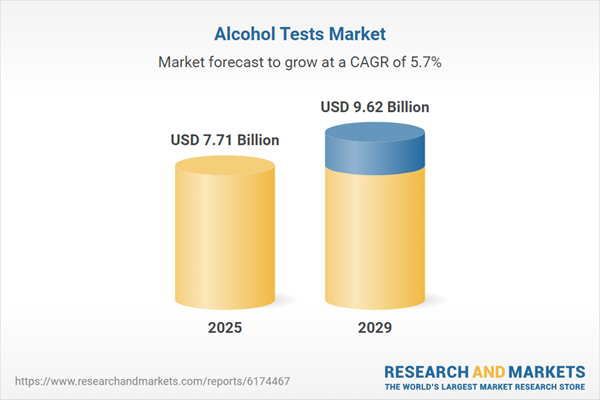

The alcohol tests market size is expected to see strong growth in the next few years. It will grow to $9.62 billion in 2029 at a compound annual growth rate (CAGR) of 5.7%. The growth during the forecast period can be attributed to the increasing demand for remote alcohol testing solutions, greater integration of alcohol testing into telehealth platforms, rising use of alcohol detection in personal safety devices, expanding applications in school and college screening programs, and a growing focus on real-time monitoring technologies. Key trends in the forecast period include advancements in smartphone-enabled alcohol testing devices, development of non-invasive alcohol detection methods, innovations in wearable alcohol monitoring technology, progress in AI-driven analysis of alcohol test results, and the emergence of cloud-connected alcohol testing platforms.

The rising incidence of alcohol-related health conditions is expected to drive growth in the alcohol tests market in the coming years. Alcohol-related health issues encompass medical complications such as liver disease, cardiovascular problems, and mental health disorders resulting from excessive or long-term alcohol consumption. The prevalence of these conditions is increasing due to higher stress levels and shifting lifestyle patterns, which lead more individuals to use alcohol as a coping mechanism. Alcohol tests support the management of these health issues by enabling early detection and monitoring of alcohol intake, facilitating timely interventions and treatment. For example, in February 2025, the Office for Health Improvement and Disparities, a UK-based government department, reported that England recorded 22,644 alcohol-related deaths in 2023, a 3.3% increase from 2022, representing a mortality rate of 40.7 per 100,000 people. As a result, the growing incidence of alcohol-related health conditions is fueling demand in the alcohol tests market.

Key players in the alcohol tests market are developing innovative products, such as alcohol breath detection devices, to improve testing accuracy, enable rapid detection, and support workplace safety and law enforcement initiatives. Alcohol breath detection devices are electronic tools that estimate blood alcohol content (BAC) through breath analysis, providing a fast and non-invasive screening method. For instance, in May 2024, Cannabix Technologies, a Canada-based developer of marijuana breathalyzer devices, launched the Compact Breath Logix Workplace Series, a wall-mounted, autonomous alcohol breath detection system designed for workplace safety. The device is smaller, lighter, and easier to install than previous models, allowing quick, contactless, and automated alcohol screening for employees in office and indoor environments. It features advanced sensors, automated identity and incident tracking, modular cartridges for easy maintenance, and real-time alerts for positive results, helping organizations save time and resources while ensuring compliance and safety.

In April 2023, Phenna Group, a UK-based provider of testing, inspection, certification, and compliance (TICC) services, acquired Cansford Laboratories for an undisclosed amount. Through this acquisition, Phenna Group aims to expand its health sciences platform by incorporating complementary drug, alcohol, and steroid testing services while supporting Cansford’s growth through a culturally aligned partnership. Cansford Laboratories is a UK-based company specializing in drug, alcohol, and steroid testing.

Major players in the alcohol tests market are Abbott Laboratories, 3M Company, Siemens Healthineers, Labcorp Holdings Inc., Drägerwerk AG & Co. KGaA, Alcohol Countermeasure Systems Corporation, MP Biomedicals LLC, LifeSafer Inc., Intoximeters Inc., Randox Laboratories, Psychemedics Corporation, Premier Biotech Inc., Omega Laboratories Inc., Lifeloc Technologies Inc., Securetec Detektions-Systeme AG, AK GlobalTech Corporation, AlcoPro Inc., Andatech Private Limited, BACtrack LLC, Lion Laboratories Limited, PAS Systems International Inc., Quest Products Inc., Sentech Korea Corp., CMI Inc.

North America was the largest region in the alcohol tests market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in alcohol tests market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the alcohol tests market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Alcohol tests are diagnostic procedures designed to detect and measure the presence of ethanol in an individual’s system, typically to assess levels of intoxication or impairment. These tests are essential in medical diagnostics, law enforcement, workplace safety, and rehabilitation, providing accurate evaluations of an individual’s alcohol-related impairment.

The main types of products used in alcohol testing include infrared (IR)-based equipment, alcohol breath analyzers, semiconductor devices, urine testing kits, fuel cell-based instruments, chromatography systems, immunoassay analyzers, and hair-testing devices. IR-based equipment employs infrared spectroscopy to detect alcohol by analyzing the absorption of infrared light by molecules in a breath sample. Alcohol tests can be conducted on various sample types, including urine, blood, hair, breath, and sweat, and are utilized by a range of end users such as hospitals, laboratories, rehabilitation centers, federal agencies, the criminal justice system, and workplaces.

The alcohol tests market research report is one of a series of new reports that provides alcohol tests market statistics, including alcohol tests industry global market size, regional shares, competitors with an alcohol tests market share, detailed alcohol tests market segments, market trends and opportunities, and any further data you may need to thrive in the alcohol tests industry. This alcohol tests market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The alcohol tests market includes sales of products such as breath alcohol testers, alcohol test strips, urine alcohol test kits, alcohol detection sensors, and handheld breath alcohol monitors. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Alcohol Tests Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on alcohol tests market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for alcohol tests? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The alcohol tests market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Infrared (IR)-Based Equipment; Alcohol Breath Analyzers; Semi-Conductor Equipment; Urine Testing Devices; Fuel Cell-Based Equipment; Chromatography Instruments; Immunoassay Analyzers; Hair-Testing Devices2) By Sample: Urine; Blood; Hair; Breath; Sweat

3) By End User: Hospitals; Laboratories; Rehabilitation Centers; Federal Agencies; Criminal Justice; Workplaces

Subsegments:

1) By Infrared (IR)-Based Equipment: Fixed Infrared Breath Analyzers; Portable Infrared Breath Analyzers2) By Alcohol Breath Analyzers: Handheld Breath Analyzers; Desktop Breath Analyzers; Wearable Breath Analyzers

3) By Semi-Conductor Equipment: Reusable Sensor Devices

4) By Urine Testing Devices: Dipstick Test Kits; Urine Analyzers

5) By Fuel Cell-Based Equipment: Personal Use Devices; Professional Use Devices

6) By Chromatography Instruments: Gas Chromatography Systems; Liquid Chromatography Systems

7) By Immunoassay Analyzers: Laboratory-Based Immunoassay Systems; Point-of-Care Immunoassay Devices

8) By Hair-Testing Devices: Single Panel Hair Test Kits; Multi-Panel Hair Test Kits

Companies Mentioned: Abbott Laboratories; 3M Company; Siemens Healthineers; Labcorp Holdings Inc.; Drägerwerk AG & Co. KGaA; Alcohol Countermeasure Systems Corporation; MP Biomedicals LLC; LifeSafer Inc.; Intoximeters Inc.; Randox Laboratories; Psychemedics Corporation; Premier Biotech Inc.; Omega Laboratories Inc.; Lifeloc Technologies Inc.; Securetec Detektions-Systeme AG; AK GlobalTech Corporation; AlcoPro Inc.; Andatech Private Limited; BACtrack LLC; Lion Laboratories Limited; PAS Systems International Inc.; Quest Products Inc.; Sentech Korea Corp.; CMI Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Alcohol Tests market report include:- Abbott Laboratories

- 3M Company

- Siemens Healthineers

- Labcorp Holdings Inc.

- Drägerwerk AG & Co. KGaA

- Alcohol Countermeasure Systems Corporation

- MP Biomedicals LLC

- LifeSafer Inc.

- Intoximeters Inc.

- Randox Laboratories

- Psychemedics Corporation

- Premier Biotech Inc.

- Omega Laboratories Inc.

- Lifeloc Technologies Inc.

- Securetec Detektions-Systeme AG

- AK GlobalTech Corporation

- AlcoPro Inc.

- Andatech Private Limited

- BACtrack LLC

- Lion Laboratories Limited

- PAS Systems International Inc.

- Quest Products Inc.

- Sentech Korea Corp.

- CMI Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.71 Billion |

| Forecasted Market Value ( USD | $ 9.62 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |