Key Highlights:

- The North America market dominated Global Generative AI in Software Development Lifecycle Market in 2024, accounting for a 41.8% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 1.58 billion by 2032.

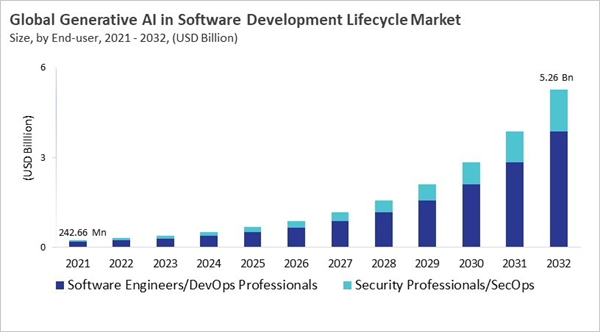

- Among the various End-user, the Software Engineers/DevOps Professionals segment dominated the global market, contributing a revenue share of 75.43% in 2024.

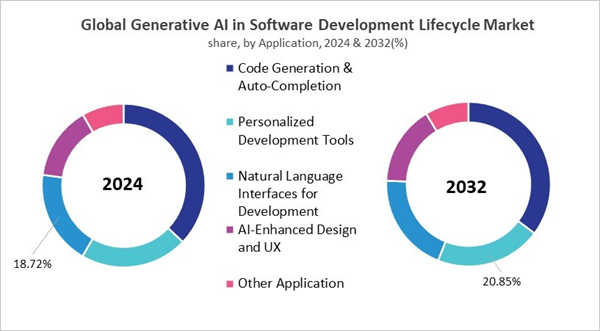

- In terms of Application, Code Generation & Auto-Completion segment are expected to lead the global market, with a projected revenue share of 35.19% by 2032.

The generative AI in the software development lifecycle market has evolved from a generic code-completion pilots to advance transformation spanning requirements, architecture, coding, testing, security, release, and operations. Adoption has changed from having individual developer copilots in IDEs to having orchestration across planning boards, CI/CD, observability, and incident response at the enterprise level. Governments and regulators have supported this change by giving advice on how to use AI safely. This has led companies to ask for built-in governance features like role-based access, logging, and data residency, and it has also changed how companies buy things. Vendors have come up with architectures that protect privacy, governed retrieval-augmented generation (RAG), and policy engines that allow for auditing. Enterprises now look at how AI affects things like defect rates, cycle time, test coverage, and developer experience.

Competition has settled on a few main patterns: foundation or specialised models shown in IDEs and chat, enterprise-specific context from code/docs/tickets, governance layers for compliance, and feedback loops linked to production metrics. Three trends stand out: governance is becoming a product, single copilots are being replaced by orchestrated multi-agent systems, and quality and security are being redefined as AI-assisted with humans in the loop. Leaders set themselves apart by incorporating AI into end-to-end engineering systems, which include governance, security scanning, human oversight, and production-grade metrics. This makes sure that AI outputs are safe, easy to understand, and linked to improvements that can be measured. The competitive edge is moving away from how well the model works on its own and towards how well it works with other systems, how well it is governed at the enterprise level, and how well it shows ROI in CI/CD and production delivery.

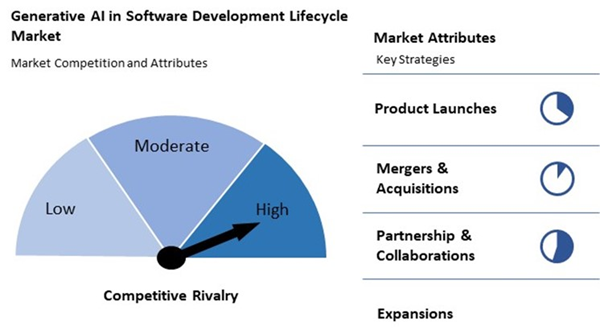

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2025, Accenture PLC announced the partnership with Dell Technologies and NVIDIA to Integrate Dell’s and NVIDIA's infrastructure with Accenture, it enhances Accenture’s AI Refinery, enabling secure, scalable, and compliant deployment of agentic AI for enterprises, particularly in regulated industries requiring data sovereignty and resilience. Additionally, In July, 2025, OpenAI, LLC teamed up with HCLTech to drive enterprise-scale generative AI adoption. Integrating OpenAI models into platforms like AI Force and AI Foundry, the collaboration enhances client services, internal productivity, and process efficiency across industries, supporting AI deployment, governance, and change management for transformative business solutions worldwide.

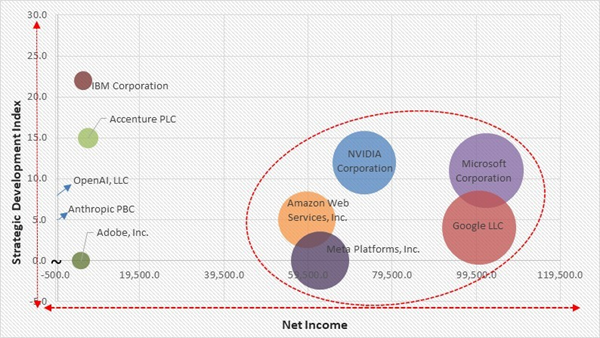

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation, Google LLC, NVIDIA Corporation, Meta Platforms, Inc. and Amazon Web Services, Inc. are the forerunners in the Generative AI in Software Development Lifecycle Market. In August, 2025, Microsoft Corporation announced the partnership with OpenAI’s GPT-5 across consumer, enterprise, and developer platforms, including Microsoft 365 Copilot, GitHub Copilot, Visual Studio Code, and Azure AI Foundry. GPT-5 enhances coding, complex reasoning, and agentic workflows, providing secure, enterprise-grade AI capabilities to improve productivity, accelerate software development, and support advanced business processes. Companies such as Accenture PLC, IBM Corporation, and Adobe, Inc. are some of the key innovators in Generative AI in Software Development Lifecycle Market.

COVID-19 Impact Analysis

The COVID-19 pandemic made businesses put off using generative AI in the SDLC at first because they had to focus on business continuity, remote work, and security. Concerns about IP and data provenance made procurement cycles slower, and pilots were limited by fragmented home setups and compliance freezes. But as remote work became more stable, businesses started using it again, but with stricter rules to please risk teams, such as tenant isolation, logging, and CI/CD gates. Distributed teams used AI for onboarding, creating tests, writing documentation, and helping with migration, which helped them get back to being productive after losing productivity when they couldn't work together in person. Thus, COVID-19 had positive impact on the market.Driving and Restraining Factors

Drivers

- Throughput pressure, talent shortages, and the need to scale developer effectiveness

- Security, compliance, and auditability embedded as code throughout the lifecycle

- Legacy modernization and platform migrations at enterprise scale

- Platform engineering economics and the shift to orchestrated, outcomes-based delivery

Restraints

- Legal liability, IP provenance, and compliance friction across the SDLC

- Technical reliability, evaluation difficulty, and non-determinism in critical paths

- Economics, operational complexity, and integration costs that blur ROI

Opportunities

- AI-native software quality and assurance (from spec synthesis to formal proof)

- Unified engineering knowledge graph and continuous onboarding at enterprise scale

- Sustainable FinOps/GreenOps optimization embedded in code and delivery pipelines

Challenges

- Enterprise knowledge curation and context governance (not just “add RAG”)

- Human factors - trust, review ergonomics, and the future of engineering craft

- Safe autonomy - coordinating multi-agent tool use without collateral damage

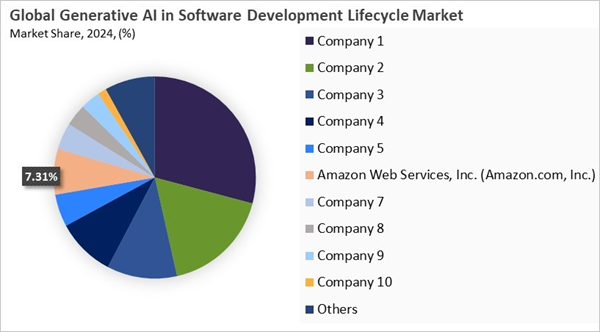

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Application Outlook

Based on Application, the market is segmented into Code Generation & Auto-Completion, Personalized Development Tools, Natural Language Interfaces for Development, AI-Enhanced Design and UX, and Other Application. The Personalized Development Tools segment recorded 21.3% revenue share in the market in 2024. These tools adapt to individual coding styles, project requirements, and team preferences, offering customized recommendations and efficient task management. By providing contextual support, they help developers improve their output while ensuring consistency across projects.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 41.8% revenue share in the market in 2024. The generative AI in software development lifecycle market is growing quickly inNorth America

andEurope

because of strong governance frameworks, widespread use in businesses, and deep integration into DevOps and security pipelines. The U.S. leads North America in compliance-by-design, tenant isolation, and measurable ROI across metrics like defect reduction and faster cycle times. According to StatisticsCanada

, TheICT sector

contributes substantially to Canada’s GDP. In 2021, the sector’s GDP was $104.5 billion (in 2012 constant dollars), accounting for 5.3% of national GDP, continuing a trend of taking a higher share of national GDP. This data shows a huge contribution of Xanada in IT development in the region Furthermore, the GDPR and the AI Act have shaped Europe to focus on privacy-preserving deployments, transparency, and auditability. Both regions are coming together around enterprise-ready platforms that include copilots in IDEs, planning boards, and CI/CD pipelines. Security posture and governance controls are becoming very important factors in buying decisions. Also, rising digital economy in the Europe is driving the growth of the market. According toITA

, United Kingdom has$170

billion digital tech annual

turnover

, over100,000 software companies are in UK’s market

, it has second largest ICT markets in ranking of ICT spending per head (U.S. #1).Though governance maturity varies, rapid digital transformation, widespread cloud adoption, and growing demand for software modernisation are the main drivers of growth in Asia-Pacific and LAMEA. With on-premises and VPC-based deployments, Asia-Pacific markets - especially those in China, Japan, Australia, and India - are concentrating on increasing productivity while addressing data sovereignty. For example, According to the Statistics Bureau of

Japan

, the nation’s totalexpenditure on R&D

during fiscal year (FY) 2021 stood at 19.74 trillion yen, out of which 174.4 billion yen forAI

. Furthermore, LAMEA is becoming more popular in the Middle East and other parts of Latin America, where businesses are turning to AI for cost savings, modernisation, and faster delivery. For instance, as per theInternationalTrade

administration

(ITA

),AI

continued to mature inBrazil

and exceeded US$1 billion in spending in 2023, representing a 33% increase year-over-year. Spending on Intelligent Process Automation (IPA) exceeded US$214 million in 2023, marking an increase of about 17% from the previous year. Also, vendors providing turnkey governance and localised compliance support are well-positioned as regulations change, while cost control, developer experience, and multi-language or framework support are important differentiators in both regions.Market Competition and Attributes

Smaller and emerging firms are fiercely competing in the generative-AI-enabled software-development-lifecycle space. Innovative startups and niche specialists battle to differentiate via specialized automation, seamless integration, and developer-centric workflows. The race centers on unique pre- and post-commit code generation, AI-driven testing, and CI/CD optimization. Low barriers for specialized innovation intensify fragmentation and heighten competitive dynamism.

Recent Strategies Deployed in the Market

- Aug-2025: OpenAI, LLC unveiled GPT-5, a more advanced AI model designed for coding, creative writing, and complex problem-solving. CEO Sam Altman calls it a “major upgrade,” offering interactions that feel like consulting an expert. The rollout aims to maintain OpenAI’s edge amid rising competition from US and Chinese rivals.

- Aug-2025: Amazon Web Services, Inc. unveiled the AI-Driven Development Lifecycle (AI-DLC), placing AI at the core of software creation to accelerate development from months to days. The launch includes the AI-Native Builders Community, agentic IDEs like Kiro, and AI agents for autonomous coding, testing, and deployment, empowering businesses and developers to integrate AI effectively.

- Jul-2025: Microsoft Corporation unveiled AI-powered, agent-driven app development, enabling users to generate production-ready code directly from natural language prompts. Combining low-code flexibility with enterprise-grade security, governance, and open standards, generative pages streamline design, customization, and deployment, empowering organizations to rapidly build scalable, secure, and fully controlled enterprise applications.

- Jul-2025: OpenAI, LLC unveiled AI agents capable of performing engineering tasks, signaling a major shift in software development. These agents could handle coding, testing, and project management, augmenting human engineers. Businesses and developers are advised to prepare for AI integration, upskill, and adapt strategies to leverage AI-enhanced workflows effectively.

- Jun-2025: IBM Corporation unveiled industry-first software integrating watsonx.governance and Guardium AI Security to unify AI governance and security for agentic and generative AI. The solution enables lifecycle monitoring, compliance mapping, automated red teaming, and secure AI operations, helping enterprises scale AI responsibly while meeting global regulatory standards efficiently.

List of Key Companies Profiled

- Microsoft Corporation

- OpenAI, LLC

- NVIDIA Corporation

- Google LLC

- Anthropic PBC

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Meta Platforms, Inc.

- IBM Corporation

- Accenture PLC

- Adobe, Inc.

Market Report Segmentation

By End-user

- Software Engineers/DevOps Professionals

- Security Professionals/SecOps

By Application

- Code Generation & Auto-Completion

- Personalized Development Tools

- Natural Language Interfaces for Development

- AI-Enhanced Design and UX

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Microsoft Corporation

- OpenAI, LLC

- NVIDIA Corporation

- Google LLC

- Anthropic PBC

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Meta Platforms, Inc.

- IBM Corporation

- Accenture PLC

- Adobe, Inc.