Personal finance software is a tool crafted to arrange and evaluate an individual's financial data, thereby assisting in enhanced financial planning. It amalgamates diverse financial information to offer insights into expenditure patterns, budgeting, monitoring investments, and managing portfolios.

Additionally, it aids in tasks like overseeing bank records and monitoring financial transactions. Variations among different software options may encompass differences in features, transparency in coding, mobile application functionalities, methods for importing data, models for monetisation, and privacy protocols.

As per the United States personal finance market analysis, users can effortlessly connect bank accounts and cards to auto-import transactions, sparing manual entry. Analysing spending, identifying savings, tracking goals, bill reminders, and investment monitoring aid in informed financial decisions, enhancing planning and net worth evaluation. In 2022, the Federal Deposit Insurance Corporation reported a total of 69,905 bank branches in the United States, contributing to the expansion of the personal finance software market in the United States.

TOTAL BANK BRANCHES IN THE UNITED STATES

Key Trends and Developments

The United States personal finance software market growth is driven by ease of management of income, budget-oriented lifestyle, and integration of IoT.United States Personal Finance Software Market Trends

As per the United States personal finance software market report, this software enables users to monitor expenditures, establish budgets, and anticipate future costs. Variation exists among software concerning feature support, code transparency, mobile app capabilities, data import methods, monetisation models, and privacy measures.Leading personal finance software streamlines income and expense management, facilitating improved financial balance. It simplifies personal financial management by minimising reliance on traditional methods like receipts and spreadsheets.

Market Segmentation

The United States Personal Finance Software Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Breakup by Product Type

- Web Based

- Mobile Based

Breakup by End Use

- Commercial

- Individual Consumers

Breakup by Region

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Far West

Mobile apps incorporating personal finance software ensure streamlined performance, offering advantages over web-based counterparts such as immediate online/offline accessibility, push notifications, productivity boosts, and cost-effectiveness, driving market expansion in this sector.

The increasing popularity of web-based software is attributed to its robust security features, integrating anti-virus and anti-malware solutions. Additionally, these programs allow users to input financial details like bank accounts, credit cards, loans, and debts, facilitating real-time transaction tracking. This is further driving the United States personal finance software market.

The ability of these software to amalgamate and segregate financial data for enhanced planning among the small business users is pushing the United States personal software market growth

It aids in recognising spending trends, facilitating debt management, and monitoring financial goals to empower business users in making informed decisions. It streamlines money management, aiding small business operators in overseeing operations and finances. Furthermore, it generates reports and invoices based on data.

Individual consumers utilise personal finance software to monitor income, expenses, credit cards, investments, and bank accounts via smartphones or computers. It efficiently manages financial transactions, helping individuals track monthly expenses.

United States Personal Finance Software Market Analysis by Region

The growing demand for finance and saving in the Southwest due to future goals is pushing the United States personal finance software market development."Attaining financial security" stands out as a key motivation for saving, particularly among consumers with ample emergency funds, especially prevalent in the Far West region.

The Consumer Financial Protection Bureau reported that 35% of people who don't have emergency savings see financial security as vital for saving, while 69% of those with at least one month's worth of emergency funds prioritize financial security.

SHARE OF RESPONDENTS WHO REPORTED EMERGENCIES, PAYING OFF DEBT, FINANCIAL SECURITY, AND RETIREMENT AS REASONS FOR SAVING

Competitive Landscape

Market players are integrating IoT and keeping up with rapid digitisation to stay ahead in the market.Other United States personal finance software market key players are Igg Software, Inc., Moneyspire Inc., PocketSmith Ltd, Doxo, Inc., You Need A Budget LLC among others.

Table of Contents

Companies Mentioned

The key companies featured in this United States Personal Finance Software market report include:- Microsoft Corporation

- Quicken

- Buxfer, Inc.

- CountAbout

- Igg Software, Inc

- Moneyspire Inc.

- PocketSmith Ltd

- Doxo, Inc.

- You Need A Budget LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | August 2025 |

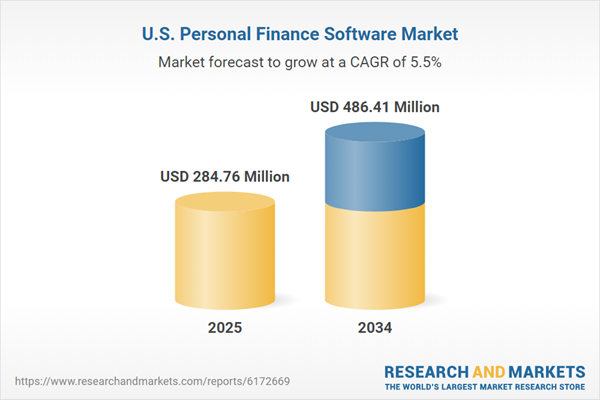

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 284.76 Million |

| Forecasted Market Value ( USD | $ 486.41 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |