The global machine tools market is driven by automated and high-precision equipment. The Asia-Pacific region is the leading regional market in the industry globally. A major trend driving the industry includes the growing automation of tasks varying from material handling to tool changing. The emphasis has also shifted toward the creation of interconnected systems and user-friendly software that facilitate users to include additional characteristics and specifications in the final product.

Key Trends and Recent Developments

Growing demand for high-precision machine tools; advancements in CNC software; rising trend of automation; and increasing emphasis on sustainability are favouring the machine tools market expansion.January 2025

Siemens announced the launch of MACHINUM, its digitisation portfolio designed to enhance the agility, speed, and endurance of machine tools in the Indian market. The portfolio boasts the potential to lower setup time up to 20% and energy consumption and cycle times up to 18%.September 2024

Brother Industries, Ltd. announced that its subsidiary, BROTHER MACHINERY INDIA PRIVATE LTD., completed the construction of a new machine tool factory near Bengaluru in southern India. Through this, the company aims to strengthen its manufacturing capabilities in the machine tools segment.February 2024

Nidec Machine Tool Corporation announced the launch of a universal head (UH), an attachment of the company’s MVR series of double column type milling machine with five-face machining capability. The universal head boasts a reduced size, enables a better accessibility between the tool-and the workpiece, and maintains the spindle capability with high output and speed.June 2023

Hyundai WIA announced its plans to launch over 20 machine tools, along with machining centres and turning centres, to expand its multi-tasking machine and large size machine tool lineup. Through this, the company aims to target next-generation and future-oriented part machining machines.Increasing demand for high-precision machine tools

Evolving manufacturing technologies and the rising demand for precise and complex components across different sectors, ranging from automotive to consumer goods, are driving the demand for high-precision machine tools. Such tools boast enhanced accuracy, reduce operational costs and material waste, facilitate shorter production times, and optimise workflow.Advancements in CNC software

Advancements in CNC software aimed at enabling better tolerance and higher precision in machining processes, minimising deviations in part dimensions, and minimising the risk of human errors are fuelling the market. Moreover, advanced CNC software incorporates tool management systems to enable manufacturers to monitor wear, track tool usage, and predict the maintenance needs of tools.Growing trend of automation

Amid the growing demand for mass production of components with complex geometries and fine lines, manufacturers are integrating technologies such as the Internet of things (IoT) and artificial intelligence (AI) in machine tools to automate repetitive tasks and enable faster production times. Automation of machine tools also ensures consistent product quality, lowers labour costs, and facilitates predictive maintenance.Increasing focus on sustainability

The growing focus on sustainability is shaping the machine tools market trends and dynamics. Energy-efficient machine tools that minimise material waste during production processes are gaining significant popularity. Besides, manufacturers are increasingly utilising eco-friendly materials, including bio-based lubricants and recyclable components, in machine tools to reduce their carbon footprints.Market Segmentation

Machine tools are the stationary, power-driven equipment used for cutting or forming metals or any other hard materials. They usually shape the workpiece by eliminating the extra material and help in performing operations like drilling, abrading, grinding, and nibbling. The advanced and modern machine tools are numerically, or computer-controlled, which improves the product uniformity and decreases the human interaction required in the process. At present, an extensive range of the product are present in the market, extending from small workbench mounted instruments to large devices.Market Breakup by Tool Type

- Metal Cutting

- Metal Forming

- Accessories

Market Breakup by Technology Type

- Conventional

- CNC

Market Breakup by End Use

- Automotive

- Aerospace and Defence

- Electrical and Electronics

- Consumer Goods

- Precision Engineering

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The global machine tools market is driven by the extensive applications of the product within industries such as automotive, electronics, aerospace, and precision engineering. This can be ascribed to the fact that machine tools are used in the manufacturing of durable goods and other machines. The market is further aided by the rapid development in these industries. Further, the initiation of advanced processes such as ultrasonics, high-pressure water jets, lasers, and plasma streams in machine tool applications has helped in increasing the speed and precision of the machining process. In addition to this, consumers are shifting toward automated higher-end technologies with improved performance, accuracy, and stability. These factors are expected to influence the market growth positively.Competitive Landscape

Key machine tools market players are leveraging Industry 4.0 technologies to enhance the connectivity and automation of machine tools. Machine tools companies are also continuously innovating to develop advanced machine tools that can easily adapt to multiple environments.Allied Machine & Engineering Corp.

Allied Machine & Engineering Corp., headquartered in Ohio, United States, and established in 1941, is a prominent manufacturer of finishing and holemaking cutting tool systems. The company leverages advanced manufacturing and engineering technologies to develop innovative value-added tooling solutions for use in metal-cutting industries.

TRUMPF

TRUMPF, founded in 1923 and headquartered in Ditzingen, Germany, is a company that offers production solutions in the laser, machine tools, as well as electronics sectors. Its machine tools are used in industrial lasers and flexible sheet metal processing. Boasting 19,018 employees, the company generated a revenue of EUR 5.17 billion in FY 2023/24.Falcon Machine Tools Co., Ltd.

Falcon Machine Tools Co., Ltd., established in 1978 and headquartered in Kaohsiung City, Taiwan, is an innovative CNC machine manufacturer. Its product portfolio includes Production CNC Grinder, Linear Motor Drive Grinder, Double Column Grinding Machine, Surface and Profile CNC Grinder, and Fully Auto Surface Grinder, among others. The company is publicly traded on the Taiwan Stock Exchange.

Okuma America Corporation

Okuma America Corporation, founded in 1898 and headquartered in North Carolina, United States, is a sales and service affiliate of Okuma Corporation, a prominent manufacturer of CNC machine tools as well as automation and control systems. The company designs its CNC controls that can seamlessly integrate with each machine tool's functionality.Other key players in the machine tools market include General Technology Group Dalian Machine Tool Corporation, DMG MORI, AMADA Co., Ltd., Mazak Corporation, and Doosan Machine Tools, Co. Ltd., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Machine Tools market report include:- Allied Machine & Engineering Corp.

- General Technology Group Dalian Machine Tool Corporation

- DMG MORI

- Falcon Machine Tools Co., Ltd.

- AMADA Co., Ltd.

- Mazak Corporation

- TRUMPF

- Doosan Machine Tools, Co. Ltd.

- Okuma America Corporation

Table Information

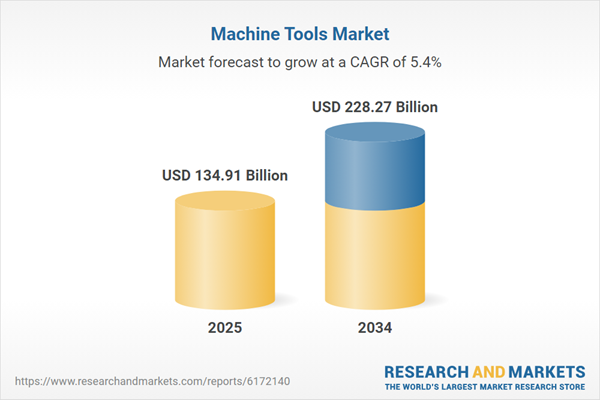

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 134.91 Billion |

| Forecasted Market Value ( USD | $ 228.27 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |