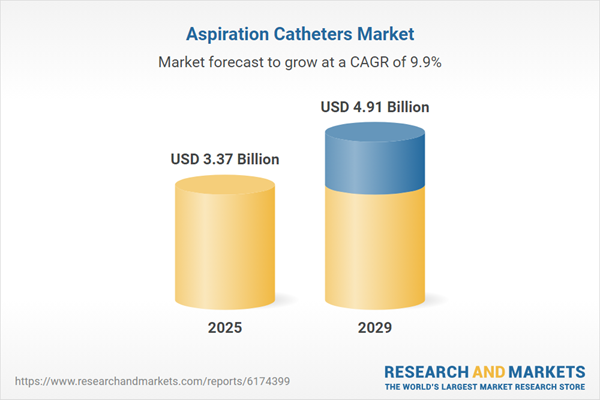

The aspiration catheters market size is expected to see strong growth in the next few years. It will grow to $4.91 billion in 2029 at a compound annual growth rate (CAGR) of 9.9%.The growth in the forecast period can be attributed to the rising adoption of neurovascular interventions, growing preference for image-guided catheterization, increasing emphasis on improving stroke treatment outcomes, higher demand for catheter-based drug delivery, and the growing prevalence of lifestyle-related conditions. Key trends anticipated during this period include technological advancements in catheter design, innovations in dual-lumen aspiration systems, increased investment in robotic-assisted catheter procedures, the development of advanced soft-tip catheter materials, and innovations in aspiration pump integration.

The rising incidence of cardiovascular diseases is expected to drive the growth of the aspiration catheters market in the coming years. Cardiovascular diseases include a range of conditions affecting the heart and blood vessels, such as heart attacks and strokes, which can lead to severe health complications or death. Their prevalence is increasing due to sedentary lifestyles, which contribute to higher obesity rates and reduced cardiovascular fitness, significantly elevating the risk of heart-related illnesses. Aspiration catheters are vital in managing cardiovascular diseases as they enable the removal of blood clots and arterial blockages, helping restore proper blood flow and reducing the risk of heart attacks and strokes during emergency interventions. For instance, in July 2025, the World Health Organization, a Switzerland-based public health agency, reported that cardiovascular diseases caused 19.8 million deaths globally in 2022, representing about 32% of all deaths worldwide, with nearly 85% attributed to heart attacks and strokes. Consequently, the rising incidence of cardiovascular diseases is fueling demand for aspiration catheters.

Companies in the aspiration catheters market are focusing on technological advancements, particularly in large-bore aspiration catheter systems, to improve clot extraction efficiency in stroke treatment. Aspiration catheter systems are integrated medical devices designed to remove clots, fluids, or debris from blood vessels, thereby restoring circulation and improving outcomes in vascular interventions. For example, in December 2023, Q'Apel Medical Inc., a US-based neurovascular device company, introduced the 072 Hippo Aspiration System, a next-generation solution for treating strokes caused by large vessel occlusions. The system features the 072 Hippo Aspiration Catheter, equipped with a proprietary adaptive and radiopaque tip that conforms to various clot sizes and shapes, ensuring precise clot engagement and real-time visibility during removal. It also includes the Cheetah, a flexible guiding device that expedites catheter delivery to the clot, and complements Q’Apel’s Walrus balloon guide catheter, forming a comprehensive solution for stroke interventions.

In April 2022, Wallaby Medical LLC, a US-based medical device company, acquired Phenox GmbH for $580 million. This acquisition was intended to strengthen Wallaby’s global neurovascular portfolio by combining complementary product lines and expertise, positioning the company as a leader in offering advanced neurovascular technologies and solutions for stroke and related diseases across major international markets. Phenox GmbH is a Germany-based medical technology manufacturer specializing in interventional neurovascular devices, including aspiration catheters.

Major players in the aspiration catheters market are Johnson & Johnson, Abbott Laboratories, Medtronic plc, Becton Dickinson and Company, Stryker Corporation, Boston Scientific Corporation, Terumo Corporation, Nipro Corporation, Smiths Medical, Teleflex Incorporated, Cook Medical, Biotronik SE & Co. KG, Merit Medical Systems Inc., Penumbra Inc., Asahi Intecc Co. Ltd., AngioDynamics Inc., Hobbs Medical Inc., iVascular S.L.U., Hexacath S.A., Simeks Medical Equipment Ltd., Acandis GmbH, and SIS-Medical AG.

North America was the largest region in the aspiration catheters market in 2024. The regions covered in aspiration catheters market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the aspiration catheters market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Aspiration catheters are flexible, specialized medical tubes used to remove unwanted substances such as blood clots, excess fluids, or tissue debris from blood vessels or body cavities during minimally invasive procedures. They are widely employed in critical interventions, including stroke and myocardial infarction treatments, where quick and efficient removal of obstructions is vital to restoring normal blood flow and minimizing tissue damage.

The primary types of aspiration catheters include disposable catheters and reusable catheters. Disposable aspiration catheters are designed for single-use, ensuring sterile and safe performance. These devices are applied across various medical fields, including cardiovascular, neurovascular, and peripheral vascular procedures, among others. Key end users include hospitals, ambulatory surgical centers, specialty clinics, and other healthcare facilities.

The aspiration catheters market research report is one of a series of new reports that provides aspiration catheters market statistics, including aspiration catheters industry global market size, regional shares, competitors with an aspiration catheters market share, detailed aspiration catheters market segments, market trends and opportunities, and any further data you may need to thrive in the aspiration catheters industry. This aspiration catheters market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The aspiration catheters market consists of sales of distal access aspiration catheters, dual-lumen aspiration catheters, steerable aspiration catheters, coaxial aspiration catheters, and balloon-guided aspiration catheters. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Aspiration Catheters Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on aspiration catheters market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for aspiration catheters? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The aspiration catheters market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Types: Disposable Catheter; Reusable Catheter2) By Application: Cardiovascular; Neurovascular; Peripheral Vascular; Other Applications

3) By End-User: Hospitals; Ambulatory Surgical Centers; Specialty Clinics; Other End-Users

Subsegments:

1) By Disposable Catheter: Soft Tip Aspiration Catheter; Dual-Lumen Aspiration Catheter; Hydrophilic Coated Aspiration Catheter; Radiopaque Aspiration Catheter; Sterile Preloaded Aspiration Catheter2) By Reusable Catheter: Autoclavable Aspiration Catheter; Rigid Tip Reusable Catheter; Flexible Reusable Aspiration Catheter; Endoscopic Suction Catheter; Reinforced Reusable Catheter

Companies Mentioned: Johnson & Johnson; Abbott Laboratories; Medtronic plc; Becton Dickinson and Company; Stryker Corporation; Boston Scientific Corporation; Terumo Corporation; Nipro Corporation; Smiths Medical; Teleflex Incorporated; Cook Medical; Biotronik SE & Co. KG; Merit Medical Systems Inc.; Penumbra Inc.; Asahi Intecc Co. Ltd.; AngioDynamics Inc.; Hobbs Medical Inc.; iVascular S.L.U.; Hexacath S.A.; Simeks Medical Equipment Ltd.; Acandis GmbH; SIS-Medical AG.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Aspiration Catheters market report include:- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- Becton Dickinson and Company

- Stryker Corporation

- Boston Scientific Corporation

- Terumo Corporation

- Nipro Corporation

- Smiths Medical

- Teleflex Incorporated

- Cook Medical

- Biotronik SE & Co. KG

- Merit Medical Systems Inc.

- Penumbra Inc.

- Asahi Intecc Co. Ltd.

- AngioDynamics Inc.

- Hobbs Medical Inc.

- iVascular S.L.U.

- Hexacath S.A.

- Simeks Medical Equipment Ltd.

- Acandis GmbH

- SIS-Medical AG.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.37 Billion |

| Forecasted Market Value ( USD | $ 4.91 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |