The influx of stricter environmental policies across the globe are impacting the molybdenum market outlook for pollution control and cleaner production processes. Across the United States and Europe, regulations limiting nitrogen oxide emissions are driving the need for molybdenum-based catalysts in chemical and refining plants. For instance, in November 2024, Syamcat introduced an iron-molybdenum catalyst to facilitate efficient methanol-to-formaldehyde conversion. The global push towards circular economy principles is further promoting the recycling of molybdenum-containing scrap whilst reducing the environmental impacts.

Governments worldwide are recognizing molybdenum as a critical mineral for national security given its use in defense alloys and energy infrastructure. The United States Department of Defense and European Union are prioritizing molybdenum in strategic stockpiling efforts to mitigate supply risks amid geopolitical uncertainties. This trend is encouraging investments in mining and processing facilities within politically stable regions, further influencing global market flows as well as long-term supply security.

Molybdenum compounds, mainly molybdenum disulfide, are serving as key catalysts in refining petroleum and petrochemicals. Hydrodesulfurization catalysts limit sulfur content in fuels for matching the stricter environmental regulations globally. The introduction of the Global Strategy is urging countries to reach low sulfur fuels by up to 50 ppm by 2025, favoring the molybdenum industry. This trend is driving the growth in refining capacities in emerging countries. Moreover, molybdenum-based catalysts are increasingly applied in green chemical processes for enhancing their strategic importance in sustainable industry practices.

Key Trends and Recent Developments

June 2025

YSU expanded its collaboration with Zangezur CopperMolybdenum Combine by integrating student internships, sponsored educational camps, and establishing a joint research center. This partnership helped to improve practical training in geology and mining while fostering industryacademia research, and skill development in Armenia’s Syunik region.February 2025

Outokumpu signed a 10-year offtake agreement with Greenland Resources for 8 million lb/year of low emission molybdenum from the Malmbjerg project. This agreement helped Outokumpu to further decarbonize while continuing its long-term strategy for cost-competitive and sustainable value-chain integration.September 2024

Chile’s Molymet began plasma spheroidization for producing molybdenum, rhenium, and alloy powders at its San Bernardo facility. By targeting additive manufacturing and MIM, this strategy helped to offer precise, high-value powders to industrial markets.August 2023

Univar Solutions expanded its partnership with Climax Molybdenum by emerging as the exclusive distributor of Molysulfide® in Latin America. This strategic expansion was built on the existing United States alliance and broadened Univar's reach into automotive, aerospace, and coatings industries with reliable and high-quality molybdenum additives.Expansion of Renewable Energy

The strong rise in renewable energy projects across the globe is driving the molybdenum market expansion due to its robust role in producing durable stainless-steel components for solar panels, wind turbines, and battery technologies. Molybdenum-based alloys are recording usage in photovoltaic cells for their excellent electrical conductivity and corrosion resistance. As per industry reports, solar PV technology is expected to account for 80% of the worldwide renewable capacity growth from 2024 to 2030, further driving the molybdenum demand in this sector. Governments pushing clean energy policies are also stimulating market growth in renewable infrastructure.Technological Advances in Alloy Development

Innovations in alloy chemistry are expanding the molybdenum market share to cater to applications beyond traditional steel. High-performance alloys combining molybdenum with nickel, titanium and zirconium provide excellent strength and heat resistance, crucial for aerospace and defense. In February 2022, a team of researchers from China developed a nanoscale ZrC-Mo alloy with exceptional strength and ductility for cutting-edge applications. These technological advances are driving market growth, particularly in developed countries where aerospace manufacturing is prominent.Urbanization and Infrastructure Development

Rapid urbanization and infrastructure projects mainly in India, Brazil, and Southeast Asia are escalating stainless steel demand, further boosting the molybdenum market. As per industry reports, the planned investments in India's infrastructure sector are estimated to touch USD 1.4 trillion by 2025, much of which necessitates durable steel structures containing molybdenum. Brazil’s booming automotive and construction sectors are also using molybdenum alloys extensively, proving vital for the market growth.Growth in Automotive Lightweighting

The molybdenum market outlook is influenced by rising usage of molybdenum-alloyed steels by automotive manufacturers to produce lighter and stronger vehicles that meet fuel efficiency and emission standards. Molybdenum improves the strength-to-weight ratio of steel, further allowing reduced vehicle weight without sacrificing safety. Leading automobile firms are integrating molybdenum alloys to enhance performance. In February 2025, Globus Metal Powders launched Alloy-X, a nickel powder combining molybdenum and tungsten for offering enhanced strength for automotive applications, making the automotive sector a significant growth driver.Emergence of New Mining Projects and Exploration

The rise of new mining projects in Greenland, Canada, and Australia for diversifying the supply sources is benefiting the molybdenum industry. For instance, in March 2025, Greenland Resources revealed plans of developing a massive uranium mine at Motzfeldt for focusing on sustainable mining practices and supply to European markets. Such exploration activities are increasing due to high molybdenum prices and demand forecasts. These developments are helping to alleviate supply risks while meeting the growing global consumption, especially as established producers encounter production limits and environmental challenges.Molybdenum Industry Segmentation

The report titled “Molybdenum Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by End Product

- Steel

- Chemical

- Foundry

- MO-Metal

- Nickel Alloy

- Others

Market Breakup by End-User Industry

- Oil and Gas

- Chemical and Petrochemical

- Automotive

- Industrial Usage

- Building and Construction

- Aerospace and Defence

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Molybdenum Market Share

Rising Demand for Chemical & Foundry Molybdenum

The chemical segment is driving the molybdenum industry due to wide usage in petroleum refining, agriculture and industrial catalysts. Molybdates, used in water treatment and corrosion-resistant coatings, are witnessing growing demand. With tightening environmental regulations globally molybdenum-based catalysts are becoming essential in pollution control and green chemistry. This segment is also expanding due to its environmental utility and the shift toward cleaner industrial processes.The molybdenum market share is increasing from the foundry segment owing to their assistance in enhancing the strength, wear resistance, and durability of metal castings. Foundries incorporate molybdenum in cast iron and steel to improve hardness and thermal conductivity, which is crucial for heavy machinery, mining equipment, and engine blocks. For instance, in September 2024, Molymet unveiled the production of highly spheroidised powders of molybdenum to cater to foundries. The growth in heavy machinery and transportation manufacturing is also boosting molybdenum's role in enhancing casting efficiency and lifespan.

Chemical and Petrochemical & Automotive Sectors to Witness Huge Molybdenum Adoption

The chemical and petrochemical segment of the molybdenum market is growing due to higher assistance to refineries in removing sulfur from crude oil to produce cleaner fuels. Molybdenum compounds serve as essential ingredients in corrosion inhibitors, lubricants, pigments, and polymers. As environmental regulations tighten worldwide, especially in Europe and North America, the demand for molybdenum-based catalytic technologies is likely to rise. The sector also benefits from ongoing investments in green chemistry and process efficiency, solidifying molybdenum’s role in modern petrochemical and chemical applications.The molybdenum market share from the automotive industry is growing steadily, as automakers are seeking stronger and lighter materials to improve fuel efficiency and safety. Molybdenum is used in engine blocks, transmission parts, exhaust systems, and chassis components for enhancing heat resistance and durability. With the shift toward electric vehicles, molybdenum is further gaining relevance in battery contacts and lightweight structural components. As per industry reports, the sales of electric cars exceeded 17 million worldwide in 2024. The evolving performance standards and the push for sustainable and high-efficiency vehicles are also benefiting segment growth.

Molybdenum Market Regional Analysis

North America and Europe Molybdenum Market Occupies a Large Share in the Market

North America is a significant contributor to the molybdenum market with the United States emerging as one of the top global producers to meet the demands of aerospace, defense, oil and gas, and stainless-steel manufacturing. As per industry reports, the United States generated about 33,000 MT of molybdenum in 2024. Technological advances and environmental regulations are pushing producers in North America to focus on sustainable extraction and high-purity applications, mainly in renewable energy technologies as well as industrial machinery that require molybdenum-based alloys.Europe molybdenum market is driven by the presence of well-established industrial and automotive sectors, especially in Germany, France, and the United Kingdom. Europe imports significant quantities to meet its needs in stainless steel production and high-performance alloys. The push for clean energy and green technologies is supporting constant usage of molybdenum for its durability and corrosion resistance. Additionally, strict environmental standards in Europe are encouraging innovations in recycling and resource efficiency, keeping the region competitive despite limited natural reserves of molybdenum.

Competitive Landscape

Key players in the molybdenum market are deploying strategies that focus on technological advances, strategic partnerships, and vertical integration. With increasing global demand from steel, energy, and electronics sectors, major firms are focusing on long-term supply agreements and acquisitions to ensure consistent access to high-grade molybdenum ores. These moves are helping to secure raw material supply chains and limit the reliance on volatile spot markets. To enhance competitiveness, players are investing in advanced mining technologies and efficient extraction processes for lowering production costs and improving recovery rates.Environmental sustainability is helping companies to adopt cleaner technologies while committing to responsible mining practices to comply with evolving regulations and ESG expectations. Many companies are engaging in strategic partnerships and joint ventures, especially in emerging markets, to expand their global footprint and tap into new demand centers. In addition, downstream integration is allowing firms to capture more value across the supply chain. Furthermore, market players are leveraging data analytics and AI for more agile responses to demand fluctuations and pricing dynamics.

Anglo American plc

Anglo American plc was established in 1917 and is headquartered in London, United Kingdom. The company operates globally in mining, producing commodities such as copper, platinum group metals, iron ore, and diamonds with an exposure to molybdenum via its copper operations for catering to construction, automotive, and energy industries.Antofagasta plc

Antofagasta plc, founded in 1888, is headquartered in London, United Kingdom with key mining operations in Chile. The company specializes in copper production with a focus on sustainable mining practices and technological innovation to enhance efficiency and reduce environmental impacts across its mineral assets.China Molybdenum Co., Ltd.

China Molybdenum Co., Ltd (CMOC), formed in 1969 and headquartered in Luoyang, China, is one of the world’s major producers of molybdenum, tungsten, and niobium. CMOC’s portfolio includes mining, processing, and trading operations in China and internationally, with assets in Africa, South America, and Australia.

Codelco

Codelco, founded in 1976 and headquartered in Santiago, Chile, is the world’s largest copper producer and a significant supplier of molybdenum. As a state-owned enterprise, Codelco manages vast mineral reserves and prioritizes modernization and sustainability in its large-scale mining operations.Other players in the molybdenum market are Freeport-McMoRan Inc., Grupo México, Teck Resources Limited, Rio Tinto, KGHM, Jiangxi Copper Corporation, and Jinduicheng Molybdenum Co. Ltd, among others.

Key Features of the Molybdenum Market Report

- In-depth quantitative analysis of market size, share, and growth forecasts till 2034.

- Covers major application sectors, including steel, chemical, and energy industries worldwide.

- Provides regional insights, highlighting key trends in Asia Pacific, North America, and Europe.

- Competitive landscape with profiles of leading players, partnerships, and recent developments.

- Detailed supply chain analysis and raw material trends impacting global production.

- Includes pricing trends, import/export data, and trade flow analysis for key molybdenum producers.

- Offers reliable and up-to-date data from verified industry sources and proprietary databases.

- Backed by a team of seasoned analysts and market forecasting experts.

- Delivers customized research solutions tailored to client goals and strategic decisions.

- Trusted by top industry players for actionable insights and competitive market intelligence.

Table of Contents

Companies Mentioned

The key companies featured in this Molybdenum market report include:- Anglo American plc

- Antofagasta plc

- China Molybdenum Co., Ltd

- Codelco

- Freeport-McMoRan Inc.

- Grupo México

- Teck Resources Limited

- Rio Tinto

- KGHM

- Jiangxi Copper Corporation

- Jinduicheng Molybdenum Co. Ltd

Table Information

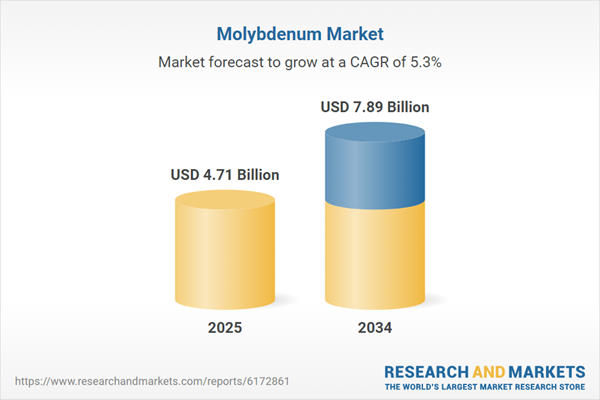

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.71 Billion |

| Forecasted Market Value ( USD | $ 7.89 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |