A growing interest in colour cosmetics as a hobby and art form is anticipated to contribute to the expansion of the colour cosmetics market share in the coming years. With the increasing penetration of social media, women and men are experimenting with vivid colour cosmetics to try out new looks and styles, augmenting the demand for the market for colour cosmetics. Globalisation is further bolstering the market for colour cosmetics as key players expand their product offerings worldwide and adapt colour cosmetics to suit local preferences. Development of new colour cosmetics with novelty textures, shades, and features are a key trend influencing the market. Rising disposable incomes are also augmenting the demand for premium colour cosmetics, which is expected to continue to increase in the coming years.

Growing Demand for Versatile and Innovative Products is Augmenting the Market for Colour Cosmetics

The market for colour cosmetics is being aided by evolving beauty trends, which are surging the demand for versatile cosmetics. As young consumers are increasingly experimenting with their make-up looks, the demand for diverse colour cosmetics is escalating, thus fuelling the market growth. In addition, the increasing demand for selfie-friendly make-up is surging the use of vibrant eye and lip make-up, which is propelling the market for colour cosmetics. The emerging trend of no-make-up make-up is increasing the preference for colour cosmetics that intensify natural beauty, which is significantly contributing to the growth of the market.Increasing Preference for Clean-Labelled Colour Cosmetics Propelling the Colour Cosmetics Market Growth

The growing trend of clean beauty is increasing the demand for colour cosmetics made of skin-friendly and ethical ingredients. This is leading to a surge in the development of colour cosmetics with botanical-rich formulas and health-conscious ingredients. Moreover, the longevity and high-quality provided by clean colour cosmetics are increasing their demand, which is significantly contributing to the market growth. The development of lightweight cosmetics that utilise clean-labelled ingredients for everyday use is further bolstering the growth of the market. In addition, the initiation of various research and development activities to develop effective colour cosmetics for versatile skin tones is expected to drive the market growth in the forecast period.

Colour Cosmetics Market Segmentation

Colour cosmetics refer to colourants and cosmetic ingredients that are used in various personal care products. They enhance the appearance of the human body, which is why they are included in nail care, lip care, eye make-up, and facial make-up products. The colourants aid in the creation of colour in a wide range of products like eyeshadows and lipsticks, among others.Market Breakup by Target Market

- Mass Product

- Prestige Product

Market Breakup by Application

- Facial Make-up

- Lip Product

- Eye Make-up

- Nail Product

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Rising Demand for Saturated Tones to Drive the Colour Cosmetics Market Demand

The rising demand for colour cosmetics with organic origins and saturated tones owing to evolved consumer preferences is driving the market growth. The increasing focus on bold eye-make-up is surging the demand for coloured products, such as eyeshadows, mascaras, and kohls, among others, hence augmenting the growth of the market for colour cosmetics. In addition, the emerging trend of at-home beauty is expected to increase the demand for easy to use colour cosmetics. This, in turn, is increasing the demand for colour cosmetics, which is predicted to propel the growth of the market in the coming years.The hybridisation of colour cosmetics with skincare ingredients to enhance their benefits is one of the primary trends in the colour cosmetics market. As make-up is increasingly used as a form of self-expression by millennial and Gen-Z consumers, the demand for bold and flashy colours is surging, which is strengthening the market for colour cosmetics. Moreover, the growing popularity of K-beauty is increasing the demand for multi-purpose products that can be used as both cosmetics and skincare products. This is encouraging the launch of innovative and cost-effective colour cosmetics, which is estimated to bolster the market growth in the forecast period.

Key Players in the Global Colour Cosmetics Market

The report presents a detailed analysis of the following key players in the global colour cosmetics market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- Unilever plc

- L’Oréal S.A

- Avon Products, Inc.

- The Estée Lauder Companies Inc.

- Shiseido Co. Ltd.

- Chantecaille Beauté

- Revlon, Inc.

- Coty Inc.

- NARS Cosmetics

- Giorgio Armani S.p.A.

- Brand Agency (London) Ltd

- Others

Table of Contents

Companies Mentioned

The key companies featured in this Colour Cosmetics market report include:- Unilever plc

- L’Oréal S.A

- Avon Products, Inc.

- The Estée Lauder Companies Inc.

- Shiseido Co. Ltd.

- Chantecaille Beauté

- Revlon, Inc.

- Coty Inc.

- NARS Cosmetics

- Giorgio Armani S.p.A.

- Brand Agency (London) Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 157 |

| Published | August 2025 |

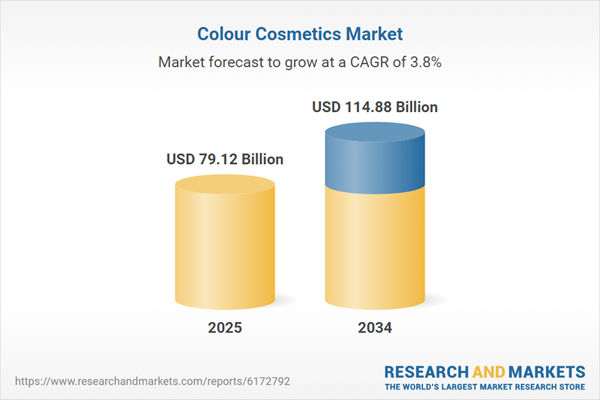

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 79.12 Billion |

| Forecasted Market Value ( USD | $ 114.88 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |