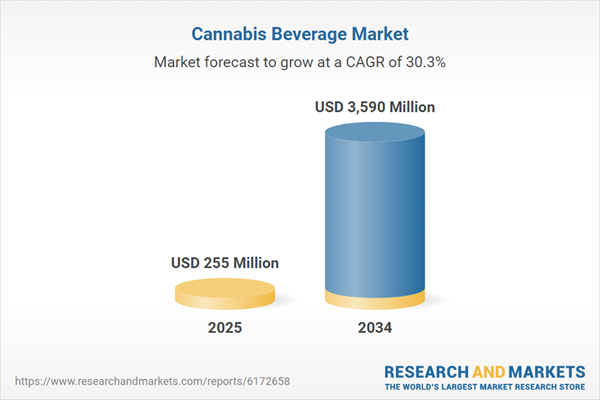

Global Cannabis Beverage Market Growth

Increasing demand for wellness drinks is anticipated to drive the expansion of the industry. The low sugar content of the product as well as the presence of an appropriate quantity of cannabis for consumption are among the drivers projected to fuel the cannabis beverage market demand. The legalization of marijuana consumption for medical and recreational purposes in many countries is predicted to drive the assembly as well as demand for cannabis-infused beverages.Global Cannabis Beverage Market Analysis

The rising use of cannabis for the treatment of varied diseases like neurological disorders, cancer, and pain control is predicted to drive the demand for cannabis drinks. Growing consumer interest in cannabis edibles is additionally expected to boost the growth of the cannabis beverage market.Cannabis consumers are shifting their interest from smoking cannabis to other ways, like beverages, tinctures, chocolates, and other edibles further boosting the cannabis beverage industry revenue.

Global Cannabis Beverage Industry Outlook

The cannabis beverage market dynamics and trends are being positively influenced by the cultivation of cannabis. The legalisation of cannabis for medical and recreational purposes across various states and provinces has established a regulated market with clear guidelines. Additionally, the United Nations Office on Drugs and Crime reported in 2020 that North America had the highest annual cannabis usage rate, around 16%. In Oceania, Australia and New Zealand showed a prevalence rate of nearly 12%. Western and Central Europe reported a rate of about 8%, while Eastern and Southeastern Europe had rates of around 4%. In Africa, North Africa and West and Central Africa had prevalence rates of 9% and 6% respectively. Central America and the Caribbean had rates of about 2% and 3%. In Asia, subregions including Central Asia, Transcaucasia, and East and Southeast Asia reported rates below 3%.According to Industry reports, by State, Oregon's legal cannabis market, covering both adult use and medical, reached around USD 1.25 billion in 2021. By 2022, this figure rose to approximately USD 1.4 billion. The illicit cannabis market was about USD 300 million in 2021. The legal market's expansion from 2021 to 2022 saw an increase of roughly USD 150 million.

According to industry reports, e-commerce in Egypt grew from 3% in 2021 to 4% in 2022. Kenya saw a significant increase, with e-commerce accounting for 2% of total retail sales in 2021, which doubled to 4% in 2022. South Africa experienced a rise in e-commerce share, from 3% in 2021 to 4% in 2022. Nigeria has consistently demonstrated a robust e-commerce presence, accounting for 7% of total retail sales in both 2021 and 2022. This trend further supports the growth of the cannabis beverage market, as e-commerce platforms enable cannabis beverage companies to expand their reach beyond local or regional markets to a national or even international customer base.

Increased acceptance and demand for cannabis products drive market expansion.

- Evolving regulations and legalization support cannabis beverage industry growth and innovation.

- A wide range of flavours and formulations attract various consumer segments.

- Production and compliance costs can be high, affecting profit margins.

- Consumer education about cannabis beverages is still developing.

- Opportunities for new flavours, formulations, and health-oriented products.

- Collaborations with established beverage companies can enhance market reach.

- Sudden shifts in legislation could impact market dynamics.

- Potential issues with product safety and health effects may affect consumer trust.

Key Players in the Global Cannabis Beverage Market and Their Key Initiatives

Anheuser Busch Inbev NU

- Tilray acquired eight beer and beverage brands.

- Announced a USD 100 million joint venture with Tilray for cannabis-infused drinks.

Canopy Growth Corporation

- Launched "Just Hits Different" campaign with new flavour-forward cannabis beverages.

- Established a USD 250 million at-the-market equity program to meet the growing demand of the cannabis beverage market.

Dixie Elixirs LLC

- Expanded into new states with a focus on building a market presence.

- Launched the Synergy Live Resin Gummies series to capture the cannabis beverage market opportunities.

Phivida Holdings Inc

- Launched nano-encapsulated CBD beverages.

- Entered a joint venture with WeedMD for cannabis-infused beverage production.

Global Cannabis Beverage Industry Segmentation

“Global Cannabis Beverage Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Breakup by Type

- Alcoholic

- Non-Alcoholic

Breakup by Component

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

Breakup by Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Store

- Mass Merchandisers

- Specialty Stores

- Online

- Others

Breakup by End Use

- Household

- HoReCa

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Cannabis Beverage Market Share

Consumers are willing to consume concentrated and cannabis-infused products, which successively, is anticipated to support the growth of the cannabis beverage industry. Cannabis beverages are predicted to exchange other marijuana-infused consumables, like chocolates, cookies, and brownies, and confectionaries like gummies and candies which are not healthy. This factor is predicted to spice up the demand for cannabis drinks over the forecasted period.Consumers are shifting their choices from soft drinks to wellness drinks resulting in the increasing sale of cannabis beverages off-trade sales channels like hotels, cafes, restaurants, clubs, and lounges are expected to boost the recognition of the product among consumers.

Cannabis beverages offer notable advantages for both household and HoReCa (Hotel, Restaurant, and Café) applications. For home use, they deliver convenience, discreet consumption, precise dosage control, and a range of flavours, serving as a healthier alternative to smoking.

In the HoReCa sector, these beverages enhance the customer experience with unique options, help businesses distinguish themselves from competitors, and generate additional revenue. They also align with wellness trends and comply with established regulations in legal regions, ensuring safe service. Overall, cannabis beverages meet various consumer needs and preferences, driving further demand of the cannabis beverage market.

Leading Companies in the Cannabis Beverage Market

The companies are concentrating on creating cannabis-infused non-alcoholic beverages by forming partnerships and joint ventures, including various collaborative efforts.- Anheuser Busch Inbev NV

- Canopy Growth Corporation

- Dixie Elixirs LLC

- Phivida Holdings Inc

- Tilray, Inc

- Others

Table of Contents

Companies Mentioned

The key companies featured in this Cannabis Beverage market report include:- Anheuser Busch Inbev NV

- Canopy Growth Corporation

- Dixie Elixirs LLC

- Phivida Holdings Inc

- Tilray, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 255 Million |

| Forecasted Market Value ( USD | $ 3590 Million |

| Compound Annual Growth Rate | 30.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |