The Germany market dominated the Europe Car Subscription Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of $1.47 billion by 2032. The UK market is experiencing a CAGR of 21.7% during 2025-2032. Additionally, the France market is expected to exhibit a CAGR of 23.8% during 2025-2032. The Germany and UK led the Europe Car Subscription Market by Country with a market share of 21.9% and 17.9% in 2024. The Spain market is expected to witness a CAGR of 24.7% during throughout the forecast period.

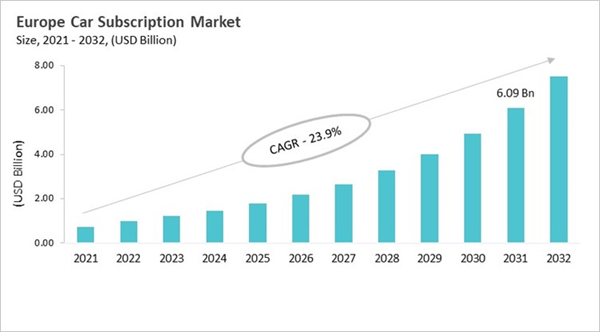

A mix of sustainability rules, consumer demand, and automakers' move toward mobility services has led to the growth of the European car subscription market. Europe's growth has been shaped by regulatory goals and planning for urban mobility, unlike North America's pilot-driven approach. Renault, through its Mobilize brand, and Sixt, through its SIXT+ brand, have been the first to offer flexible models that combine insurance, service, and digital management. Acciona's NanoCar was a new idea that connected electric vehicle access to battery subscriptions and swap networks. Car subscriptions are part of a larger, more sustainable transportation ecosystem, not just a way to get rid of car ownership. This is supported by city-level Mobility as a Service (MaaS) programs in cities like Helsinki and Brussels.

Some of the most important trends are the integration of energy services, like battery subscriptions with EVs; the creation of dedicated mobility brands, like Renault's Mobilize; and the addition of subscriptions to multi-modal urban platforms. Renault sees subscriptions as a core business, Sixt combines services into one app, and Acciona focuses on the convergence of energy and mobility. There is a lot of competition, including car makers, rental companies, startups, and city-backed MaaS platforms. This interaction shows how Europe's unique mix of public-private coordination, sustainability priorities, and consumer culture has made subscriptions a well-known and growing part of modern mobility across the region.

Subscription Type Outlook

Based on Subscription Type, the market is segmented into Single Brand (Single-Brand Swap), and Multi Brand. With a compound annual growth rate (CAGR) of 20.8% over the projection period, the Single Brand (Single-Brand Swap) Market, dominate the Germany Car Subscription Market by Subscription Type in 2024 and would be a prominent market until 2032. The Multi Brand market is expected to witness a CAGR of 21.8% during 2025-2032.End User Outlook

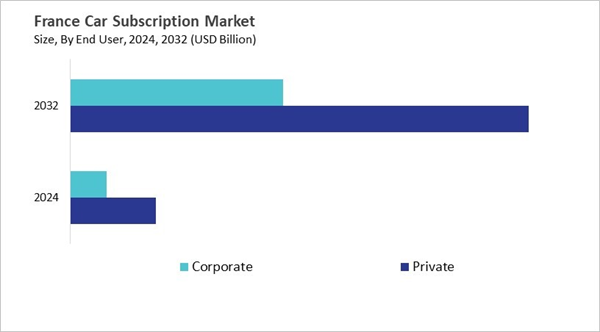

Based on End User, the market is segmented into Private, and Corporate. The Private market segment dominated the France Car Subscription Market by End User is expected to grow at a CAGR of 23.4 % during the forecast period thereby continuing its dominance until 2032. Also, The Corporate market is anticipated to grow as a CAGR of 24.8 % during the forecast period during 2025-2032.Service Provider Outlook

Based on Service Provider, the market is segmented into OEM/Captives, Mobility Providers, and Technology Companies. Among various Spain Car Subscription Market by Service Provider; The OEM/Captives market achieved a market size of USD $60.6 Million in 2024 and is expected to grow at a CAGR of 24.1 % during the forecast period. The Technology Companies market is predicted to experience a CAGR of 26.7% throughout the forecast period from (2025 - 2032).Country Outlook

Germany's car subscription market is doing well because people in the country like high-end transportation, the government supports electric cars, and people's lifestyles are changing to favor flexibility over ownership. Younger professionals want app-based services that are easy to use because of their concerns about digitalization and sustainability. Policymakers want to cut emissions and get more people to use electric vehicles (EVs), which makes it easier for providers to add electric fleets and build more charging stations. There are both chances and problems in the market. For example, some car companies are cutting back because they aren't making enough money, while new companies like FINN are doing well with their all-inclusive, eco-friendly products. Long-standing companies like Sixt use brand trust to add subscriptions to larger mobility ecosystems. In Germany's changing mobility landscape, competition between startups, legacy companies, and tech companies is driving innovation, making things better for users, and making subscriptions a real option.List of Key Companies Profiled

- Volvo Group

- Mercedes-Benz Group AG

- BMW AG

- Hyundai Motor Company

- Volkswagen AG

- Sixt SE

- The Hertz Corporation

- FINN GmbH

- Ayvens

- Cazoo

Market Report Segmentation

By Propulsion Type

- Internal-Combustion Engine (ICE)

- Electric Vehicle (EV)

By End User

- Private

- Corporate

By Subscription Type

- Single Brand (Single-Brand Swap)

- Multi Brand

By Service Provider

- OEM/Captives

- Mobility Providers

- Technology Companies

By Subscription Period

- 1 to 6 Months

- 6 to 12 Months

- More than 12 Months

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Volvo Group

- Mercedes-Benz Group AG

- BMW AG

- Hyundai Motor Company

- Volkswagen AG

- Sixt SE

- The Hertz Corporation

- FINN GmbH

- Ayvens

- Cazoo