supporting reliable and efficient power transmission in large-scale green energy projects.February 2025

With its new brand identity, Lauritz Knudsen Electrical and Automation (previously L&T Switchgear) made a strong debut at ELECRAMA 2025. The business launched a cutting-edge line of goods and services designed for retail, homes, infrastructure, industries, and agriculture. The debut of innovative products for retail, industrial, and agricultural applications drives diversified switchgear market penetration and infrastructure modernization across multiple sectors.April 2024

EasySet MV air-insulated indoor switchgear was introduced by Schneider Electric. The business asserts that "this cutting-edge and environmentally friendly switchgear offers unparalleled ease of operation, monitoring, and maintenance for meeting electrical distribution needs."Rising Demand for Eco-Efficient Switchgear

Environmental regulations are forcing utilities to gradually phase out SF6-based switchgear due to its high global warming potential. In August 2024, Hitachi Energy launched EconiQ switchgear that eliminates SF6 entirely, aligning with EU’s F-gas regulation. Utilities across Germany and France are already piloting these systems, showing early signs of mainstream adoption. Similarly, China’s “Dual Carbon” policy is incentivizing power companies to invest in low-emission equipment, opening up large-scale procurement opportunities for switchgear market expansion. As governments tighten emissions laws, eco-efficient solutions will emerge as a central investment priority for transmission operators and industrial buyers.Expansion of Data Centers and Digital Infrastructure

The digital economy boom is accelerating electricity demand across hyperscale data centers. As per the switchgear market analysis, in 2023, over USD 48 billion was invested in new data center projects globally, with switchgear being the pillar of uninterrupted power supply. The United States and Singapore governments are expanding incentives for data centers that adopt energy-efficient electrical systems, pushing demand for digital switchgear. Companies like ABB and Schneider Electric are already deploying medium-voltage GIS systems specifically tailored for server farms, reducing downtime risks.Grid Modernization and Urban Electrification

Aging grid infrastructure in the United States and Europe is pushing utilities to invest in modernization programs. The Biden administration announced USD 13 billion in grid resiliency upgrades in November 2022, heavily involving new switchgear installations. In rapidly urbanizing economies like India and Southeast Asia, metro rail projects and smart city developments are further fueling demand in the switchgear market. For instance, India’s National Smart Grid Mission has deployed over 4 million smart meters in its initial rollout as of April 2022, demanding large volumes of advanced switchgear. This convergence of modernization and urban electrification is reshaping demand across all regions.Growth in Offshore Wind and Renewable Projects

Offshore wind energy is becoming a critical area of investment, requiring high-capacity solutions for transmission at sea, while reshaping the switchgear market trends. According to the Global Wind Energy Council (GWEC), global offshore wind capacity is expected to reach 380 GW by 2032. This shift creates a multi-billion-dollar demand pipeline for HV switchgear. In March 2023, Siemens Energy introduced offshore-ready GIS units in the United Kingdom to support North Sea wind farms. Similarly, South Korea’s Green New Deal includes large-scale offshore wind integration, where advanced switchgear is essential for export cables and substations.Electrification of Transportation and EV Charging Networks

The global shift to electric vehicles is creating downstream demand in charging infrastructure. According to the switchgear market analysis, at the end of 2023, there were 3.9 million public charging points globally, more than 1.1 million of which were installed in the same year. Each charging hub requires compact LV switchgear for safe distribution, while highway-based fast-charging corridors need MV systems. Europe’s Alternative Fuels Infrastructure Regulation (AFIR) mandates the installation of charging stations every 60 km by 2026, significantly boosting demand. With automakers scaling EV production, investments in grid-connected charging infrastructure will continue to position switchgear as a critical enabler.Global Switchgear Industry Segmentation

The report titled “Global Switchgear Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

Market Breakup by Installation Type

- Outdoor

- Indoor

Market Breakup by Insulation Type

- Air

- Gas

- Oil

- Vacuum

Market Breakup by Application

- T&D Utility

- Commercial

- Industrial

- Residential

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Switchgear Market Share

By voltage type, low voltage switchgear registers the largest share of the market due to expanding urban infrastructure needsLow voltage switchgear dominates the market, fueled by surging urbanization and industrial automation. Residential complexes, commercial real estate, and small manufacturing units depend on LV switchgear for safety and efficiency. With growing construction activity in Asia-Pacific, especially India and Indonesia, demand for compact, modular LV solutions is strong, strengthening the switchgear demand forecast. Governments are also mandating stricter electrical safety standards, accelerating adoption across schools, hospitals, and transport hubs. For example, Singapore’s Green Building Masterplan emphasizes low-voltage distribution efficiency in construction projects.

High voltage switchgear is projected to witness the fastest growth over the forecast period, due to large-scale renewable and cross-border grid projects. Offshore wind farms, interconnection systems, and ultra-high voltage transmission corridors require HV switchgear for safe long-distance power transfer. China’s investments in ultra-high-voltage (UHV) transmission lines, already surpassing 40,000 km by 2023, is a prime example of this switchgear market trend. Similarly, the European Supergrid initiative is driving adoption of advanced HV GIS to connect solar and wind hubs across borders. As governments compete to scale renewable integration, demand for HV switchgear is set to accelerate at unprecedented levels.

By installation type, outdoor switchgear accounts for the largest share of the market due to utility grid expansion

Outdoor switchgear holds the largest share, primarily driven by utility projects, rural electrification, and renewable energy integration. Outdoor installations are integral for substations, solar parks, and wind farms, where durability and weather resistance are crucial. Governments in Africa and Asia are heavily investing in rural electrification, deploying robust outdoor switchgear to extend grid reach. For instance, Kenya’s Last Mile Connectivity Project has installed thousands of outdoor switchgear units to serve remote areas.

As per the switchgear market report, indoor installation is gaining rapid traction, fueled by industrial automation and digital infrastructure projects. Data centers, metro stations, airports, and large manufacturing plants increasingly prefer compact indoor GIS for space optimization and enhanced safety. The indoor category is also benefiting from stricter workplace safety standards across North America and Europe, where enclosed systems reduce the risks of arc flash and fire.

By insulation type, gas insulated switchgear holds the dominant position in the market due to compact design and reliability

Gas-insulated switchgear (GIS) dominates the market due to its compact footprint, safety, and reliability in high-density urban settings. Utilities and industries are increasingly adopting GIS because it provides higher operational efficiency, minimal maintenance, and the ability to withstand extreme environmental conditions. Its sealed design makes it suitable for metro rail projects, underground substations, and offshore platforms, where space constraints are critical.

Vacuum insulated switchgear (VIS) observes fast-paced growth in the switchgear market as industries and utilities become stricter about SF6 gas. VIS provides efficient arc quenching and longer operational life, making it particularly attractive for medium-voltage applications. With stricter environmental norms worldwide, VIS is gaining traction as an eco-friendly alternative. Industrial automation and the electrification of transportation hubs are also driving significant adoption. Its capability to deliver safe, reliable performance while complying with low-emission standards makes it highly relevant in smart grids and urban infrastructure.

By application, T&D utilities register the largest share of the market due to large-scale grid investments

Transmission and distribution utilities account for the largest market share, driven by large-scale modernization of aging grids and renewable energy integration. Switchgear has become indispensable for substations, interconnections, and rural electrification projects, ensuring stable and safe power delivery. Governments across North America, Europe, and Asia are investing heavily in upgrading infrastructure to improve resiliency against blackouts, transforming the switchgear market dynamics. This creates sustained demand for both high-voltage and medium-voltage switchgear across large-scale utility projects.

The industrial application is forecasted to grow rapidly in the coming years, as automation, digitalization, and electrification expand in manufacturing and heavy industries. From mining operations to petrochemicals and automotive plants, reliable switchgear is critical for uninterrupted processes. The rising demand for electric-driven equipment and robotics in manufacturing further boosts the requirement for robust low and medium-voltage switchgear. Additionally, industries in emerging economies are upgrading facilities to meet international safety standards, creating substantial opportunities for suppliers.

Global Switchgear Market Regional Analysis

Asia Pacific accounts for the largest share of the market due to infrastructure expansion and electrificationAsia Pacific holds the largest share, driven by rapid urbanization, mega infrastructure projects, and ongoing electrification programs. Countries like China and India are investing heavily in renewable power, smart cities, and rural connectivity, creating massive switchgear demand across all voltage levels. Strong government initiatives, coupled with industrial expansion and growing data center deployments, make Asia Pacific the global hub for this market. In addition, population growth and rising urban electricity consumption drive continuous upgrades in residential and commercial infrastructure.

The Middle East and Africa (MEA) switchgear market is projected to witness the fastest growth over the forecast period, fueled by investments in utility-scale renewable energy projects and electrification initiatives. Countries in the Gulf are aggressively developing solar and wind farms, requiring advanced switchgear for efficient integration. Meanwhile, Africa’s rural electrification programs are expanding grid networks, creating opportunities for both outdoor and compact switchgear installations.

Competitive Landscape

Leading switchgear market players are focusing on eco-efficient technologies, digital monitoring systems, and modular designs. Growing electrification, renewable integration, and digital infrastructure projects are expanding opportunities for innovation. Manufacturers are channeling R&D activities toward SF6-free solutions, vacuum-based designs, and smart grid-compatible systems to align with global sustainability goals. Strategic collaborations with governments and utilities are helping companies secure large-scale contracts, while emerging markets offer untapped potential.In addition, switchgear companies are enhancing predictive maintenance capabilities through AI-driven analytics and real-time monitoring, improving operational reliability. They are also exploring hybrid insulation technologies and customizable solutions for diverse industrial and utility applications. By integrating renewable-ready and energy-efficient designs, players are positioning themselves to meet stricter environmental regulations and growing demand from smart cities, data centers, and electrified transportation networks globally.

ABB Ltd.

ABB Ltd., established in 1988 and headquartered in Zurich, Switzerland, focuses on sustainable switchgear solutions with its EconiQ range that eliminates SF6 gas. The company is investing in digital substations, integrating IoT sensors for predictive maintenance. ABB’s compact and modular designs are being deployed in space-constrained metro projects and renewable energy installations.

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation, founded in 1921 and headquartered in Tokyo, Japan, is a pioneer in high-voltage and smart switchgear. The company’s vacuum circuit breaker systems are designed for sustainability, enabling carbon reduction across utility and industrial networks. Mitsubishi is advancing AI-powered condition monitoring, which enhances reliability in demanding applications like offshore wind and rail systems.Siemens AG

Siemens AG, established in 1847 and headquartered in Munich, Germany, is leading the charge in digital and SF6-free switchgear. Siemens introduced Clean Air-insulated switchgear, utilizing natural air instead of harmful gases. Its smart GIS is being deployed in urban substations and offshore platforms where space and safety are critical.Eaton Corporation plc

Eaton Corporation plc, established in 1911 and headquartered in the United States, specializes in modular, digital, and sustainable switchgear solutions. The company’s Xiria line is SF6-free, offering eco-friendly medium-voltage alternatives. Eaton is innovating with compact GIS systems that fit the growing demand for urban electrification and renewable integration.Other key players in the market are Toshiba Energy Systems & Solutions Corporation, and Hitachi, Ltd., among others.

Key Highlights of the Global Switchgear Market Report:

- Examination of next-generation technologies such as SF6-free vacuum switchgear, AI-enabled predictive monitoring, and compact GIS for urban infrastructure.

- Competitive benchmarking of global and regional players emphasizing sustainable design, modularity, and smart-grid integration capabilities.

- Detailed regional mapping highlighting renewable energy hotspots, electrification corridors, and rapidly urbanizing industrial hubs driving market growth.

- Investment insights with scenario-based projections, showcasing opportunities in EV charging infrastructure, offshore wind integration, and digital utility modernization projects.

- Deep expertise from energy, utilities, and industrial automation analysts with a focus on emerging technologies.

- Actionable intelligence tailored to strategic business expansion, product development, and sustainability initiatives.

- Proven methodology combining field expert interviews, patent analyses, and verified secondary research to ensure accuracy.

- Advanced data analytics and scenario modeling for evaluating risks, innovation adoption, and long-term ROI in evolving switchgear markets.

- Strategic insights designed to guide B2B decision-makers in digitalization, renewable integration, and eco-efficient infrastructure investments.

Table of Contents

Companies Mentioned

The key companies featured in this Switchgear market report include:- ABB Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Eaton Corporation plc

- Toshiba Energy Systems & Solutions Corporation

- Hitachi, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 161 |

| Published | August 2025 |

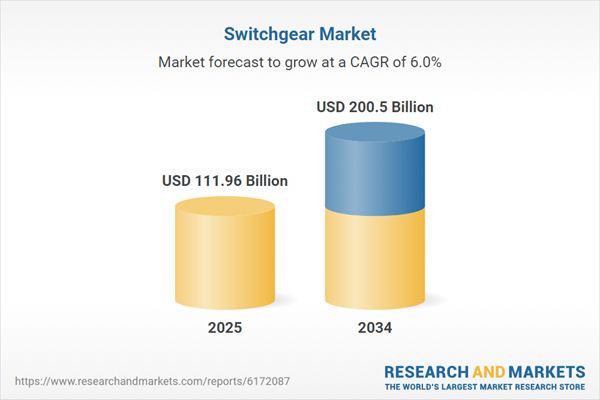

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 111.96 Billion |

| Forecasted Market Value ( USD | $ 200.5 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |