Cyclohexanone Market Overview

Cyclohexanone is used in various commercial and industrial applications and finds major applications in the paints and coating industry and the food and pharmaceutical industries. The use of cyclohexanone as a raw material in the production of adipic acid is augmenting the growth of the cyclohexanone market. The extensive use of adipic acid in manufacturing activities in various industries, especially the nylon industry, is driving the market growth. Moreover, the rising use of food-grade adipic acid as gelling and leavening agents in the food and beverage industry is augmenting the market for cyclohexanone. As the nylon industry is witnessing robust growth, the demand for cyclohexanone as a raw material is increasing. The wide use of nylon in commercial and industrial applications is fuelling the market for cyclohexanone. In addition, the growing demand for polymers such as polyurethane and polyvinyl chloride, among others, is also increasing the demand for nylon, which is fuelling the growth of the cyclohexanone industry.Key Trends and Developments

Rising usage of solvents in paints, shift towards sustainable and bio-based alternatives, and rising demand for caprolactam are the key trends propelling the market growth.October 2024

Nippon Paint Holdings announced a definitive agreement to acquire LSF11 A5 TopCo LLC and its subsidiaries, collectively known as AOC, for approximately USD 2.3 billion. This acquisition is strategically aligned with NPHD's goal to enhance its global presence in the specialty chemicals sector, particularly in composite resins and materials used across various industries such as automotive, construction, and marine.August 2024

INVISTA, a prominent U.S.-based chemical company, announced plans to double its annual production capacity of nylon 6,6 to 400,000 metric tons at its Shanghai facility. This expansion is pivotal as it enhances local supply capabilities and aligns with the increasing demand for nylon products, which are closely linked to the cyclohexanone market.April 2024

NILIT, an Israeli manufacturer of nylon, announced a joint venture with a Chinese firm to produce high-quality industrial-grade nylon in China. This collaboration aims to expand NILIT's global footprint and enhance its presence in the Asian market.April 2024

Nylon Corporation of America (NYCOA) announced the launch of NY-Clear, an innovative amorphous 6I/6T nylon specifically designed for packaging and precision moulded applications. NY-Clear is a transparent nylon that offers high clarity and strong permeation resistance, boasting up to 30% higher resistance to oxygen, carbon dioxide, and water vapour transmission compared to competing materials.Rising Usage of Solvents in Paints

The increasing demand for solvents in the paint industry is surging the deployment of cyclohexanone, which is invigorating the growth of the market. As the demand for optimal consistency to effectively paint surfaces is surging, the use of cyclohexanone is increasing. Moreover, the development of innovative and durable paints that can withstand extreme weather conditions is increasing the utilisation of solvents, hence fuelling the growth of the cyclohexanone industry. In addition, the growing use of cyclohexanone as a solvent and antiseptic in the cosmetics and personal care industry is providing further impetus to the growth of the market. The market growth can further be attributed to the growing demand for cyclohexanone in the pharmaceutical industry. The rising demand for flexible packaging is surging the utilisation of cyclohexanone, thus significantly contributing to the market growth.Shift Towards Sustainable and Bio-Based Alternatives

There is a noticeable trend towards developing bio-based cyclohexanone as companies seek to align with sustainability goals and reduce reliance on fossil fuels. The rising demand for environmentally friendly materials is prompting manufacturers to explore alternative production methods, including the use of renewable resources. This shift is driven by both regulatory pressures and consumer preferences for sustainable products, creating innovative cyclohexanone market opportunities. For instance, India has established itself as a centre for bio innovation and biomanufacturing, which is vital to the country's goal of reaching a USD 5 trillion economy by 2027. The Indian government has also introduced the BioE3 (Biotechnology for Economy, Environment, and Employment) Policy, which aims to foster high-performance biomanufacturing and promote a circular bioeconomy. This policy encourages the transition from traditional chemical-based industries to sustainable bio-based models, thereby supporting the development of bio-based chemicals like cyclohexanone.Rising Demand for Caprolactam

The demand for caprolactam, a primary derivative of cyclohexanone, is significantly driving the cyclohexanone market. Caprolactam is essential for producing nylon 6, which is widely used in various applications, including textiles, automotive parts, and consumer goods. The global production of nylon-6 is expected to rise as manufacturers like NILIT enter joint ventures in regions like China to meet the growing demand for high-quality industrial-grade nylon. Additionally, companies such as BASF are expanding their caprolactam production capacity to cater to the rising needs of the textile and automotive industries. This trend is projected to boost cyclohexanone consumption as it serves as a key precursor in caprolactam production.Expanding Applications in the Automotive Sector

The automotive industry's growth is significantly impacting the cyclohexanone market due to its role in producing lightweight and durable materials. Cyclohexanone is crucial for manufacturing nylon and other engineering plastics used in vehicle production. As per industry reports, the U.S. automotive industry produced approximately 13 million vehicles in 2021, creating substantial demand for nylon-based components that use cyclohexanone. Companies like Nippon Paint are also expanding their operations through strategic acquisitions to enhance their offerings in automotive coatings and materials, further driving the need for cyclohexanone. Furthermore, major automakers such as Toyota and Ford are increasingly incorporating nylon components in their vehicles to improve safety and performance, leading to higher consumption of cyclohexanone.Cyclohexanone Market Trends

Advancements in production technologies are enhancing the efficiency of cyclohexanone manufacturing. Innovations such as direct production from phenol are being explored to improve yield and reduce costs. Additionally, companies are investing in energy-efficient manufacturing technologies to meet growing demand while minimising environmental impact. For instance, INVISTA's expansion in Shanghai includes integrating energy-efficient technology into its facilities, which aligns with global trends toward more sustainable industrial practices.Moreover, a recent patent outlined a high-yield production method for cyclohexanone that leverages coking benzene as a raw material, impacting cyclohexanone market dynamics and trends. This process improves material utilisation rates, reducing benzene consumption from 1.0 tons per ton of cyclohexanone to 0.8 tons, and enhances the overall efficiency of the production process by recycling hydrogen generated during dehydrogenation. Recent advancements in catalytic processes have also improved the efficiency of cyclohexanone production. For example, researchers have developed a process involving the esterification of cyclohexene with acetic acid followed by hydrogenation to produce cyclohexanol with high conversion rates (99.5%) and selectivity (99.7%). This approach not only enhances yield but also optimises resource use and minimises waste generation.

Cyclohexanone Market Restraints

The market for cyclohexanone faces challenges due to fluctuating raw material prices, particularly for benzene and hydrogen, which are essential feedstocks for its production. These price fluctuations can affect profit margins for manufacturers and disrupt supply chains, affecting cyclohexanone demand forecast. Unexpected plant shutdowns and technical difficulties at major manufacturing facilities have temporarily limited the availability of cyclohexanone. For example, recent disruptions in Europe due to maintenance issues have resulted in decreased supply, which has led to price increases amid high demand from downstream industries such as nylon production.The market is characterised by major competition among producers, which can drive cost pressures and margin erosion. With numerous players in the market, price wars can occur, leading to instability in pricing and profitability. This competitive landscape may deter investment in new technologies or expansion initiatives, affecting long-term growth prospects for the industry.

Cyclohexanone Market Dynamics

As environmental regulations become stricter globally, manufacturers are under pressure to comply with sustainability standards. This includes reducing emissions and waste associated with cyclohexanone production. For instance, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation in the European Union requires companies to register chemical substances they manufacture or import. Cyclohexanone, being a chemical substance, falls under this regulation which can impact the cyclohexanone demand. Manufacturers must provide data on the properties and uses of cyclohexanone, assess risks associated with its use, and implement measures to manage those risks. This regulation encourages companies to adopt safer production processes and reduce emissions associated with cyclohexanone.Companies are investing in compliance measures and adopting practices that align with regulatory frameworks to avoid penalties and enhance their market reputation. For example, BASF managed to reduce its greenhouse gas (GHG) emissions by nearly 50% over the past three decades, despite doubling its production volumes.

Cyclohexanone Industry Segmentation

“Cyclohexanone Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Cyclohexane

- Phenol

Market Breakup by End Users

- Paints and Dyes

- Fertilisers

- Nylon Industry

- Pharmaceuticals

- Films

- Soaps

- Others

Market Breakup by Application

- Caprolactam

- Adipic Acid

- Solvents

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Cyclohexanone Market Share

Market Insights by Type

Cyclohexane is the predominant feedstock, holding the highest cyclohexanone market share. The primary industrial method involves the oxidation of cyclohexane in air, typically using cobalt catalysts, to produce cyclohexanone. The preference for cyclohexane as a feedstock is due to its cost-effectiveness and the established efficiency of the oxidation process, making it the dominant source for cyclohexanone production in the industry.Phenol-based production of cyclohexanone is gaining traction due to the growing demand for phenol derivatives in various industries. The process involves the oxidation of phenol to produce cyclohexanone, which is often integrated into high-performance polymer production. Phenol-based cyclohexanone production is considered more environmentally friendly because it uses existing phenol production infrastructure. The U.S. Department of Energy (DOE) has acknowledged the role of phenol-based cyclohexanone in advancing sustainable industrial processes. Countries such as Japan and China, where phenol is a key industry, have reported increasing adoption of this method in line with their green chemistry initiatives.

Market Insights by End Users

The nylon industry holds a major market share as cyclohexanone is a key intermediate in producing caprolactam and adipic acid, both essential for manufacturing nylon-6 and nylon-6,6 fibres and resins. These materials are extensively used in textiles, automotive components, and industrial applications, which boosts the cyclohexanone market value. The substantial demand for nylon products drives the consumption of cyclohexanone in this sector. The increasing demand for nylon in applications such as 3D printing is further expected to sustain a high consumption of cyclohexanone.Cyclohexanone is used as a solvent in the paints and dyes industry due to its ability to dissolve resins and pigments. According to the U.S. Environmental Protection Agency (EPA), cyclohexanone’s low volatility makes it a safer alternative to other solvents. The growing focus on sustainable and low-VOC (volatile organic compound) solvents is driving demand for cyclohexanone in this sector. European regulations, such as the REACH initiative, are pushing the industry towards greener chemicals, further enhancing cyclohexanone's role in coatings.

In the fertiliser industry, cyclohexanone is used in the production of herbicides and pesticides, which are essential in crop protection. The Food and Agriculture Organisation (FAO) has reported increasing demand for chemical pesticides in agriculture, particularly in developing regions. As agricultural productivity rises globally, cyclohexanone's demand in agrochemical formulations is expected to grow. Sustainable farming initiatives are also prompting a shift towards safer chemical intermediates, with cyclohexanone being one of the preferred options.

In pharmaceuticals, cyclohexanone serves as a precursor for the synthesis of active pharmaceutical ingredients (APIs) and other chemicals. The U.S. Food and Drug Administration (FDA) has highlighted the importance of safe and regulated chemical intermediates in drug manufacturing. Cyclohexanone’s use in pharmaceutical formulations is growing, driven by the increasing demand for synthetic medicines and treatments in emerging markets. Government health agencies globally are focusing on maintaining high-quality standards for pharmaceutical chemicals, thus boosting cyclohexanone market value in the sector.

Cyclohexanone is also used in the production of films, particularly in the manufacture of photographic and packaging films. The U.S. Department of Energy (DOE) highlights the expanding use of cyclohexanone in advanced materials, including electronic films. As the demand for flexible electronics and packaging materials rises, cyclohexanone’s role in film production is expected to grow. The increasing trend of eco-friendly packaging solutions is likely to drive further demand for cyclohexanone in biodegradable film applications.

Market Insights by Application

Caprolactam is a major consumer of cyclohexanone as it is primarily used in the production of nylon 6 fibres, which are widely utilised in various industries, including textiles, automotive, and consumer goods. The demand for caprolactam is driven by its essential role in producing nylon, which is favoured for its strength, durability, and versatility. Adipic acid is another significant application of cyclohexanone, though it represents a smaller portion compared to caprolactam. It is primarily used in producing nylon 66 and various polyurethanes.Cyclohexanone Market Regional Analysis

North America Cyclohexanone Market Growth

The North American market is primarily driven by the increasing consumption of caprolactam and adipic acid, which are essential for nylon production. As per the cyclohexanone industry analysis, many textile yarn manufacturers in the United States and Canada are making substantial investments to capitalise on evolving consumption patterns and the growing demand for clothing and home furnishings made from nylon. The demand for nylon 6,6 fibres in automotive applications is also driving market growth as these materials are favoured for their strength and durability.Asia Pacific Cyclohexanone Market Dynamics

The regional market growth is primarily driven by industrialisation and urbanisation in countries like China and India. According to the United Nations, by 2023, around 60% of China's population and 35% of India's population live in urban areas, with expectations for these figures to rise. This urbanisation is driving demand for various materials, including those derived from cyclohexanone, as infrastructure development grows, further contributing to cyclohexanone market revenue. The rapid expansion of the automotive sector in China, where around 26 million vehicles were produced in 2021, significantly boosts the demand for nylon products that depend on cyclohexanone. The region is also witnessing advancements in manufacturing technologies that enhance production efficiency, further contributing to market growth.Europe Cyclohexanone Market Opportunities

The European market is expected to grow due to high demand from the automotive industry for lightweight materials and the increasing need for adipic acid in textiles and packaging. European manufacturers are focusing on eco-friendly production processes, which enhances the attractiveness of cyclohexanone as a solvent and intermediate in various applications, further fuelling demand of cyclohexanone market.Early September 2024 saw notable cyclohexanone price increases in Germany and the Netherlands. This was attributed to moderate demand from sectors such as nylon and adipic acid production.

Latin America Cyclohexanone Market Analysis

Increased trade activities and investments in infrastructure development are driving demand for cyclohexanone as it is crucial for various chemical applications. Trade agreements such as the United States-Mexico-Canada Agreement (USMCA) and other bilateral agreements are enhancing trade connectivity within Latin America. These agreements facilitate smoother trade flows and logistics operations, further driving the cyclohexanone demand growth.Government bodies are investing in public transit systems to improve urban mobility. This includes large-scale urban rail projects and bus rapid transit (BRT) systems, which require various chemicals for construction and maintenance, including cyclohexanone used in adhesives and coatings. Countries such as Colombia and Mexico have initiated significant urban transit projects that will enhance logistics capabilities and support regional trade.

Middle East and Africa Cyclohexanone Market Trends

Countries in the Middle East and Africa are investing heavily in logistics infrastructure to diversify their economies away from oil dependence. This includes developing transport networks that facilitate trade and improve connectivity. As industrial activities expand, there is an increasing demand for chemicals like cyclohexanone used in various applications including solvents and intermediates, which increases cyclohexanone industry revenue.For instance, in Africa, there is a strong push for improving transport infrastructure to facilitate trade among countries. The Trans-African Highway Network spans over 54,120 km, but many segments require upgrades and maintenance to improve connectivity. Enhancing logistics capabilities will support industrial activities and increase demand for chemicals like cyclohexanone.

Innovative Cyclohexanone Startups

Emerging companies in the market are developing eco-friendly processes for cyclohexanone synthesis, such as utilising bio-based feedstocks and implementing green chemistry principles to reduce environmental impact. Startups are researching and deploying novel catalysts to improve reaction efficiency, aiming to lower energy consumption and increase yield in cyclohexanone production. By integrating advanced process control systems and data analytics, these companies strive to optimise manufacturing operations, enhancing both productivity and product quality.Anellotech Inc.

Anellotech is a U.S.-based startup in cyclohexanone market specialising in developing sustainable chemical production processes. The company has pioneered a technology called Bio-TCat™, which converts non-food biomass into aromatic chemicals like benzene, toluene, and xylene. These aromatics can be further processed to produce cyclohexanone, offering a renewable alternative to traditional petrochemical routes.

Vertimass LLC

Vertimass is a California-based startup focused on converting ethanol and other renewable alcohols into hydrocarbons and chemicals. The company has developed a catalytic technology that transforms ethanol into a mix of hydrocarbons, including those that can be used as precursors for cyclohexanone production. The company’s technology provides a pathway to produce cyclohexanone from renewable resources, aligning with global sustainability goals and offering an alternative to conventional petrochemical processes.Competitive Landscape

The report presents a detailed analysis of the following key players in the global cyclohexanone market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions. Major players are increasing their production capacities to cater to the rising demand for cyclohexanone, primarily used in producing caprolactam and adipic acid for nylon manufacturing. Companies are adopting advanced manufacturing technologies to improve efficiency and product quality. This includes implementing sustainable production methods and exploring bio-based alternatives to address environmental concerns.DuPont de Nemours, Inc.

DuPont de Nemours, commonly known as DuPont, is an American company specialising in technology-based materials and solutions. Founded in 2015 and headquartered in Wilmington, Delaware, DuPont operates in sectors such as electronics, water solutions, protection, and industrial technologies.

Exxon Mobil Corporation

Exxon Mobil Corporation, commonly known as ExxonMobil, is a leading American multinational oil and gas corporation. Headquartered in Spring, Texas, ExxonMobil engages in the exploration, production, transportation, and sale of crude oil, natural gas, and petroleum products.BASF SE

BASF SE is a German multinational chemical company and the largest chemical producer in the world. Founded in 1865 and headquartered in Ludwigshafen am Rhein, Germany, BASF operates through six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care, and Agricultural Solutions.Other major players in the market are Qingdao Hisea Chem Co. Ltd, Grupa Azoty S.A., Ube Industries, Ltd., Versalis S.p.A., Domo Caproleuna GmbH, and Fibrant B.V., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Cyclohexanone market report include:- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- BASF SE

- Qingdao Hisea Chem Co. Ltd

- Grupa Azoty S.A.

- Ube Industries, Ltd.

- Versalis S.p.A.

- Domo Caproleuna GmbH

- Fibrant B.V.

Table Information

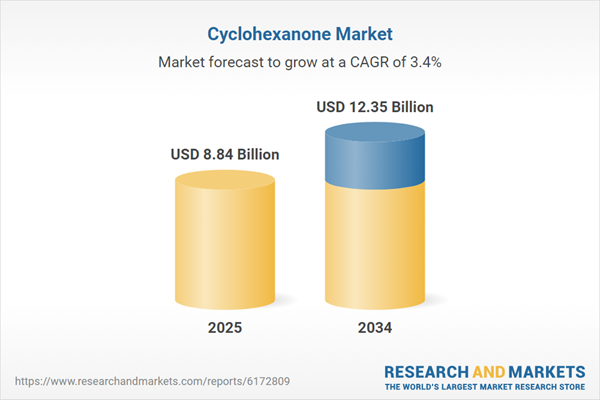

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.84 Billion |

| Forecasted Market Value ( USD | $ 12.35 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |