Spray Adhesives Market Analysis

Spray adhesives are glues applied onto a surface from a pressurised container as a mist. These adhesives have a small droplet size that makes them easy to use and quick to dry.The growth in the global market for spray adhesives can be associated with the uninterrupted demand for spray adhesives from various application industries, such as packaging, construction, and automotive, for different applications. Spray adhesives are being rapidly replaced by tape glue, hot glue, and liquid glue, among others, for their favourable properties like resistivity to moisture and heat, quick and robust bond, and ability to dry quickly. Furthermore, spray adhesives from the food and beverage sector for healthy packaging of food items is another factor aiding the growth of the spray adhesives market.

Spray Adhesives Market Growth

The furniture sector is undergoing significant transformation, especially in emerging markets like India and China. As disposable incomes rise, the demand for furniture, particularly for premium and designer items, is increasing. Spray adhesives play a crucial role in furniture production for bonding materials like laminates, upholstery, and cushions.In addition to this, spray adhesives are widely used as a choice of material in the construction sector to glue drywalls, plasters, fibreglass, and ceilings, hence pushing the growth of the market. Apart from this, green advancements in volatile organic compounds (VOC) that are safe for the environment and human use is another factor expected to impact the market positively.

The rise in DIY (Do-It-Yourself) culture, especially in developed markets, is another growth factor. Spray adhesives are popular in-home improvement projects, crafts, and hobbies due to their convenience and ability to bond a variety of materials such as wood, fabric, metal, and plastics.

Key Trends and Developments

Advancements in automobiles, demand for eco-friendly products, and usage in furniture are crucial trends aiding the market growth.September 2024

DuPont Performance Building Solutions announced the launch of Great Stuff™ Wide Spray Foam Sealant, which is suitable for air sealing seams, joints and large gaps, among others.June 2024

Huntsman Building Solutions (HBS), a provider of high-performance building envelope solutions, announced the addition of Icynene Xpress 55 to its Icynene Series, which is designed for use in unventilated attics and crawl spaces.March 2024

Gorilla announced the launch of Gorilla Heavy Duty Spray Adhesive which is known for its toughness for heavy-duty DIY projects as well as small projects and crafts.September 2023

H.B. Fuller Company announced that it has acquired the business of UK-based Sanglier Limited which offers sprayable industrial adhesives. Along with technologies acquired through the acquisitions of Apollo and Fourny and spray capabilities developed in the United States, the acquisition broadens H.B. Fuller's product portfolio and innovation capabilities throughout the UK and Europe, especially in the Construction Adhesives and Engineering Adhesives businesses.Technological Advancements in Automobiles

Advancements in automobile designs have further augmented the demand for spray adhesives as opposed to screws in the interiors. This can be attributed to the fact that adhesives are concealed and add to the aesthetics of the vehicle. Further, the inflating disposable incomes and the corresponding high demand for vehicles are major factors contributing to the growth of the spray adhesives industry. Automotive manufacturers are increasingly relying on materials like composites and lightweight alloys to improve fuel efficiency and reduce emissions. Spray adhesives play a vital role in bonding these materials, providing strong and flexible connections. In particular, polyurethane adhesives have gained popularity due to their durability and compatibility with various substrates, making them well-suited for complex vehicle designs and structures. The rapid growth of EVs is fuelling the need for specialised adhesives that meet the special demands of these vehicles such as thermal management, electrical insulation, and lightweight construction. Companies such as Sika have developed products specifically for electric vehicles, offering resistance to extreme temperatures and chemicals, which are crucial for maintaining vehicle safety and performance.Rising Demand for Eco-Friendly and Low-VOC Products

As environmental regulations become more stringent, there is an increasing demand for eco-friendly adhesives with low levels of volatile organic compounds (VOCs). Numerous manufacturers of spray adhesives are moving away from solvent-based products in favour of water-based and hot-melt adhesives, which release fewer harmful substances. Hot-melt adhesives, in particular, are becoming more popular due to their solvent-free composition, resulting in very low VOC emissions, which contributes to the spray adhesives market value. This transition is greatly influenced by stringent regulatory measures in North America and Europe, where there is a strong emphasis on minimising environmental impact. For instance, in the USA, the Environmental Protection Agency (EPA) implements the National Volatile Organic Compound Emission Standards for consumer and commercial products, which puts strict restrictions on VOCs for adhesives and sealants. States such as California, have adopted more rigorous regulations through the California Air Resources Board (CARB). CARB has established strict VOC limits for consumer products, including adhesives, as part of the Consumer Products Regulation, requiring that specific adhesives contain no more than 30% VOCs.Usage in Furniture

The furniture sector is significantly contributing to the expansion of the spray adhesives market. With the increasing demand for furniture and cabinetry, especially in emerging markets, there is a rise in the demand for effective and long-lasting adhesives. These adhesives are widely utilised for the adhesion of wood, foam, and fabric components in the manufacturing of furniture and can positively impact the spray adhesives demand forecast. Furthermore, the growth of the woodworking sector in developing areas such as Southeast Asia and Latin America is enhancing the demand for spray adhesives within this sector. In Southeast Asia, the demand for furniture is significantly driven by rapid urbanisation and a rise in infrastructural development. Countries such as Vietnam, Thailand, and Indonesia are experiencing a boost in furniture manufacturing, particularly in high-end wooden furniture, as disposable incomes continue to grow. Indonesia has the highest number of infrastructure projects followed by Thailand and the Philippines. The Asian Development Bank (ADB) further forecasted that between 2016 to 2030, infrastructure in Southeast Asia was expected to grow from USD 2.8 trillion to USD 3.1 trillion, which can benefit the woodworking sector.Demand of Spray Adhesives in Packaging

The packaging sector is increasingly adopting spray adhesives, particularly for applications which have the demand for robust and durable bonds. The rise of the e-commerce sector and growing consumer preference for sustainable packaging have fuelled the use of spray adhesives for activities like box sealing, labelling, and tape production, among others, aiding the demand of spray adhesives market. This trend is especially prominent in the Asia-Pacific region, where rapid industrial growth and expanding consumer markets are driving demand. The industrial sector also depends on the physical properties of spray adhesives and their versatility with different materials. The rise of the e-commerce sector has further fuelled the demand for packaging solutions that can withstand long transit while enhancing brand visibility during the unboxing process. The Asia-Pacific region, particularly in countries such as China, India, and Indonesia, is witnessing significant growth in the use of packaging adhesives, including spray adhesives. For instance, Indonesia had the highest e-commerce business revenue in 2022, among other ASEAN countries with USD 51.9 billion.Spray Adhesives Market Trends

The market is experiencing significant advancements in product formulations. Adhesive manufacturers are focusing on improving the performance, bonding strength, and ease of application of their products. Innovations such as faster curing times, better adhesion to various substrates (like metal, wood, plastic), and increased durability are becoming key trends in spray adhesives market.The increasing reliance on e-commerce has led to a surge in demand for packaging materials that are durable, secure, and cost-effective. Spray adhesives are increasingly used in the packaging industry for corrugated board and paper packaging, where strong and flexible bonds are crucial for maintaining product integrity during shipping.

Spray Adhesives Market Restraints

The market faces challenges due to the volatility in the prices of raw materials, including polyurethane, epoxy, and synthetic rubbers, which are critical for the production of spray adhesives. This price instability is affected by global supply chain disruptions and variations in oil prices, as many of these raw materials are derived from petroleum, which can ultimately affect spray adhesives demand. For instance, on November 30, 2023, several OPEC+ countries announced a continuation and expansion of their voluntary cuts, which affected the oil price volatility.Additionally, spray adhesives, particularly those that are solvent-based, release volatile organic compounds (VOCs) that contribute to air pollution and may adversely affect health. Numerous countries in North America and Europe have implemented strict regulations to limit VOC emissions. For example, both the United States and the European Union have established more rigorous standards regarding allowable VOC levels in adhesives, prompting a transition towards low-VOC or VOC-free options, such as water-based and hot-melt adhesives.

Spray Adhesives Industry Segmentation

“Spray Adhesives Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Water Based

- Solvent Based

- Hot Melts

- Others

Market Breakup by Application

- Construction

- Packaging

- Furniture

- Automotive and Transportation

- Textile and Leather

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Spray Adhesives Market Share

Market Analysis by Product

Water-based adhesives occupy a significant market share due to their low emissions of volatile organic compounds (VOCs) and the environmental benefits they offer. They are especially favoured in regions with strict environmental regulations such as North America and Europe because they emit fewer pollutants than solvent-based alternatives and can contribute to the spray adhesives market revenue. Furthermore, these adhesives are widely used in several applications, including general product assembly, where rapid application and high-speed performance are essential.Besides, hot melts enhance the performance and efficiency of spray adhesives by providing fast bonding, strong adhesion, durability, and ease of application. Their environmental benefits and versatility make them a preferred choice in the adhesive industry, especially in sectors like packaging, automotive, and textiles.

Market Analysis by Application

The global market for spray adhesives is being driven by the robust demand for the product in the transportation sector, where it is used in commercial vehicles like aircraft and trains, among others. As per the spray adhesives market dynamics and trends, owing to their strong shear strengths, fast drying rates, and high adhesive versatility, spray adhesives are widely used for bonding foam, fabric, fibreglass, and leather, among other upholstery materials, in the interiors of vehicles. This is a key factor augmenting the demand for the product in the automotive and transportation sectors, thereby boosting market growth.Spray adhesives are used extensively in construction for bonding a wide range of materials, including insulation, drywall, flooring, carpeting, wood, and plastics. Their versatility helps streamline the construction process, reducing the need for mechanical fasteners and providing a cleaner, more efficient alternative. As per the spray adhesives market report, construction projects often require noise reduction, especially in multi-family housing or commercial buildings. Spray adhesives are used to bond soundproofing materials, such as acoustic panels, to walls, ceilings, and floors, helping to improve the acoustics in buildings.

Spray Adhesives Market Regional Insights

North America Spray Adhesives Market Drivers

There is a rising demand for eco-friendly spray adhesives in the region owing to the stringent environmental regulations. In Canada, the VOC regulations closely align with the standards established by the California Air Resources Board (CARB). The Volatile Organic Compound Concentration Limits for Certain Products Regulations, created under the Canadian Environmental Protection Act (CEPA), outline the maximum allowable VOC levels for various product categories, including adhesives, which can affect the spray adhesives industry revenue.Manufacturers and importers were expected to adhere to these VOC concentration limits, which were expected to take effect on January 1, 2024. The primary objective of this regulation was to reduce the environmental and health effects associated with VOC emissions by promoting the use of more sustainable products.

Asia Pacific Spray Adhesives Market Outlook

The Asia Pacific region occupies a significant market share, primarily due to the growing construction and automotive sectors, especially in China and India. The continuous industrialisation and urbanisation in these countries are fuelling the demand for spray adhesives in construction, particularly for applications like insulation and roofing bonding, which increase spray adhesives market opportunities.Additionally, government initiatives such as India's "Make in India" have fuelled local manufacturing capabilities, particularly in the automotive sector, where spray adhesives are essential for interior applications. For instance, the Indian government aims to make automobile manufacturing the main driver of this initiative by aiming to triple the passenger vehicles sector and reach 9.4 million units by 2026.

Europe Spray Adhesives Market Dynamics

The market growth in the region is driven by the burgeoning popularity of low-VOC spray adhesives. For instance, in the EU, the VOC Directive sets maximum permissible levels of VOCs for a range of products, such as paints, adhesives, and sealants. As per the spray adhesives industry analysis, these limits are tailored to the specific type of product and its intended application. For example, general-purpose adhesives have a VOC limit of 200 g/L, while some specialised uses may be subject to stricter regulations. These rules are part of broader efforts to reduce air pollution, particularly the creation of ground-level ozone, which poses significant threats to health and the environment.Latin America Spray Adhesives Market Growth

The growth of spray adhesives market share is primarily fuelled by the expansion of the construction and furniture sectors. Countries such as Brazil and Mexico are making significant investments in infrastructure and residential development, thereby fuelling the demand for adhesives in various applications, including drywall installation and insulation.Additionally, the region's rapidly developing furniture sector, rising middle class and increased consumer interest in cost-effective furniture options, have fuelled the demand for spray adhesives in areas such as cabinetry, upholstery, and decorative veneers. For instance, the middle-class population in the region has reached around 60-70 per cent of the region’s population.

Middle East and Africa Spray Adhesives Market Trends

This region is witnessing an increase in the use of spray adhesives, driven by continuous infrastructure projects and development efforts, especially in countries such as Saudi Arabia and the United Arab Emirates. These areas are readily focused on the modernisation of their infrastructure, with increased construction initiatives fuelling the spray adhesives demand growth. Furthermore, the growth of the manufacturing sector in countries such as South Africa is enhancing the demand for robust adhesives across a range of applications, including automotive assembly and packaging for consumer goods.Competitive Landscape

The report presents a detailed analysis of the following key players in the global spray adhesives market, looking into their capacity, market share, and latest developments like capacity expansions, plant turnabouts and mergers and acquisitions. Several companies are developing spray adhesives that contain low levels of volatile organic compounds (VOCs) in order to comply with strict environmental regulations and to address the increasing consumer preference for sustainable products. These adhesives minimise harmful emissions, thereby enhancing their environmental sustainability.The 3M Company

3M is a technology company involved in various sectors, including industrial, healthcare, safety, and consumer products. Founded in 1902, it is well-known for its innovative strategies and the development of products such as adhesives, abrasives, laminates, passive fire protection systems, personal protective equipment, and medical supplies, among others.H.B. Fuller Company

H.B. Fuller, established in 1887 and based in St. Paul, Minnesota, is a global manufacturer of adhesives. The company specialises in adhesive solutions for sectors like packaging, construction, and electronics, offering a wide range of products that include industrial adhesives, sealants, coatings, and speciality chemicals for various manufacturing processes.Henkel AG

Henkel, headquartered in Düsseldorf, Germany, operates in three primary business areas: Adhesive Technologies, Beauty Care, and Laundry & Home Care. Founded in 1876, Henkel is recognised for its well-known brands, including Loctite, Schwarzkopf, and Persil.Other major players in the spray adhesives market are BASF SE and Bostik S.A., among others.

Innovative Startups in Spray Adhesives Market

Startups are leveraging e-commerce platforms to reach a global customer base, often improving customer experiences on their websites by providing product bundles or subscription services for frequently used adhesive products. Several innovative startups also focus on user convenience by developing portable, easy-to-use spray adhesive kits that offer customisation options designed for DIY projects and the needs of small businesses.Biosynthetic Technologies

Biosynthetic Technologies in the spray adhesives market specialises in the development of sustainable, bio-based adhesive solutions, including spray adhesives. The company relies on renewable resources to create eco-friendly products that reduce dependence on petroleum-based materials. Their adhesives are primarily targeted at eco-conscious sectors such as packaging and construction, where sustainability is becoming increasingly important.Glue Dots International (A subsidiary of Ellsworth Adhesives)

Glue Dots focuses on developing pressure-sensitive adhesive solutions, including spray adhesives designed for various end-use sectors. The company is establishing its place in the niche market by providing specialised adhesive solutions for crafts, packaging, and product assembly. While their products may not fit the traditional definition of spray adhesives, their innovative delivery systems offer an alternative that caters to applications requiring precision and a clean application.Table of Contents

Companies Mentioned

The key companies featured in this Spray Adhesives market report include:- The 3M Company

- H.B. Fuller Company

- Henkel AG

- BASF SE

- Bostik S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 161 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

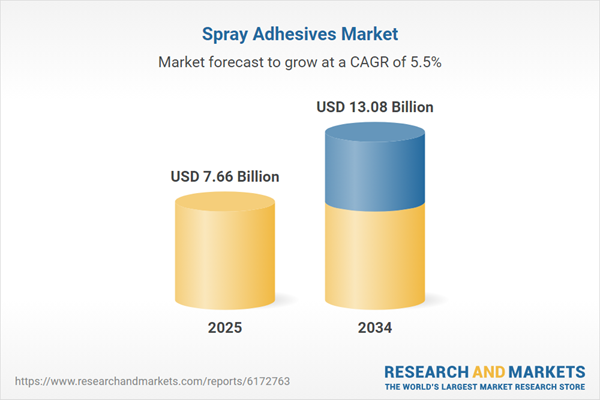

| Estimated Market Value ( USD | $ 7.66 Billion |

| Forecasted Market Value ( USD | $ 13.08 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |