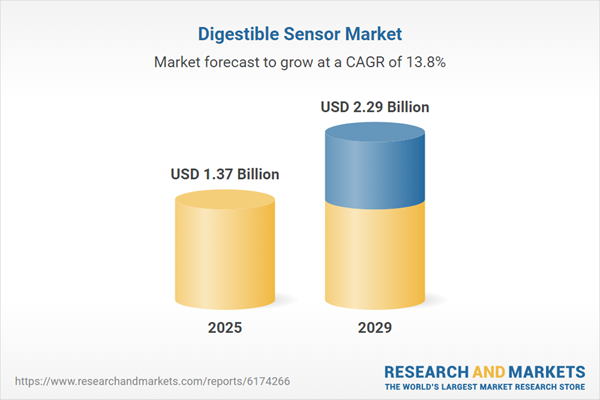

The digestible sensor market size is expected to see rapid growth in the next few years. It will grow to $2.29 billion in 2029 at a compound annual growth rate (CAGR) of 13.8%. The growth in the forecast period can be attributed to increasing consumer demand for health tracking, rising adoption of wearable devices, expansion of healthcare data analytics, growth in personalized healthcare, increasing demand for real-time health monitoring, rising telemedicine usage, and the growing need for continuous patient monitoring. Major trends during this period include advancements in sensor technology, improvements in biosensor capabilities, integration of AI in health data analysis, miniaturization of sensors, progress in wearable health devices, and innovations in digital therapeutics.

The increasing demand for remote health monitoring is expected to propel the growth of the digestible sensor market going forward. Remote health monitoring involves using technology to track and manage a patient’s health outside traditional healthcare settings, allowing care from a distance. The rise in remote health monitoring is driven by people preferring personalized, real-time healthcare at home and cost-effective alternatives to in-person visits. Digestible sensors support remote health monitoring by providing real-time data on gastrointestinal function, enabling early detection of infections or diseases without invasive procedures. For instance, in June 2022, The Health Innovation Network reported that over 286,000 people in 2021/22 received support at home through technology-enabled remote monitoring, rapidly expanded under the leadership of the National Innovation Collaborative for digital health. Therefore, the increasing demand for remote health monitoring is driving the growth of the digestible sensor market.

The growing demand for personalized medicine is also expected to propel the digestible sensor market. Personalized medicine uses information about a person’s genes and lifestyle to tailor treatments and healthcare to individual needs. The rise of personalized medicine is driven by patients seeking technologies that allow real-time monitoring and customized treatment based on their unique biology. Digestible sensors enable personalized medicine by providing physicians with real-time internal data, supporting accurate diagnoses and individualized care. For instance, in February 2023, the Personalized Medicine Coalition reported that in 2022, 12 new personalized medicines were approved, representing 34% of all newly approved therapies, reflecting a substantial increase from previous years. Therefore, the growing demand for personalized medicine is driving the digestible sensor market.

Major companies in the market are developing miniaturized, multi-parameter ingestible sensors to improve gut health monitoring and diagnostic accuracy. Multi-parameter sensors simultaneously measure multiple physical or chemical parameters in a compact device. For instance, in May 2025, the Interuniversity Microelectronics Centre in Belgium unveiled a highly miniaturized ingestible sensor measuring 2.1 cm in length and 0.75 cm in diameter about three times smaller than traditional endoscopic capsules. The capsule integrates sensors for oxidation-reduction potential (ORP), pH, and temperature, recording readings every 20 seconds throughout digestion. Equipped with wireless data transmission, a biocompatible casing, low-energy electronics, and a compact battery, it enables continuous, noninvasive monitoring of internal gut conditions, supporting early diagnosis of inflammation, oxidative stress, and microbiome imbalances.

Major players in the digestible sensor market are Medtronic plc, Koninklijke Philips N.V., Otsuka Pharmaceutical Co Ltd., Olympus Corporation, Sencure B.V., Millar Inc., Check Cap Ltd, Proteus Digital Health Inc., CapsoVision Inc., Atmo Biosciences, IntroMedic Co Ltd., RF Co. Ltd, BodyCAP S.A.S, Capsule Technologies Inc., etectRx Inc., Motus GI Inc., SmartPill Corporation, JINSHAN Science & Technology (Group) Co Ltd., MC10, and HQ Inc.

North America was the largest region in the digestible sensor market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in this market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the digestible sensor market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

A digestible sensor is a small, ingestible electronic device designed to be swallowed to monitor internal health conditions or provide specific diagnostic information. These sensors are often embedded in pills and can measure physiological parameters such as temperature, pH, or medication adherence while passing through the gastrointestinal (GI) tract.

The primary types of digestible sensors include capsule sensors, wearable sensors, ingestible sensors, and implantable sensors. Capsule sensors are miniaturized, ingestible devices shaped like a capsule that travel through the GI tract. These devices are distributed through channels such as online retail, pharmacies, hospitals and clinics, and direct sales. They utilize technologies including microelectromechanical systems (MEMS), wireless communication, optical sensors, and bioelectronic interfaces, and are applied in medical diagnostics, drug delivery, patient monitoring, sports and fitness, and more, serving end users such as healthcare providers, research institutions, pharmaceutical companies, and individual consumers.

The digestible sensor market research report is one of a series of new reports that provides digestible sensor market statistics, including digestible sensor industry global market size, regional shares, competitors with a digestible sensor market share, digestible sensor market segments, market trends and opportunities, and any further data you may need to thrive in the digestible sensor industry. This digestible sensor market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The digestible sensor market consists of sales of ingestion event marker (IEM), electronic pills, and ingestible thermometers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digestible Sensor Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digestible sensor market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digestible sensor? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The digestible sensor market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Capsule Sensors; Wearable Sensors; Ingestible Sensors; Implantable Sensors2) By Distribution Channel: Online Retail; Pharmacies; Hospitals and Clinics; Direct Sales

3) By Technology: Microelectromechanical Systems (MEMS); Wireless Communication Technologies; Optical Sensors; Bioelectronic Interfaces

4) By Application: Medical Diagnostics; Drug Delivery; Patient Monitoring; Sports and Fitness; Other Applications

5) By End-User: Healthcare Providers; Research Institutions; Pharmaceutical Companies; Individual Consumers

Subsegments:

1) By Capsule Sensors: pH Monitoring Capsules; Temperature Monitoring Capsules; Pressure Sensing Capsules; Smart Capsule Endoscopy; Drug Delivery Capsules With Sensors2) By Wearable Sensors: Patch-Based External Receivers; Gastrointestinal Motility Trackers; Bio-Signal Monitoring Wearables; Wearable Adherence Trackers

3) By Ingestible Sensors: Vital Sign Monitoring Sensors; Drug Adherence Monitoring Sensors; Imaging Sensors; Gas Sensing Sensors; Electrochemical Sensors

4) By Implantable Sensors: GI Electrophysiology Sensors; pH and Enzyme Sensors; Neuromodulation Devices; Metabolic Sensors

Companies Mentioned: Medtronic plc; Koninklijke Philips N.V.; Otsuka Pharmaceutical Co Ltd.; Olympus Corporation; Sencure B.V.; Millar Inc.; Check-Cap Ltd; Proteus Digital Health Inc.; CapsoVision Inc.; Atmo Biosciences; IntroMedic Co Ltd.; RF Co. Ltd; BodyCAP S.A.S.; Capsule Technologies Inc.; etectRx Inc.; Motus GI Inc.; SmartPill Corporation; JINSHAN Science & Technology (Group) Co Ltd.; MC10; HQ Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Digestible Sensor market report include:- Medtronic plc

- Koninklijke Philips N.V.

- Otsuka Pharmaceutical Co Ltd.

- Olympus Corporation

- Sencure B.V.

- Millar Inc.

- Check-Cap Ltd

- Proteus Digital Health Inc.

- CapsoVision Inc.

- Atmo Biosciences

- IntroMedic Co Ltd.

- RF Co. Ltd

- BodyCAP S.A.S.

- Capsule Technologies Inc.

- etectRx Inc.

- Motus GI Inc.

- SmartPill Corporation

- JINSHAN Science & Technology (Group) Co Ltd.

- MC10

- HQ Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.37 Billion |

| Forecasted Market Value ( USD | $ 2.29 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |